Region:Middle East

Author(s):Shubham

Product Code:KRAA2671

Pages:97

Published On:August 2025

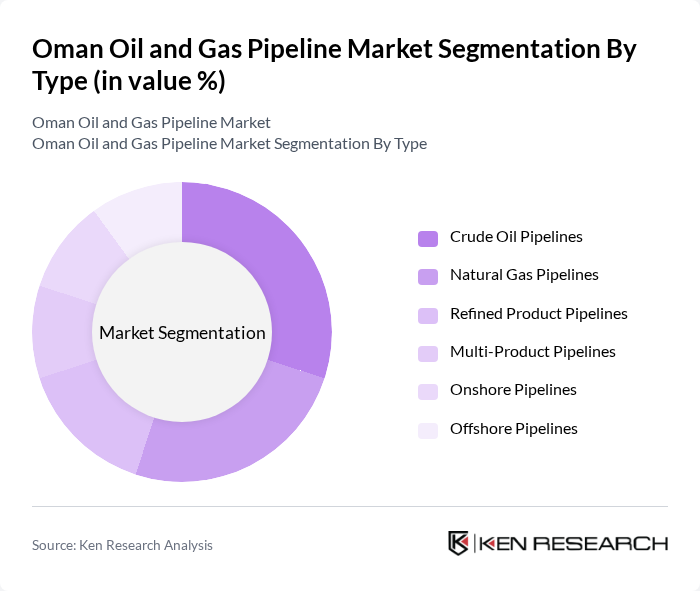

By Type:The segmentation by type covers crude oil pipelines, natural gas pipelines, refined product pipelines, multi-product pipelines, onshore pipelines, and offshore pipelines. Each segment addresses specific transportation needs: crude oil pipelines facilitate movement from production to refineries, natural gas pipelines support both domestic supply and export, refined product pipelines distribute processed fuels, while multi-product, onshore, and offshore pipelines enable flexibility and connectivity across Oman’s diverse energy landscape .

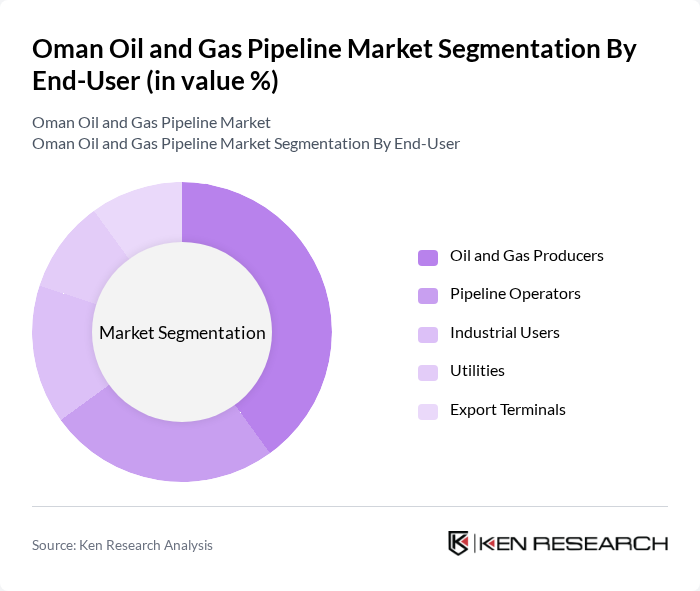

By End-User:The end-user segmentation includes oil and gas producers, pipeline operators, industrial users, utilities, and export terminals. Oil and gas producers rely on pipelines for efficient upstream-to-downstream transport; pipeline operators focus on network reliability and safety; industrial users and utilities depend on stable supply for operations; and export terminals require robust connectivity to international markets .

The Oman Oil and Gas Pipeline Market is characterized by a dynamic mix of regional and international players. Leading participants such as OQ S.A.O.C., Petroleum Development Oman LLC, Oman Gas Company S.A.O.C. (now OQ Gas Networks S.A.O.C.), Gulf Petrochemical Services & Trading LLC, Al Hassan Engineering Co. S.A.O.G., Galfar Engineering & Contracting S.A.O.G., Dodsal Engineering & Construction Pte. Ltd., Larsen & Toubro Oman LLC, Al Turki Enterprises LLC, Oman Oil Refineries and Petroleum Industries Company (Orpic, now part of OQ), Sohar Port and Freezone, Salalah Methanol Company LLC, Oman LNG LLC, Special Technical Services LLC (STS), and Bahwan Engineering Company contribute to innovation, geographic expansion, and service delivery in this space .

The Oman oil and gas pipeline market is poised for significant transformation as it adapts to evolving energy demands and regulatory landscapes. With a focus on sustainability, companies are increasingly investing in digital technologies and smart pipeline solutions to enhance operational efficiency. The integration of renewable energy sources into existing infrastructure is also gaining traction, reflecting a broader shift towards cleaner energy. As Oman continues to attract foreign investment, the pipeline sector is expected to evolve, fostering innovation and resilience in the face of global energy transitions.

| Segment | Sub-Segments |

|---|---|

| By Type | Crude Oil Pipelines Natural Gas Pipelines Refined Product Pipelines Multi-Product Pipelines Onshore Pipelines Offshore Pipelines |

| By End-User | Oil and Gas Producers Pipeline Operators Industrial Users Utilities Export Terminals |

| By Application | Transportation (Onshore/Offshore) Storage Distribution Inter-country Connections |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| By Pipeline Diameter | Small Diameter Pipelines (<16 inches) Medium Diameter Pipelines (16–24 inches) Large Diameter Pipelines (>24 inches) |

| By Pipeline Material | Steel Pipelines Plastic Pipelines Composite Pipelines |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crude Oil Pipeline Operations | 50 | Operations Managers, Pipeline Engineers |

| Natural Gas Transportation | 40 | Project Managers, Regulatory Affairs Specialists |

| Refined Products Distribution | 40 | Logistics Coordinators, Supply Chain Analysts |

| Pipeline Maintenance Services | 40 | Maintenance Supervisors, Safety Officers |

| Infrastructure Development Projects | 40 | Business Development Managers, Investment Analysts |

The Oman Oil and Gas Pipeline Market is valued at approximately USD 1.5 billion, driven by increased domestic energy demand, government investments in infrastructure, and the expansion of the pipeline network to support both domestic consumption and exports.