Region:Asia

Author(s):Geetanshi

Product Code:KRAA2298

Pages:97

Published On:August 2025

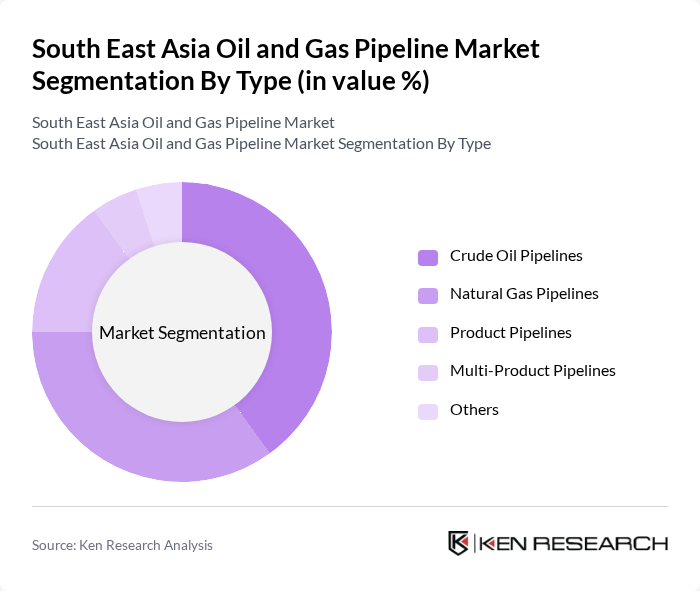

By Type:The segmentation by type includes various pipeline categories such ascrude oil pipelines, natural gas pipelines, product pipelines, multi-product pipelines, and others. Each type serves distinct roles in the transportation and distribution of energy resources. Crude oil pipelines are primarily used for field evacuation and refinery logistics, while natural gas pipelines are increasingly important for gas-to-power projects and industrial feedstock. Product and multi-product pipelines support refined product distribution and flexible supply chain management .

By End-User:The end-user segmentation includesoil and gas companies, industrial users, utilities, and government agencies. Oil and gas companies are the primary consumers, driven by the need for efficient resource transportation. Industrial users and utilities rely on pipelines for stable energy supply to support manufacturing and power generation, while government agencies focus on regulatory oversight and infrastructure development .

The South East Asia Oil and Gas Pipeline Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Perusahaan Gas Negara Tbk (PGN), PTT Public Company Limited, Petroliam Nasional Berhad (PETRONAS), PT Pertamina (Persero), Vietnam Oil and Gas Group (PetroVietnam), Gas Malaysia Berhad, Thai Oil Public Company Limited, Scomi Energy Services Bhd, Dialog Group Berhad, Medco Energi Internasional Tbk, Keppel Infrastructure Holdings Pte Ltd, Surya Esa Perkasa Tbk, Sapura Energy Berhad, JGC Corporation, Myanmar Oil and Gas Enterprise (MOGE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Southeast Asia oil and gas pipeline market appears promising, driven by increasing energy demands and significant infrastructure investments. As countries prioritize energy security, the integration of renewable energy sources into existing pipeline networks is expected to gain momentum. Additionally, advancements in smart pipeline technologies will enhance operational efficiency and safety. Collaborative efforts among industry stakeholders will be crucial in addressing regulatory challenges and environmental concerns, ensuring sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Crude Oil Pipelines Natural Gas Pipelines Product Pipelines Multi-Product Pipelines Others |

| By End-User | Oil and Gas Companies Industrial Users Utilities Government Agencies |

| By Location of Deployment | Onshore Offshore |

| By Application | Transportation Storage Distribution |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies Tax Incentives Regulatory Support |

| By Pipeline Diameter | Small Diameter Pipelines Medium Diameter Pipelines Large Diameter Pipelines |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Onshore Pipeline Projects | 100 | Project Managers, Operations Directors |

| Offshore Pipeline Developments | 80 | Engineering Managers, Environmental Compliance Officers |

| Regulatory Framework Insights | 60 | Government Officials, Policy Advisors |

| Market Entry Strategies | 50 | Business Development Managers, Market Analysts |

| Investment Trends in Oil & Gas | 70 | Financial Analysts, Investment Managers |

The South East Asia Oil and Gas Pipeline Market is valued at approximately USD 1.5 billion, driven by increasing energy demand, rapid industrialization, and significant investments in pipeline infrastructure across the region.