Region:Global

Author(s):Rebecca

Product Code:KRAC2483

Pages:85

Published On:October 2025

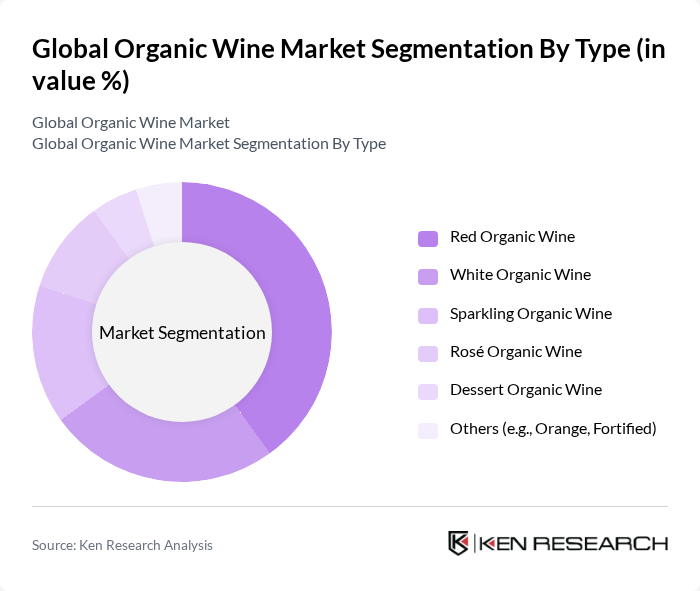

By Type:The organic wine market is segmented into Red Organic Wine, White Organic Wine, Sparkling Organic Wine, Rosé Organic Wine, Dessert Organic Wine, and Others (e.g., Orange, Fortified). Red Organic Wine remains the most popular choice among consumers, driven by its rich flavors and perceived health benefits. The increasing trend of pairing red wine with meals has further boosted its demand, making it a staple in both retail and restaurant settings. The market share distribution by type is consistent with industry reporting, with red organic wine leading the segment .

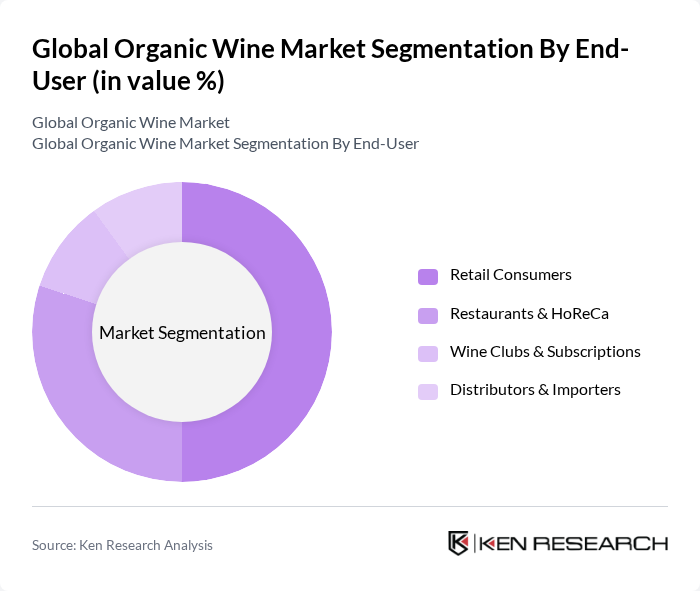

By End-User:The end-user segmentation includes Retail Consumers, Restaurants & HoReCa, Wine Clubs & Subscriptions, and Distributors & Importers. Retail Consumers represent the largest segment, as the growing trend of health-consciousness among individuals drives demand for organic products. The rise of e-commerce platforms has made organic wines more accessible, further enhancing their popularity in the retail sector. Millennials, in particular, account for over half of organic product purchases, underscoring the demographic shift in demand .

The Global Organic Wine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Concha y Toro, E. & J. Gallo Winery, Jackson Family Wines, The Organic Wine Company, Bonterra Organic Vineyards, Frey Vineyards, Domaine de la Vougeraie, Emiliana Organic Vineyards, Château Maris, La Cantina Pizzolato, Domaine Bousquet, The Wine Group, Treasury Wine Estates, King Estate Winery, Bronco Wine Company contribute to innovation, geographic expansion, and service delivery in this space .

The future of the organic wine market in the None region appears promising, driven by increasing consumer awareness and a shift towards sustainable practices. As health consciousness continues to rise, more consumers are expected to seek organic options. Additionally, the expansion of e-commerce platforms will facilitate access to organic wines, allowing producers to reach a broader audience. Collaborations with restaurants and retailers will further enhance visibility and sales, positioning organic wines favorably in the competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Red Organic Wine White Organic Wine Sparkling Organic Wine Rosé Organic Wine Dessert Organic Wine Others (e.g., Orange, Fortified) |

| By End-User | Retail Consumers Restaurants & HoReCa Wine Clubs & Subscriptions Distributors & Importers |

| By Sales Channel | Online Retail/E-commerce Supermarkets/Hypermarkets Specialty Wine Stores Direct-to-Consumer (Winery Sales) |

| By Price Range | Premium Mid-Range Budget |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Glass Bottles Tetra Packs Cans Bag-in-Box |

| By Organic Certification Type | USDA Organic EU Organic Australian Certified Organic Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Organic Wine Producers | 60 | Winemakers, Vineyard Managers |

| Retailers of Organic Wines | 50 | Store Managers, Category Buyers |

| Distributors in Organic Wine Market | 40 | Sales Representatives, Distribution Managers |

| Consumers of Organic Wines | 150 | Wine Enthusiasts, Health-Conscious Consumers |

| Industry Experts and Analysts | 40 | Market Analysts, Industry Consultants |

The Global Organic Wine Market is valued at approximately USD 12.9 billion, reflecting a significant growth trend driven by increasing consumer awareness of health benefits and a demand for sustainable agricultural practices.