Region:Middle East

Author(s):Rebecca

Product Code:KRAA9339

Pages:95

Published On:November 2025

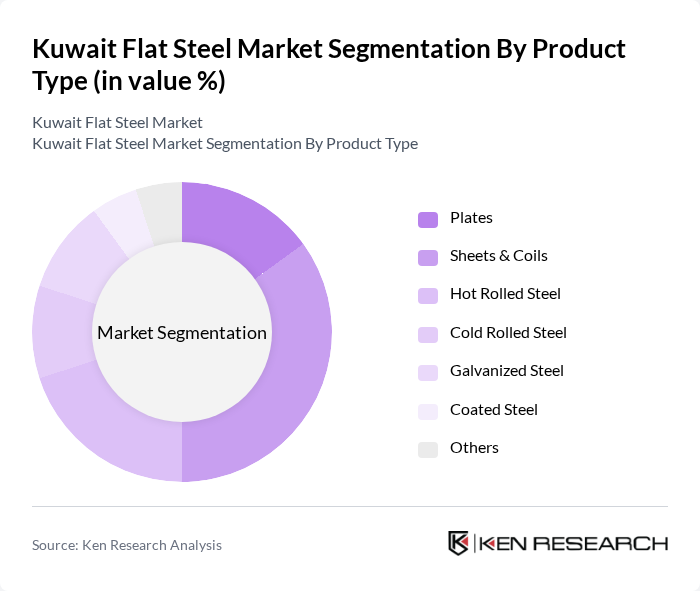

By Product Type:The product type segmentation includes categories such as Plates, Sheets & Coils, Hot Rolled Steel, Cold Rolled Steel, Galvanized Steel, Coated Steel, and Others. Recent market data indicates that Plates and Sheets & Coils collectively account for the majority of market share, with Plates leading due to their extensive use in infrastructure and industrial projects. Sheets & Coils remain highly sought after for their versatility and ease of fabrication, particularly in construction and manufacturing. The demand for galvanized and coated steel is rising due to increased requirements for corrosion resistance in harsh environments .

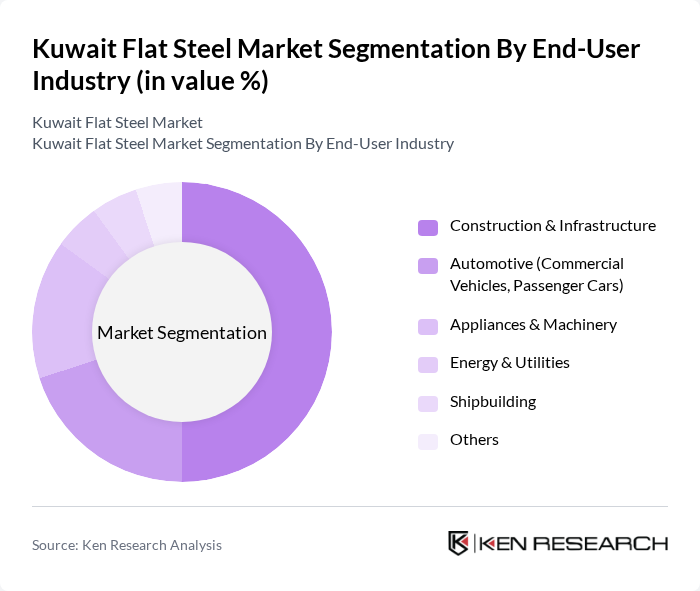

By End-User Industry:The end-user industry segmentation encompasses Construction & Infrastructure, Automotive (Commercial Vehicles, Passenger Cars), Appliances & Machinery, Energy & Utilities, Shipbuilding, and Others. The Construction & Infrastructure sector is the dominant segment, accounting for half of the market share. This is driven by ongoing government projects, urban development initiatives, and increased investments in residential and commercial buildings. The automotive sector is also witnessing steady growth due to rising vehicle production and demand for lightweight, durable steel components. Appliances & Machinery and Energy & Utilities segments are expanding as industrialization accelerates and energy projects require advanced steel solutions .

The Kuwait Flat Steel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Steel, United Steel Industrial Company (Kuwait), Al-Qatami Steel, Gulf Steel Works, Al-Jazeera Steel Products Co., National Industries Group, Al-Mabani General Contractors, KSC Steel, Al-Falah Group, Al-Khaldiya Steel, Al-Mansouria Steel, Al-Mohammedia Steel, Al-Salam Steel, Al-Hazm Steel, Al-Mutlaa Steel contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait flat steel market appears promising, driven by ongoing construction and infrastructure projects aligned with national development goals. As the government continues to invest in industrial growth and sustainability, local manufacturers are likely to adopt advanced technologies to enhance production efficiency. Additionally, the increasing focus on renewable energy projects will create new demand for flat steel products, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Plates Sheets & Coils Hot Rolled Steel Cold Rolled Steel Galvanized Steel Coated Steel Others |

| By End-User Industry | Construction & Infrastructure Automotive (Commercial Vehicles, Passenger Cars) Appliances & Machinery Energy & Utilities Shipbuilding Others |

| By Application | Structural Components Fabrication & Manufacturing Packaging Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Others |

| By Quality Grade | Commercial Grade Structural Grade High-Strength Grade Advanced High-Strength Steel Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| By Market Segment | Large Enterprises SMEs Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Flat Steel Usage | 100 | Project Managers, Procurement Officers |

| Manufacturing Industry Demand | 80 | Operations Managers, Supply Chain Coordinators |

| Distribution Channel Insights | 60 | Sales Managers, Logistics Managers |

| Retail Market Trends | 50 | Retail Managers, Category Buyers |

| Government Infrastructure Projects | 40 | Public Works Officials, Policy Makers |

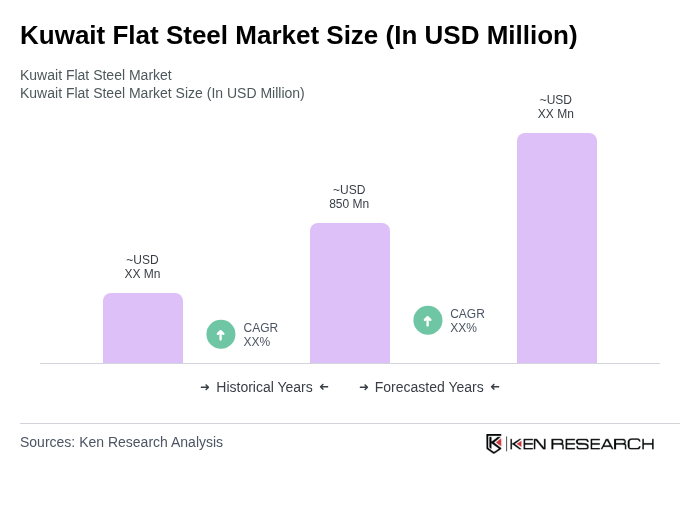

The Kuwait Flat Steel Market is valued at approximately USD 850 million, reflecting a robust growth trajectory driven by increasing demand in construction, automotive, and manufacturing sectors, alongside government infrastructure initiatives.