Region:Middle East

Author(s):Shubham

Product Code:KRAC2257

Pages:93

Published On:October 2025

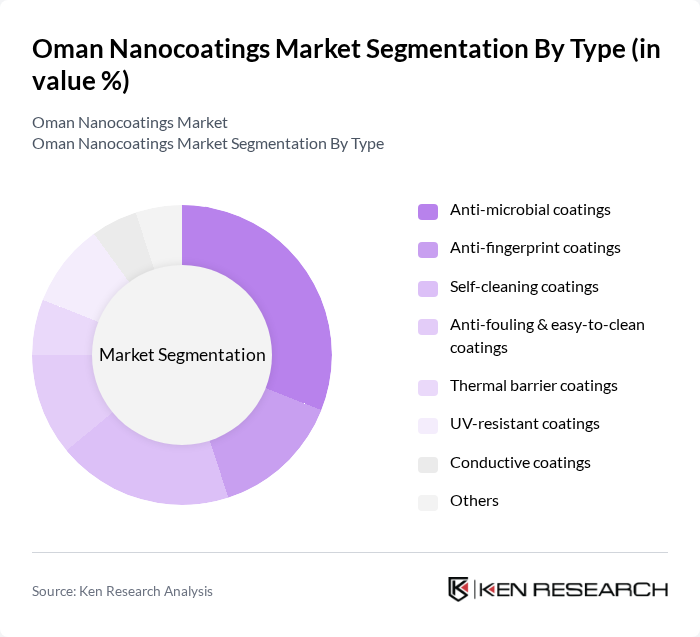

By Type:The nanocoatings market is segmented into anti-microbial coatings, anti-fingerprint coatings, self-cleaning coatings, anti-fouling & easy-to-clean coatings, thermal barrier coatings, UV-resistant coatings, conductive coatings, and others.Anti-microbial coatingsare gaining significant traction, especially in healthcare and food packaging, due to increasing hygiene and safety demands.Self-cleaning coatingsare also witnessing growth, particularly in construction and automotive sectors, as they offer maintenance-free and durable surface solutions.

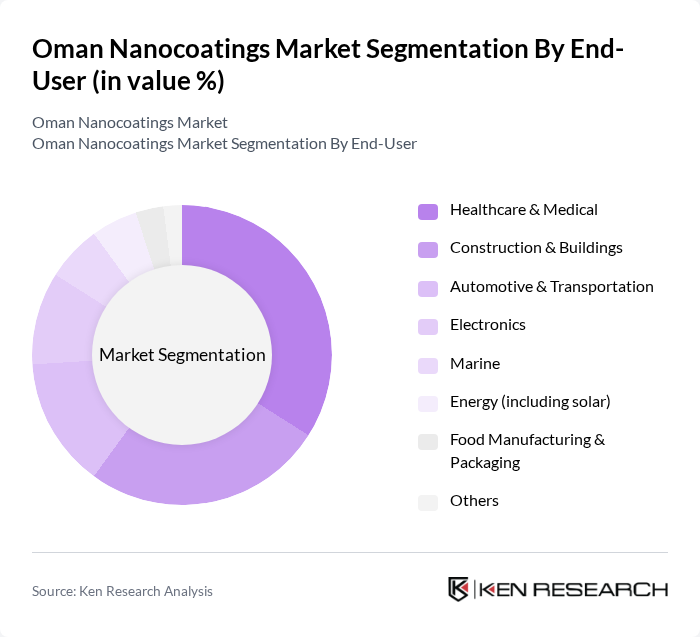

By End-User:The end-user segments for nanocoatings include healthcare & medical, construction & buildings, automotive & transportation, electronics, marine, energy (including solar), food manufacturing & packaging, and others. Thehealthcare & medicalsegment leads due to the rising demand for hygienic surfaces and medical devices. The construction sector is a significant contributor, driven by the need for durable and sustainable building materials, while automotive and electronics sectors are increasingly adopting nanocoatings for enhanced performance and longevity.

The Oman Nanocoatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as PPG Industries, Inc., AkzoNobel N.V., BASF SE, DuPont de Nemours, Inc., The Sherwin-Williams Company, 3M Company, NanoTech Coatings, Inc., Hempel A/S, Jotun A/S, Clariant AG, Eastman Chemical Company, Huntsman Corporation, RPM International Inc., Nanophase Technologies Corporation, and Bio-Gate AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman nanocoatings market appears promising, driven by technological advancements and increasing environmental awareness. As industries seek sustainable solutions, the demand for eco-friendly nanocoatings is expected to rise significantly. Additionally, the integration of smart technologies and IoT in coating applications will likely enhance product functionality, leading to broader adoption. With ongoing research and development efforts, the market is poised for innovation, creating new opportunities for manufacturers and end-users alike in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Anti-microbial coatings Anti-fingerprint coatings Self-cleaning coatings Anti-fouling & easy-to-clean coatings Thermal barrier coatings UV-resistant coatings Conductive coatings Others |

| By End-User | Healthcare & Medical Construction & Buildings Automotive & Transportation Electronics Marine Energy (including solar) Food Manufacturing & Packaging Others |

| By Application | Industrial coatings Consumer goods coatings Protective coatings Decorative coatings Automotive coatings Electronics coatings Others |

| By Distribution Channel | Direct sales Distributors Online sales Retail outlets Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Al Sharqiyah Others |

| By Price Range | Low-cost coatings Mid-range coatings Premium coatings |

| By Policy Support | Subsidies for nanotechnology Tax incentives for manufacturers Grants for research and development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Nanocoatings | 50 | Product Managers, R&D Engineers |

| Construction Sector Applications | 40 | Project Managers, Architects |

| Electronics Coating Solutions | 40 | Manufacturing Engineers, Quality Control Managers |

| Consumer Goods Coatings | 30 | Brand Managers, Product Development Specialists |

| Industrial Applications of Nanocoatings | 50 | Operations Managers, Procurement Specialists |

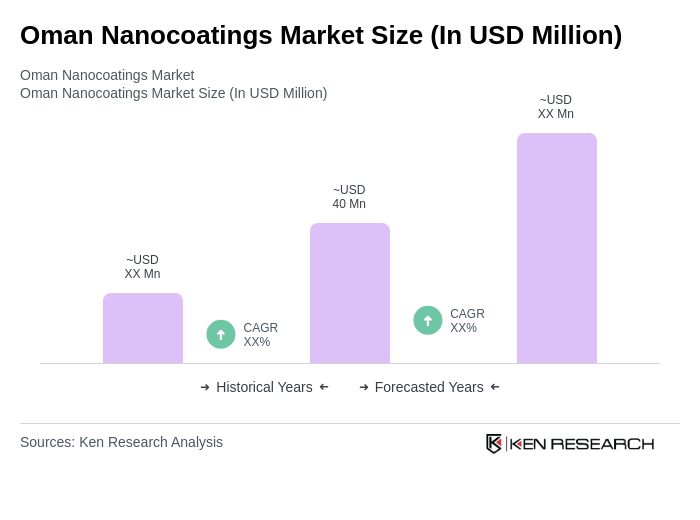

The Oman Nanocoatings Market is valued at approximately USD 40 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for advanced coatings across various sectors, including healthcare, construction, and automotive.