Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7134

Pages:97

Published On:December 2025

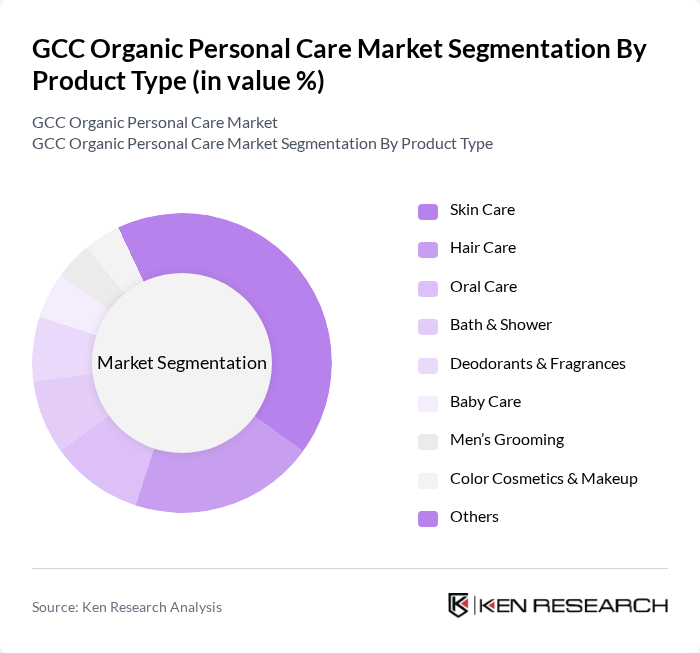

By Product Type:The product type segmentation includes various categories such as Skin Care, Hair Care, Oral Care, Bath & Shower, Deodorants & Fragrances, Baby Care, Men’s Grooming, Color Cosmetics & Makeup, and Others. Among these, Skin Care is the leading subsegment, in line with global organic personal care dynamics where skin care holds the largest revenue share, supported by rising multi?step skincare routines, demand for anti?aging and sensitive?skin solutions, and preference for plant?based actives. The trend towards clean beauty, ingredient transparency, and “free?from” claims, together with the influence of social media influencers and dermatology?backed content advocating for organic and natural skincare products, has significantly boosted this segment's popularity.

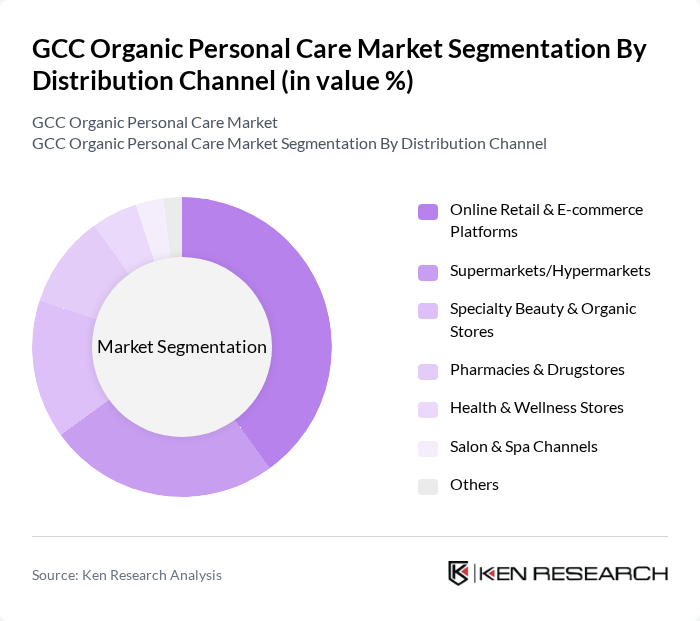

By Distribution Channel:The distribution channel segmentation includes Online Retail & E-commerce Platforms, Supermarkets/Hypermarkets, Specialty Beauty & Organic Stores, Pharmacies & Drugstores, Health & Wellness Stores, Salon & Spa Channels, and Others. Online Retail & E-commerce Platforms are currently the dominant channel, consistent with global patterns where e?commerce has become the leading distribution channel for organic personal care due to its broader assortment, access to niche and indie brands, subscription models, and extensive consumer reviews. The COVID?19 pandemic accelerated digital adoption and shifted beauty and personal care purchasing behavior online, leading to a sustained increase in online sales of organic and natural personal care products across the GCC, supported by regional and cross?border marketplaces.

The GCC Organic Personal Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Farm Organic International (UAE), Herbal Essentials Skincare (UAE), Neal’s Yard Remedies (regional operations), Lush Fresh Handmade Cosmetics (GCC operations), The Body Shop (GCC operations), Dabur International Ltd. (Middle East & GCC), Himalaya Wellness (Middle East & GCC), Arabian Oud – Natural & Organic Lines (Saudi Arabia), Shiffa Dubai Skincare (UAE), Izil Beauty – Natural Moroccan Products (UAE/GCC), Nudska Organic Skincare (UAE), Secret Skin – Clean Beauty Platform & Brands (UAE/GCC), Green Bar Inc. (Bahrain), Kora Organics (regional presence via retail & e?commerce), Tata Harper Skincare (regional presence via retail & e?commerce) contribute to innovation, geographic expansion, and service delivery in this space.

The GCC organic personal care market is poised for significant growth, driven by evolving consumer preferences and increasing environmental awareness. As sustainability becomes a priority, brands are expected to innovate with eco-friendly packaging and formulations. The rise of social media influencers will further amplify the reach of organic products, creating a more informed consumer base. Additionally, the expansion of e-commerce will facilitate access to a broader audience, enhancing market penetration and brand visibility in future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Skin Care Hair Care Oral Care Bath & Shower Deodorants & Fragrances Baby Care Men’s Grooming Color Cosmetics & Makeup Others |

| By Distribution Channel | Online Retail & E-commerce Platforms Supermarkets/Hypermarkets Specialty Beauty & Organic Stores Pharmacies & Drugstores Health & Wellness Stores Salon & Spa Channels Others |

| By Consumer Demographics | Women Men Children & Babies High-income (Premium Segment) Middle-income (Mass & Masstige Segment) Halal-Conscious & Ethically Oriented Consumers Others |

| By Packaging Type | Glass Plastic (Recyclable/Bio?based) Paper & Cardboard Metal Refill & Bulk Packaging Others |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others (Re-exports & Free Zones) |

| By Ingredient Type | Certified Organic Ingredients Natural-Origin Ingredients Halal-Certified Ingredients Vegan & Cruelty-Free Formulations Others |

| By Price Range | Premium/Luxury Masstige (Affordable Premium) Mass/Budget Travel & Mini Sizes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Organic Skincare | 150 | Health-conscious Consumers, Beauty Enthusiasts |

| Market Trends in Organic Hair Care | 100 | Salon Owners, Hair Care Product Managers |

| Purchasing Behavior in Organic Cosmetics | 120 | Makeup Artists, Retail Buyers |

| Impact of Sustainability on Buying Decisions | 80 | Eco-conscious Consumers, Sustainability Advocates |

| Brand Loyalty in Organic Personal Care | 90 | Frequent Buyers, Brand Ambassadors |

The GCC Organic Personal Care Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing consumer awareness and demand for organic and natural products free from harmful chemicals.