Region:Middle East

Author(s):Geetanshi

Product Code:KRAA6010

Pages:86

Published On:January 2026

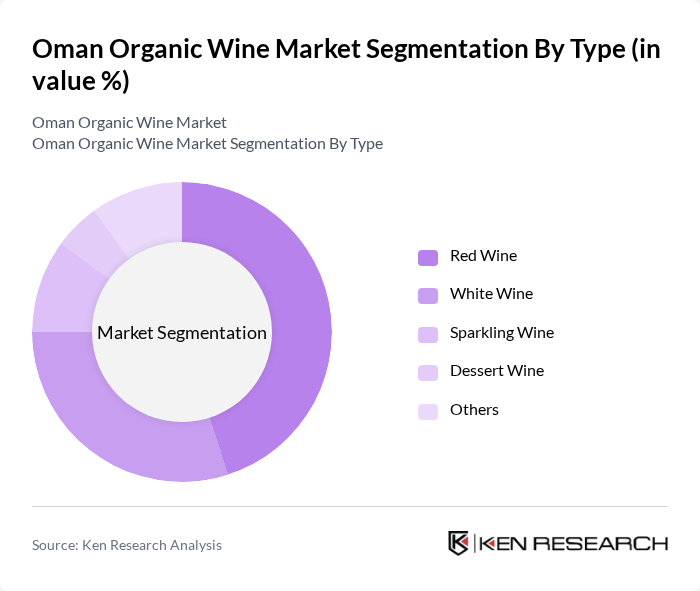

By Type:The organic wine market in Oman is segmented into various types, including red wine, white wine, rosé wine, sparkling wine, and others. Among these, red wine has emerged as the dominant segment, driven by consumer preferences for robust flavors and the increasing popularity of red wine's health benefits. White wine and rosé are also gaining traction, particularly among younger consumers and women, who are increasingly exploring diverse wine options. The sparkling wine segment, while smaller, is growing due to its association with celebrations and special occasions.

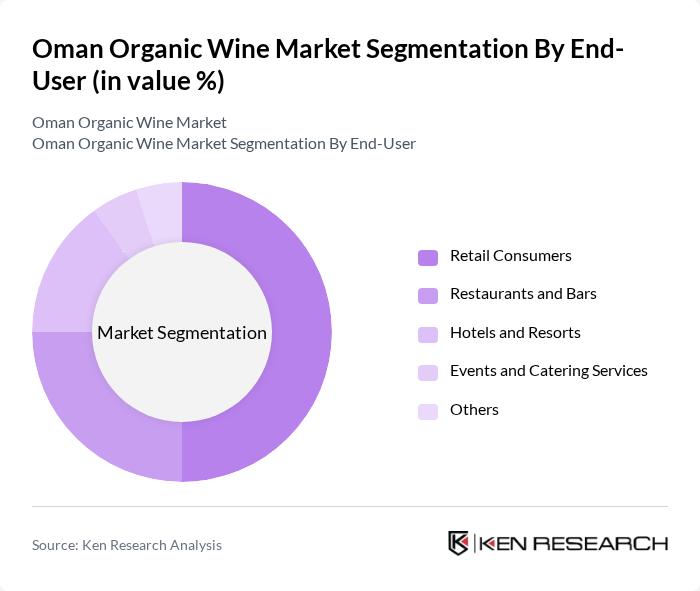

By End-User:The end-user segmentation of the organic wine market includes retail consumers, restaurants and bars, hotels, events and catering, and others. Retail consumers represent the largest segment, driven by the increasing availability of organic wines in supermarkets and online platforms. Restaurants and bars are also significant contributors, as they cater to a growing clientele seeking premium organic options. Hotels and catering services are expanding their organic wine offerings to meet the demands of health-conscious guests, further driving market growth.

The Oman Organic Wine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Jazeera Winery, Oman Vineyards, Muscat Wine Company, Dhofar Wines, Al Harthy Winery, Oman Organic Wines, Al Batinah Vineyards, Al Dakhiliyah Winery, Muscat Hills Winery, Salalah Organic Wines, Al Sharqiyah Vineyards, Oman Wine Estates, Al Wusta Winery, Sohar Organic Wines, Buraimi Vineyards contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman organic wine market appears promising, driven by a growing trend towards sustainable and organic products. As consumers become more health-conscious and environmentally aware, the demand for organic wines is expected to rise. Additionally, the expansion of e-commerce platforms provides new distribution channels, facilitating access to organic wines. The integration of wine tourism and experiential events can further enhance consumer engagement, promoting organic wine consumption and education in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Red Wine White Wine Rosé Wine Sparkling Wine Others |

| By End-User | Retail Consumers Restaurants and Bars Hotels Events and Catering Others |

| By Packaging Type | Glass Bottles Tetra Packs Kegs Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Distribution Channel | Online Retail Supermarkets Specialty Stores Direct Sales Others |

| By Origin | Domestic Imported Others |

| By Consumer Demographics | Age Group Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Organic Wine Retailers | 100 | Store Managers, Wine Buyers |

| Consumers of Organic Products | 150 | Health-conscious Consumers, Organic Product Enthusiasts |

| Local Organic Wine Producers | 50 | Winemakers, Production Managers |

| Distributors of Organic Wines | 70 | Logistics Managers, Sales Representatives |

| Industry Experts and Analysts | 30 | Market Analysts, Wine Industry Consultants |

The Oman Organic Wine Market is valued at approximately USD 260 million, reflecting a significant growth trend driven by rising tourism, an expanding expatriate population, and increasing consumer preferences for premium, health-oriented products.