UAE Nicotine Replacement Therapy Market Overview

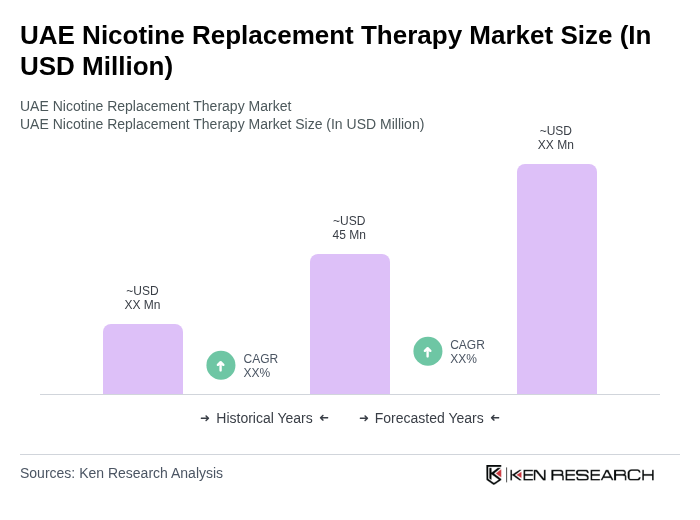

- The UAE Nicotine Replacement Therapy Market is valued at USD 45 million, based on a five-year historical analysis. Market growth is driven by increasing smoking cessation efforts, rising wellness awareness among a high-income population, and strong regulatory support through government cessation programs integrating NRT into primary healthcare. These factors bolster demand for clinically backed, accessible nicotine cessation products.

- Key players in this market include multinational pharmaceutical companies known for NRT products—like Johnson & Johnson, GlaxoSmithKline, and Pfizer—alongside pharmacy chains and healthcare providers that ensure broad access in both urban and clinic settings based on GCC trends. The UAE and Saudi Arabia drive regional dynamics due to robust healthcare infrastructure and national anti-tobacco initiatives that promote NRT uptake.

- The UAE government facilitates NRT through supportive regulation under the Ministry of Health and Prevention, allowing over-the-counter access and subsidizing part of the cost within public health programs, while licensing NRT as pharmaceutical products with labeling and safety requirements. Broader tobacco control policies—such as Federal Law No. 15 of 2009 and associated executive regulations—restrict tobacco promotion and encourage cessation methods, reinforcing NRT’s role within public health strategy.

UAE Nicotine Replacement Therapy Market Segmentation

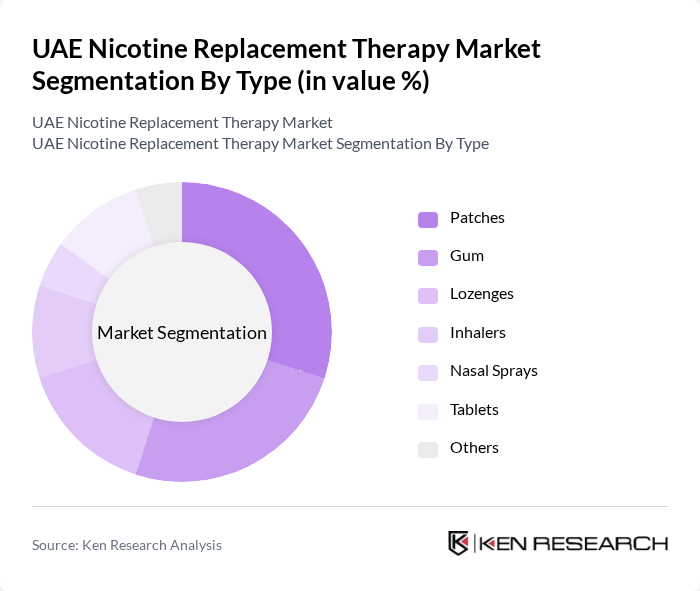

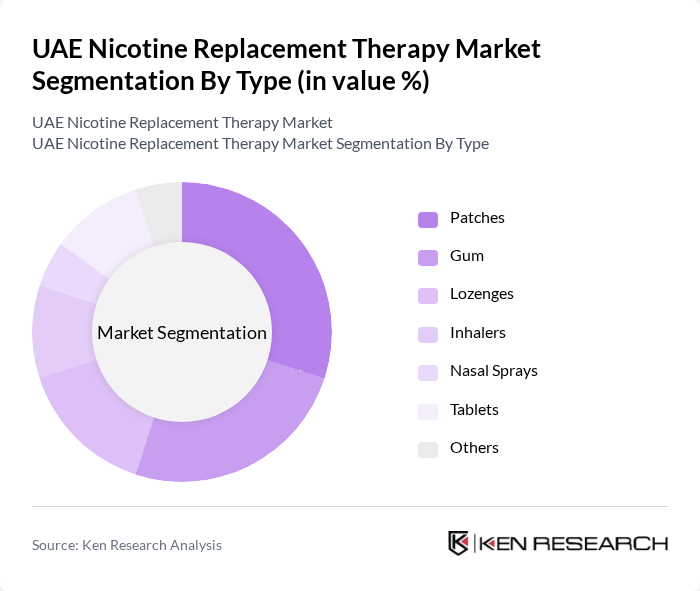

By Type:The market is segmented into various types of nicotine replacement therapies, including patches, gum, lozenges, inhalers, nasal sprays, tablets, and others. Among these, patches and gum are the most popular due to their ease of use and effectiveness in helping individuals quit smoking. Patches provide a steady release of nicotine, while gum offers a more immediate relief from cravings, making them preferred choices for many users. The increasing awareness of the health risks associated with smoking and the growing number of smoking cessation programs have further propelled the demand for these products.

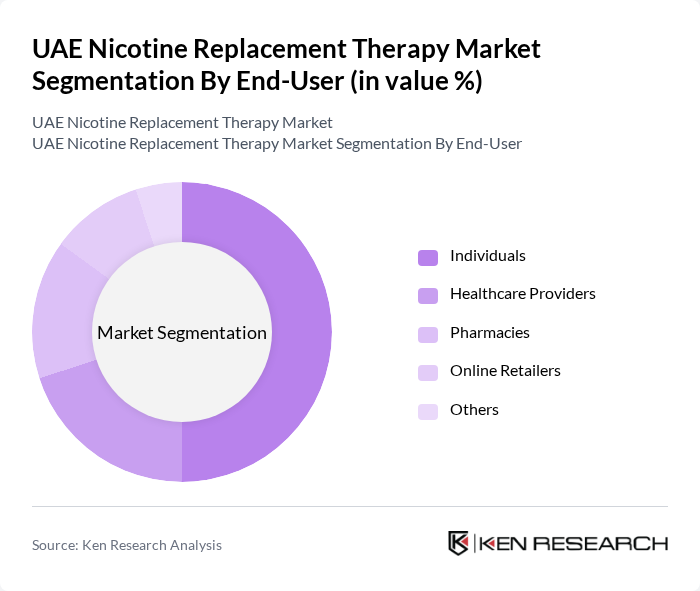

By End-User:The end-user segmentation includes individuals, healthcare providers, pharmacies, online retailers, and others. Individuals represent the largest segment as they directly seek nicotine replacement therapies to aid in quitting smoking. Healthcare providers also play a crucial role by recommending these therapies to patients. The rise of e-commerce has led to an increase in online retailing of NRT products, making them more accessible to consumers. This trend is expected to continue as more individuals turn to online platforms for their healthcare needs.

UAE Nicotine Replacement Therapy Market Competitive Landscape

The UAE Nicotine Replacement Therapy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., GlaxoSmithKline plc, Johnson & Johnson, Novartis AG, Sanofi S.A., Perrigo Company plc, Reynolds American Inc., British American Tobacco plc, Altria Group, Inc., Imperial Brands PLC, Dr. Reddy's Laboratories, Cipla Ltd., Mylan N.V., Teva Pharmaceutical Industries Ltd., Aurobindo Pharma Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

UAE Nicotine Replacement Therapy Market Industry Analysis

Growth Drivers

- High GDP per Capita (Nominal):The UAE's GDP per capita is projected to reach USD 54,000 in future, reflecting a robust economy and strong purchasing power. This economic strength enables consumers to invest in premium nicotine replacement therapy (NRT) products, facilitating greater adoption rates. As disposable income rises, individuals are more likely to prioritize health-related expenditures, including smoking cessation aids, thereby driving market growth. Source: Economy of the United Arab Emirates—Nominal GDP per capita future estimate ((https://en.wikipedia.org/wiki/Economy_of_the_United_Arab_Emirates?utm_source=openai)).

- Substantial Retail Spending on FMCG and Tech:In Q2 of future, the UAE witnessed AED 15 billion (approximately USD 4 billion) spent on fast-moving consumer goods (FMCG) and technology. This significant retail expenditure indicates a strong consumer demand and confidence, which is conducive to the adoption of nicotine replacement products. As consumers increasingly seek health solutions, the retail environment becomes more favorable for NRT products, enhancing their market presence. Source: UAE retail spend on FMCG and tech Q2 of future ((https://www.reddit.com/r/JobXDubai/comments/1fel31h?utm_source=openai)).

- Government Tobacco Dependence Guidelines Launched:The UAE government launched the Practical Guideline for Management of Tobacco Dependence on December 18 in future. This initiative encourages healthcare professionals to incorporate NRT into cessation protocols, thereby enhancing the accessibility and credibility of these products. By formalizing support for smoking cessation, the government is likely to increase the utilization of NRT, positively impacting market growth. Source: MoHAP launches Practical Guideline (18 Dec in future) ((https://mohap.gov.ae/en/w/mohap-launches-practical-guideline-for-management-of-tobacco-dependence?utm_source=openai)).

Market Challenges

- Competition from Alternative Nicotine Products:The UAE nicotine replacement therapy market is estimated to be valued between USD 40 million and USD 50 million in future. However, it faces significant competition from alternative nicotine delivery systems, such as e-cigarettes and heated tobacco products. These alternatives are gaining popularity among consumers, which poses a challenge to traditional NRT segments, potentially limiting market growth and share. Source: UAE NRT market size USD 40–50 million, alternative product competition ((https://www.actualmarketresearch.com/product/uae-nicotine-replacement-therapy-market?utm_source=openai)).

- Stringent Regulatory Compliance Requirements:The regulatory landscape for nicotine products in the UAE is becoming increasingly stringent. Each nicotine pouch must contain less than 16.6 mg of nicotine and must gain ECAS certification by July 31 in future. These compliance requirements can delay product launches and increase the costs associated with bringing NRT products to market, creating barriers for new entrants and existing players alike. Source: Technical requirements and ECAS certification deadline ((https://www.dubayynews.com/uae-introduces-tobacco-free-nicotine-pouches?utm_source=openai)).

UAE Nicotine Replacement Therapy Market Future Outlook

The future of the UAE nicotine replacement therapy market appears promising, driven by evolving consumer preferences and regulatory changes. The legalization of tobacco-free nicotine pouches, effective from July 29 in future, is expected to introduce innovative product formats, enhancing market diversity. Additionally, the enforcement of ECAS certification will ensure product quality and safety, fostering consumer trust. As public health initiatives integrate NRT into cessation programs, the market is likely to expand, reaching previously untapped demographics and increasing overall adoption rates.

Market Opportunities

- Integration into Public Healthcare Cessation Programs:The launch of the Practical Guideline by MoHAP in December in future supports the integration of NRT into public healthcare cessation frameworks. This initiative will enhance access to NRT in public quit clinics, significantly increasing market reach and encouraging more smokers to utilize these products as part of their cessation efforts. Source: Launch of Practical Guideline ((https://mohap.gov.ae/en/w/mohap-launches-practical-guideline-for-management-of-tobacco-dependence?utm_source=openai)).

- Excise Tax Exemption for Smoking-Cessation Products:Effective October 1 in future, nicotine gum, patches, and sprays will be exempt from excise tax as per Ministerial Decision No. 249/2025. This tax exemption will lower the cost of NRT products, making them more affordable and accessible, thereby incentivizing adoption among consumers and reducing barriers for pharmaceutical suppliers. Source: Ministerial Decision exempting NRT from excise tax, effective 1 Oct in future ((https://www.bsalaw.com/insight/uae-tax-updates-september-2025/?utm_source=openai)).