Region:Middle East

Author(s):Rebecca

Product Code:KRAD1527

Pages:86

Published On:November 2025

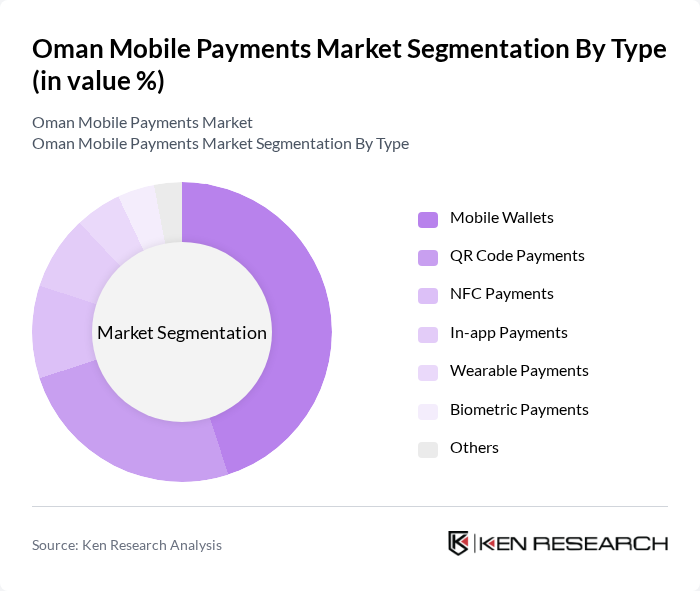

By Type:The mobile payments market can be segmented into various types, including Mobile Wallets, QR Code Payments, NFC Payments, In-app Payments, Wearable Payments, Biometric Payments, and Others. Among these, Mobile Wallets are leading the market due to their convenience and widespread acceptance among consumers and merchants. QR Code Payments are also gaining traction, especially in retail environments, as they offer a quick and easy payment method without the need for physical contact. NFC Payments are increasingly favored in urban retail, while biometric and wearable payments are emerging as secure and innovative alternatives.

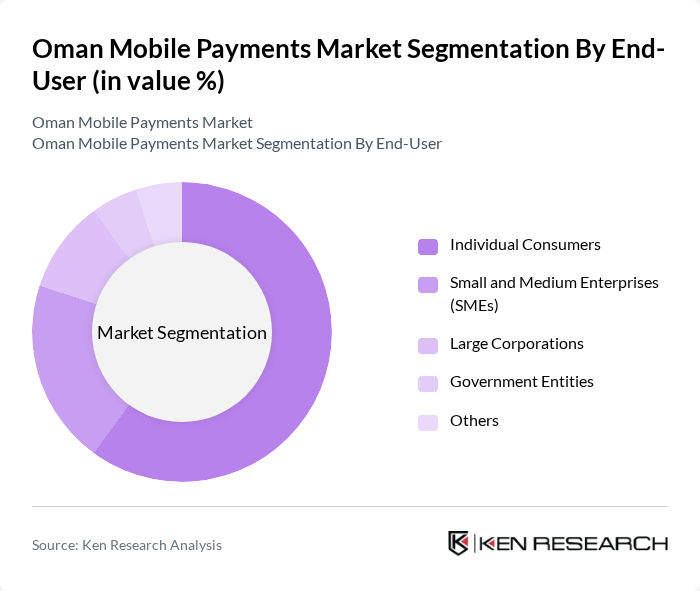

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, and Others. Individual Consumers dominate the market, driven by the increasing use of mobile wallets and payment apps for everyday transactions. SMEs are also significant contributors, as they adopt mobile payment solutions to enhance customer experience and streamline operations. The digitalization trend among businesses and government initiatives to digitize services further support adoption across all segments.

The Oman Mobile Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Muscat, National Bank of Oman, Bank Dhofar, Oman Arab Bank, Sohar International, Ahli Bank, HSBC Bank Oman, Ooredoo Oman, Omantel (Oman Telecommunications Company), Thawani Technologies, Fatora, PayFort (Amazon Payment Services), Visa, Mastercard, Apple Pay, and Samsung Pay contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mobile payments market in Oman appears promising, driven by technological advancements and evolving consumer behaviors. With the increasing integration of artificial intelligence and machine learning in payment systems, transaction efficiency and security are expected to improve significantly. Additionally, the rise of mobile wallets and digital banking solutions will likely enhance user experience, making cashless transactions more appealing. As the government continues to support digital initiatives, the market is poised for substantial growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets QR Code Payments NFC Payments In-app Payments Wearable Payments Biometric Payments Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities Others |

| By Payment Method | Direct Carrier Billing Bank Transfers Credit/Debit Card Payments Prepaid Cards Contactless Cards In-App Payments Wearable Device Payments Others |

| By Industry Vertical | Retail and E-commerce Hospitality and Tourism Transportation and Logistics Healthcare Entertainment and Leisure Others |

| By Transaction Size | Micro Transactions Small Transactions Medium Transactions Large Transactions Others |

| By User Demographics | Age Groups Income Levels Urban vs Rural Education Levels Others |

| By Security Features | Biometric Authentication Two-Factor Authentication Encryption Technologies Fraud Detection Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mobile Payment Usage | 120 | Regular mobile payment users, age 18-45 |

| Merchant Adoption of Mobile Payments | 90 | Small to medium-sized business owners, retail managers |

| Banking Sector Insights | 60 | Product managers, digital banking executives |

| Fintech Innovations in Payments | 60 | Founders, CTOs of fintech startups |

| Regulatory Perspectives | 40 | Regulatory officials, policy advisors |

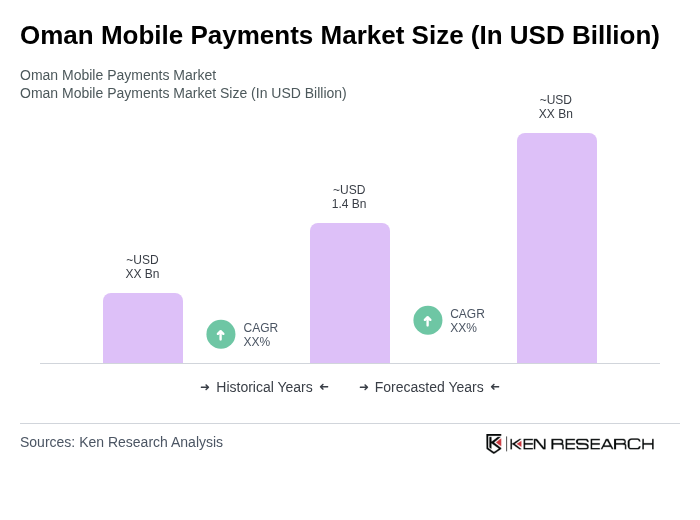

The Oman Mobile Payments Market is valued at approximately USD 1.4 billion, reflecting significant growth driven by smartphone adoption, improved internet connectivity, and a shift towards cashless transactions among consumers.