Region:Middle East

Author(s):Shubham

Product Code:KRAA8481

Pages:99

Published On:November 2025

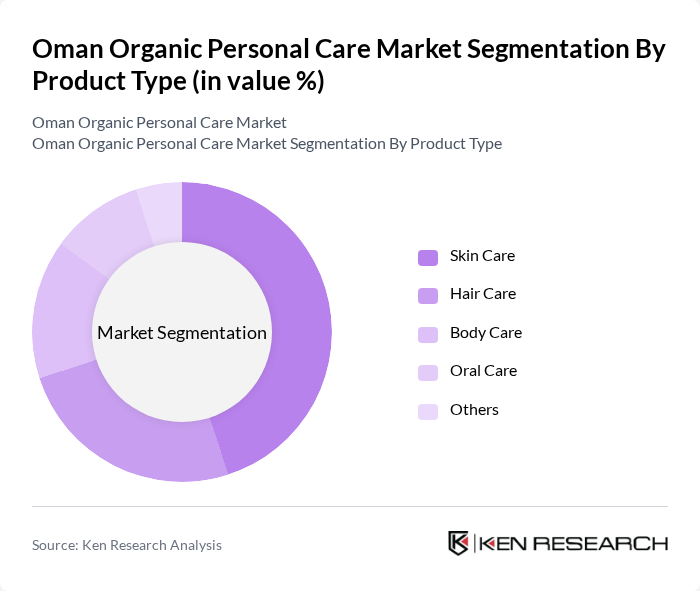

By Product Type:The product type segmentation includes various categories such as Skin Care, Hair Care, Body Care, Oral Care, and Others. Among these, Skin Care products are currently leading the market due to the increasing focus on skincare routines and the rising awareness of skin health. Consumers are increasingly opting for organic skincare solutions that promise fewer chemicals and more natural benefits. Hair Care products also show significant demand, particularly among younger demographics who are more inclined towards organic formulations. The trend towards holistic health and wellness is driving growth across all product types.

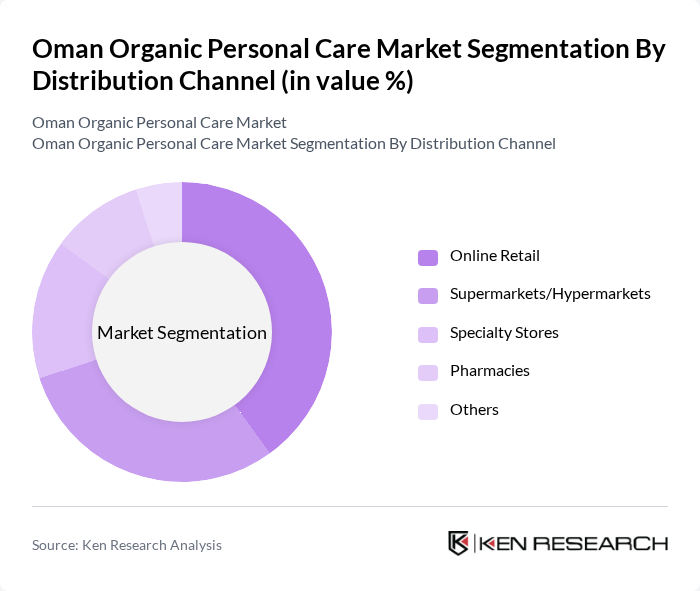

By Distribution Channel:The distribution channel segmentation includes Online Retail, Supermarkets/Hypermarkets, Specialty Stores, Pharmacies, and Others. Online Retail is rapidly gaining traction, especially among younger consumers who prefer the convenience of shopping from home. Supermarkets and hypermarkets remain significant players due to their wide reach and ability to offer a variety of organic products under one roof. Specialty stores also cater to niche markets, providing curated selections of organic personal care items, which appeals to health-conscious consumers. The growth of e-commerce is reshaping how consumers access organic personal care products, with digital platforms offering greater product transparency and personalized recommendations .

The Oman Organic Personal Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Muscat Natural, Al Haramain Perfumes, Organic Oasis, The Body Shop Oman, Lush Fresh Handmade Cosmetics Oman, Nuxe Oman, Weleda Oman, Dr. Hauschka Oman, Khadi Natural Oman, Aesop Oman, Kiehl's Oman, Burt's Bees Oman, Tatcha Oman, Herbivore Botanicals Oman, 100% Pure Oman contribute to innovation, geographic expansion, and service delivery in this space.

The future of the organic personal care market in Oman appears promising, driven by increasing consumer demand for sustainable and ethical products. As the market matures, brands are likely to innovate with new formulations and eco-friendly packaging. Additionally, the rise of social media influencers is expected to play a significant role in shaping consumer preferences, further propelling the market. With government support for organic farming and certification, the sector is poised for substantial growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Skin Care Hair Care Body Care Oral Care Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Lifestyle Preferences |

| By Packaging Type | Bottles Tubes Jars Pouches Others |

| By Ingredient Type | Natural Ingredients Organic Ingredients Synthetic Ingredients Others |

| By Price Range | Premium Mid-range Budget Others |

| By Brand Loyalty | Brand Loyal Consumers Price-sensitive Consumers First-time Buyers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Organic Skincare | 120 | Regular users of skincare products, Aged 18-45 |

| Market Insights from Retailers | 65 | Store Managers, Beauty Product Buyers |

| Expert Opinions on Organic Trends | 45 | Beauty Industry Consultants, Dermatologists |

| Distribution Channel Effectiveness | 55 | Distributors, Wholesalers in Personal Care |

| Brand Loyalty and Consumer Behavior | 95 | Consumers who purchase organic personal care products |

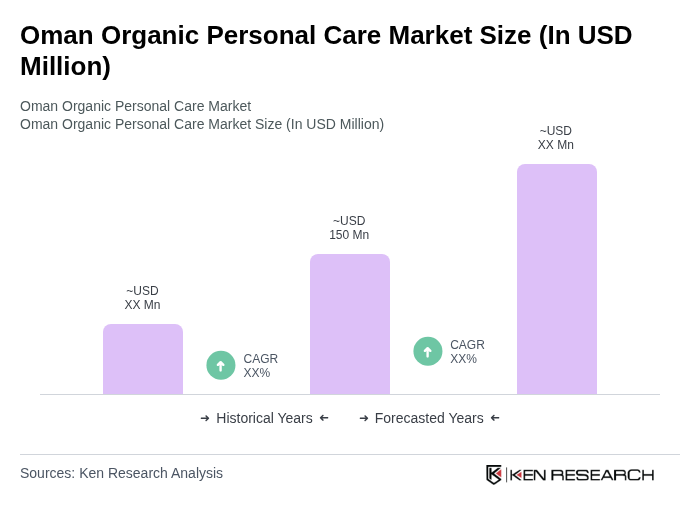

The Oman Organic Personal Care Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increasing consumer awareness and demand for organic products and natural ingredients.