Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4146

Pages:100

Published On:December 2025

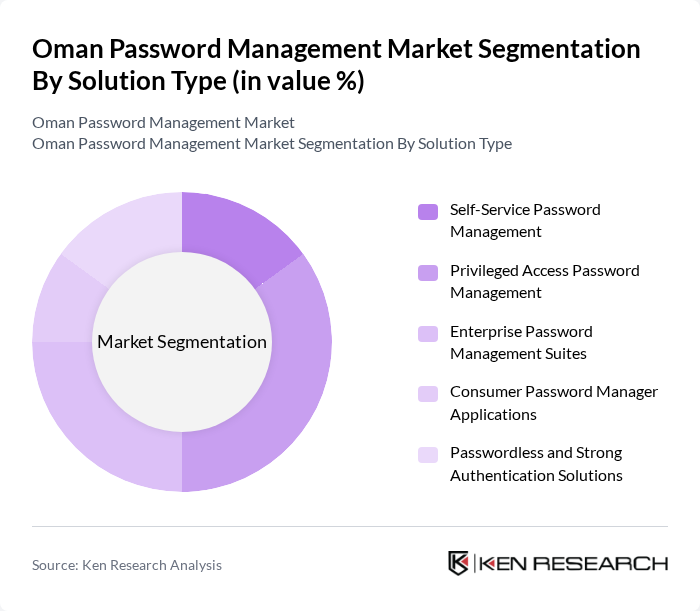

By Solution Type:The solution type segmentation includes various subsegments such as Self-Service Password Management, Privileged Access Password Management, Enterprise Password Management Suites, Consumer Password Manager Applications, and Passwordless and Strong Authentication Solutions. This structure aligns with global market taxonomies that differentiate between self?service reset tools, privileged access management, enterprise vaults, and consumer applications. Among these, Privileged Access Password Management is currently gaining the largest share of enterprise spend due to the increasing focus on securing administrator and high?risk accounts, meeting audit requirements, and integrating with broader identity and access management (IAM) and zero?trust architectures. The rise in targeted cyber threats, ransomware, and insider?risk scenarios has led enterprises in Oman’s banking, oil and gas, utilities, and government sectors to prioritize solutions that manage, rotate, and monitor privileged accounts effectively.

By Deployment Model:The deployment model segmentation encompasses On-Premises, Cloud-Based (SaaS), and Hybrid solutions, which reflects how password management is offered globally across enterprise and SME buyers. The Cloud-Based (SaaS) model is leading the market due to its flexibility, rapid implementation, scalability, and subscription pricing, making it an attractive option for organizations looking to streamline password management and support remote and hybrid workforces. The increasing adoption of cloud technologies, the expansion of SaaS business applications, and the need for secure remote access and federated identity across on?premise and cloud environments have further propelled the growth of this segment in Oman.

The Oman Password Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as LastPass, Dashlane, 1Password, Keeper Security, Bitwarden, CyberArk Software Ltd., BeyondTrust Corporation, Delinea Inc., Okta Inc., Microsoft Corporation, IBM Corporation, Zoho Corporation (Zoho Vault), Broadcom Inc. (Symantec Enterprise Security), Gen Digital Inc. (Norton Password Manager), McAfee Corp. contribute to innovation, geographic expansion, and service delivery in this space, offering portfolios that span consumer password vaults, enterprise password management, privileged access management, single sign-on, and multi-factor authentication capabilities.

The future of the password management market in Oman appears promising, driven by increasing cybersecurity threats and the growing emphasis on regulatory compliance. As organizations adapt to hybrid work environments, the demand for secure password management solutions will likely rise. Furthermore, advancements in technology, such as AI-driven tools and biometric authentication, are expected to enhance user experience and security, making password management solutions more appealing to businesses across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Self-Service Password Management Privileged Access Password Management Enterprise Password Management Suites Consumer Password Manager Applications Passwordless and Strong Authentication Solutions |

| By Deployment Model | On-Premises Cloud-Based (SaaS) Hybrid |

| By Authentication Method | Password-Based Authentication Multi-Factor Authentication (MFA) Single Sign-On (SSO) Integration Biometric and Passwordless Authentication |

| By End-User Organization Size | Small and Medium Enterprises (SMEs) Large Enterprises Micro and SOHO Users |

| By Industry Vertical | Banking, Financial Services and Insurance (BFSI) Government and Public Sector Healthcare IT and Telecommunications Oil & Gas and Industrial Retail and E-commerce Education |

| By Application | Identity and Access Management Integration Privileged Account and Session Management Endpoint and Mobile Password Management Web and Cloud Application Password Management |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate IT Departments | 60 | IT Managers, Security Officers |

| Small and Medium Enterprises (SMEs) | 50 | Business Owners, IT Consultants |

| Government Agencies | 40 | Cybersecurity Analysts, Compliance Officers |

| Educational Institutions | 40 | IT Administrators, Faculty Members |

| Healthcare Organizations | 40 | IT Directors, Data Protection Officers |

The Oman Password Management Market is valued at approximately USD 50 million, reflecting a strong demand for cybersecurity solutions driven by increasing cyber threats and data breaches across various sectors, including government and banking.