Region:Middle East

Author(s):Geetanshi

Product Code:KRAB1200

Pages:80

Published On:January 2026

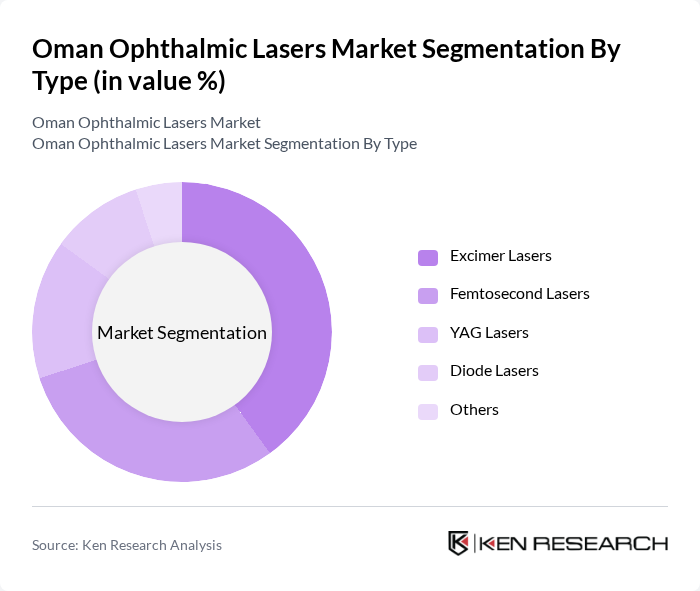

By Type:The market is segmented into various types of lasers, including Excimer Lasers, Femtosecond Lasers, YAG Lasers, Diode Lasers, and Others. Among these, Excimer Lasers are leading due to their widespread use in refractive surgeries, particularly LASIK, which is favored for its precision and effectiveness. Femtosecond Lasers are also gaining traction for their applications in cataract surgeries, enhancing the overall surgical experience.

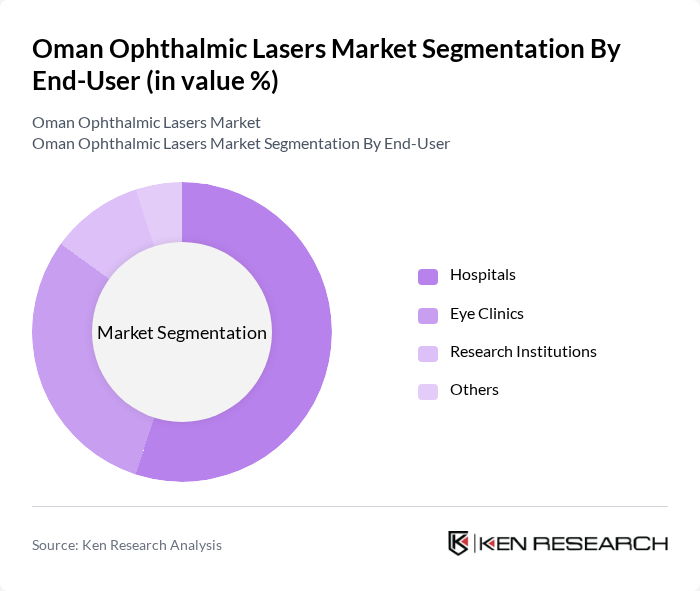

By End-User:The end-user segmentation includes Hospitals, Eye Clinics, Research Institutions, and Others. Hospitals dominate the market due to their comprehensive facilities and advanced technologies, which cater to a larger patient base. Eye Clinics are also significant players, providing specialized services and attracting patients seeking targeted treatments.

The Oman Ophthalmic Lasers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alcon, Johnson & Johnson Vision, Bausch + Lomb, Zeiss, Nidek, Lumenis, Abbott Medical Optics, Topcon, Optos, Santen Pharmaceutical, Iridex, Ellex Medical Lasers, LightMed, Avedro, and Heidelberg Engineering contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman ophthalmic lasers market appears promising, driven by a diversified government strategy under Vision 2040, which emphasizes healthcare modernization. This initiative aims to enhance healthcare services and infrastructure, thereby increasing the demand for advanced medical technologies. Additionally, the growing adoption of digital health technologies and telemedicine is expected to facilitate the integration of ophthalmic lasers into clinical practices, improving patient outcomes and accessibility.

| Segment | Sub-Segments |

|---|---|

| By Type | Excimer Lasers Femtosecond Lasers YAG Lasers Diode Lasers Others |

| By End-User | Hospitals Eye Clinics Research Institutions Others |

| By Application | Cataract Surgery Refractive Surgery Glaucoma Treatment Retinal Surgery Others |

| By Technology | Laser-Assisted In Situ Keratomileusis (LASIK) Photorefractive Keratectomy (PRK) Laser Peripheral Iridotomy Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Muscat Salalah Sohar Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmic Surgeons | 100 | Ophthalmologists, Laser Treatment Specialists |

| Healthcare Administrators | 80 | Hospital Managers, Procurement Officers |

| Medical Device Distributors | 60 | Sales Managers, Product Specialists |

| Patients undergoing Laser Treatments | 75 | Recent Patients, Patient Advocates |

| Regulatory Bodies | 50 | Health Policy Makers, Regulatory Affairs Managers |

The Oman Ophthalmic Lasers Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the increasing prevalence of eye disorders and advancements in healthcare technologies.