Region:Global

Author(s):Geetanshi

Product Code:KRAB1662

Pages:92

Published On:January 2026

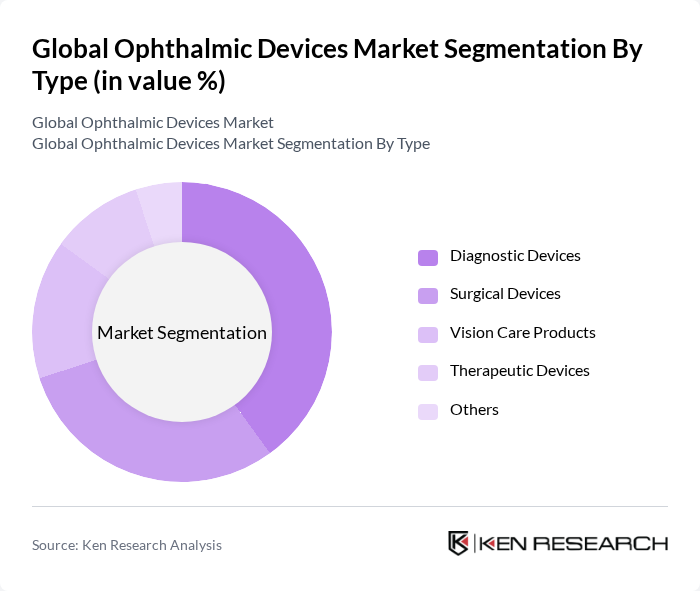

By Type:The market is segmented into Diagnostic Devices, Surgical Devices, Vision Care Products, Therapeutic Devices, and Others. Among these, Diagnostic Devices are leading due to the increasing demand for early detection of eye diseases. The rise in routine eye examinations and advancements in diagnostic technologies, such as optical coherence tomography, have significantly contributed to this segment's growth. Surgical Devices also hold a substantial share, driven by the rising number of cataract surgeries and other ophthalmic procedures.

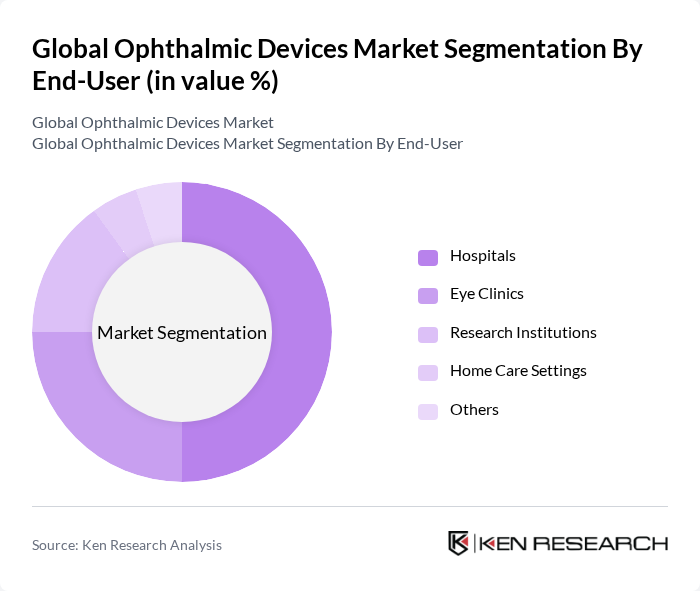

By End-User:The market is categorized into Hospitals, Eye Clinics, Home Care Settings, Research Institutions, and Others. Hospitals are the leading end-user segment, primarily due to the high volume of surgical procedures performed and the availability of advanced medical technologies. Eye Clinics also play a significant role, as they provide specialized care and treatment for various eye conditions, contributing to the overall growth of the market.

The Global Ophthalmic Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson Vision, Alcon Inc., Bausch + Lomb, CooperVision, Carl Zeiss AG, Novartis AG, Hoya Corporation, EssilorLuxottica, Rayner Surgical Group, Topcon Corporation, Medtronic, Santen Pharmaceutical Co., Ltd., Haag-Streit AG, Nidek Co., Ltd., Ophtec B.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ophthalmic devices market appears promising, driven by ongoing technological advancements and an increasing focus on patient-centered care. The integration of artificial intelligence and telemedicine is expected to enhance diagnostic capabilities and treatment accessibility. Additionally, the growing emphasis on personalized medicine will likely lead to tailored treatment options, improving patient outcomes. As healthcare systems adapt to these trends, the market is poised for significant growth, particularly in emerging economies where demand for eye care services is rising.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Devices Surgical Devices Vision Care Products Therapeutic Devices Others |

| By End-User | Hospitals Eye Clinics Home Care Settings Research Institutions Others |

| By Product Category | Intraocular Lenses Retinal Surgery Devices Cataract Surgery Devices Glaucoma Devices Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Laser Technology Optical Coherence Tomography Ultrasound Technology Others |

| By Application | Diagnostic Applications Surgical Applications Therapeutic Applications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmic Device Usage in Clinics | 120 | Ophthalmologists, Optometrists |

| Hospital Procurement Insights | 100 | Procurement Managers, Hospital Administrators |

| Market Trends in Surgical Instruments | 80 | Surgeons, Medical Device Buyers |

| Consumer Preferences for Vision Correction | 100 | Patients, Eye Care Professionals |

| Innovations in Diagnostic Equipment | 90 | R&D Managers, Product Development Specialists |

The Global Ophthalmic Devices Market is valued at approximately USD 50 billion, driven by the rising prevalence of eye disorders, advancements in technology, and increased awareness regarding eye health. This market is expected to grow significantly in the coming years.