Region:Middle East

Author(s):Rebecca

Product Code:KRAD4991

Pages:100

Published On:December 2025

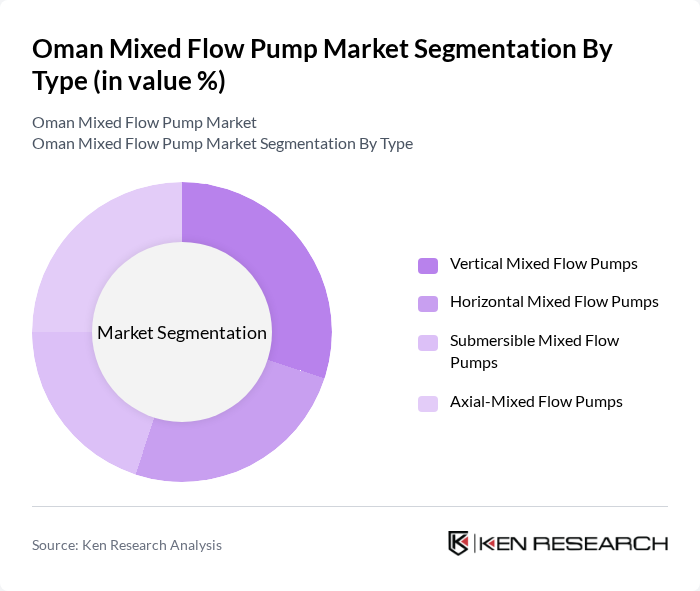

By Type:The market is segmented into various types of mixed flow pumps, including Vertical Mixed Flow Pumps, Horizontal Mixed Flow Pumps, Submersible Mixed Flow Pumps, and Axial-Mixed Flow Pumps. Each type serves specific applications and industries, contributing to the overall market dynamics, and fits within the wider centrifugal and mixed-flow categories used in MENA water and industrial pump applications.

The Vertical Mixed Flow Pumps segment is currently leading the market due to their efficiency in handling large volumes of water at relatively low to medium heads, making them ideal for municipal water intake, flood control, and industrial cooling and circulation services, in line with mixed and axial flow deployments across the region. Their design allows for high flow rates and competitive energy performance, which aligns with the growing demand for sustainable, energy?efficient solutions in large pumping stations and desalination?linked networks. Additionally, increasing investments in water transmission pipelines, wastewater pumping stations, and industrial utilities under national infrastructure and industrial diversification programs further bolster the demand for this type of pump.

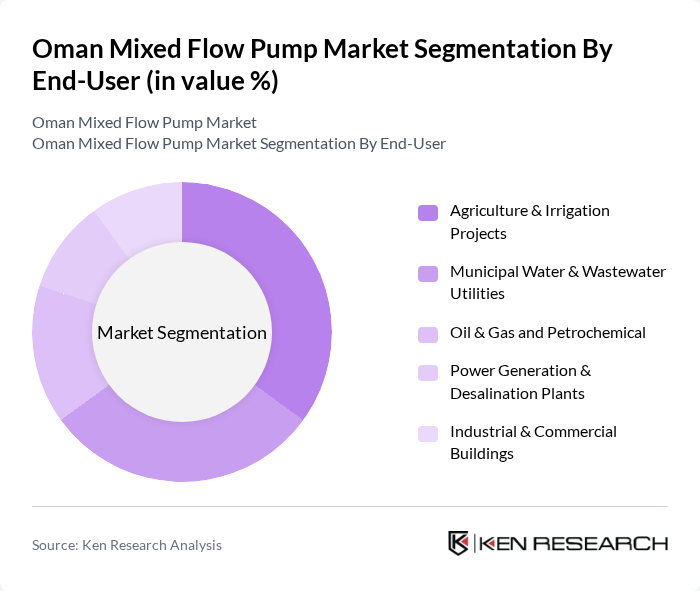

By End-User:The market is segmented based on end-users, including Agriculture & Irrigation Projects, Municipal Water & Wastewater Utilities, Oil & Gas and Petrochemical, Power Generation & Desalination Plants, and Industrial & Commercial Buildings. Each end-user segment has unique hydraulic, flow, and reliability requirements that influence the selection and demand for mixed flow pump configurations.

The Agriculture & Irrigation Projects segment dominates the market, driven by the increasing need for efficient irrigation systems in Oman’s agricultural sector, where high?flow, low?to?medium head pumps are widely deployed for surface and groundwater distribution. The government’s focus on enhancing food security and sustainable farming practices under national strategies has led to significant investments in pressurized irrigation networks, farm support schemes, and rural water infrastructure, thereby boosting the demand for mixed flow and axial?mixed pumps in this segment.

The Oman Mixed Flow Pump Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sulzer Ltd., KSB SE & Co. KGaA, Xylem Inc., Grundfos Holding A/S, Flowserve Corporation, Ebara Corporation, Pentair plc, Wilo SE, ITT Inc., Tsurumi Manufacturing Co., Ltd., Franklin Electric Co., Inc., Torishima Pump Mfg. Co., Ltd., KBL – Kirloskar Brothers Limited, Ebara Pumps Middle East FZE, KSB Pumps Arabia Ltd. contribute to innovation, geographic expansion, and service delivery in this space, reflecting the broader Middle East pump supplier landscape where these companies are prominent in water, wastewater, desalination, and industrial pumping projects.

The Oman mixed flow pump market is poised for significant transformation, driven by technological advancements and increasing environmental awareness. The integration of smart technologies, such as IoT for real-time monitoring, is expected to enhance operational efficiency and reduce energy consumption. Additionally, the focus on sustainable water management practices will likely lead to the adoption of energy-efficient pumps, aligning with global trends towards sustainability and resource conservation, thereby fostering a more resilient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Vertical Mixed Flow Pumps Horizontal Mixed Flow Pumps Submersible Mixed Flow Pumps Axial-Mixed Flow Pumps |

| By End-User | Agriculture & Irrigation Projects Municipal Water & Wastewater Utilities Oil & Gas and Petrochemical Power Generation & Desalination Plants Industrial & Commercial Buildings |

| By Application | Raw Water Intake & Transfer Seawater Intake & Desalination Irrigation & Drainage Canals Flood Control & Stormwater Management Cooling Water Circulation |

| By Material | Cast Iron Stainless Steel Duplex & Super Duplex Stainless Steel Bronze & Other Alloys |

| By Power Source | Grid-connected Electric Motors Diesel Engine Driven Solar and Hybrid Power |

| By Capacity (Flow Rate) | Up to 500 m³/h –2,000 m³/h ,001–10,000 m³/h Above 10,000 m³/h |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Al Sharqiyah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Water Management | 100 | Agricultural Engineers, Farm Managers |

| Construction Sector Applications | 90 | Project Managers, Site Engineers |

| Municipal Water Supply Systems | 80 | Water Resource Managers, City Planners |

| Industrial Applications | 70 | Facility Managers, Operations Directors |

| Research and Development in Pump Technology | 60 | R&D Engineers, Product Development Managers |

The Oman Mixed Flow Pump Market is valued at approximately USD 140 million, reflecting its significance within the broader centrifugal and mixed-flow pump sectors in the Middle East and MENA regions.