Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3937

Pages:84

Published On:November 2025

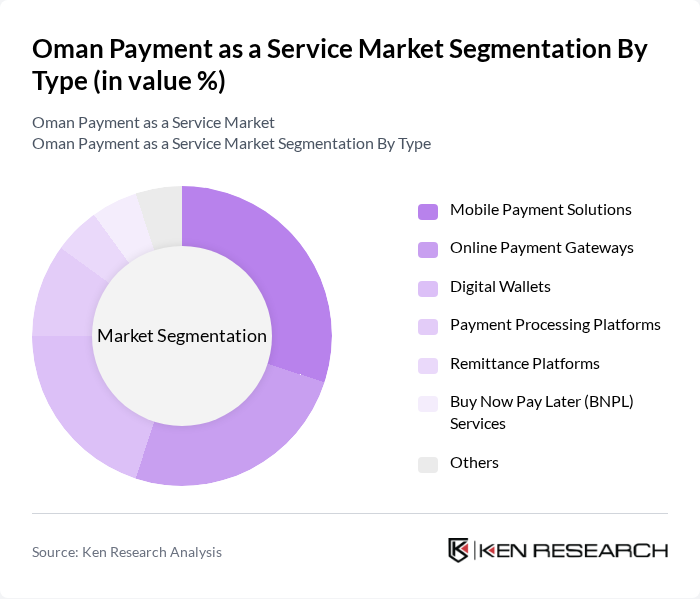

By Type:The market is segmented into various types of payment solutions, including Mobile Payment Solutions, Online Payment Gateways, Digital Wallets, Payment Processing Platforms, Remittance Platforms, Buy Now Pay Later (BNPL) Services, and Others. Among these, Mobile Payment Solutions are gaining significant traction due to the proliferation of smartphones and the convenience of app-based transactions. Digital Wallets are also increasingly popular, offering secure, contactless, and efficient ways to make payments, especially for e-commerce and in-store purchases .

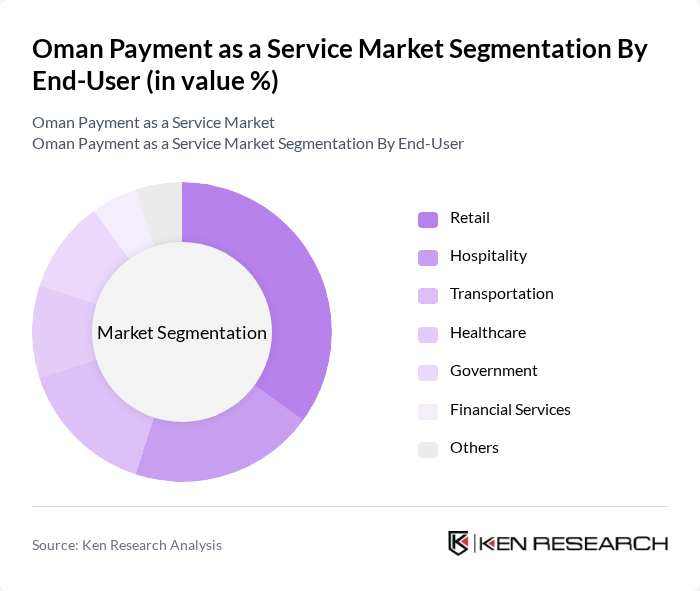

By End-User:The end-user segmentation includes Retail, Hospitality, Transportation, Healthcare, Government, Financial Services, and Others. The Retail sector leads the market, propelled by the rapid expansion of e-commerce and the increasing consumer preference for online and mobile shopping. The Healthcare sector is also emerging as a significant user of digital payment solutions, particularly for telemedicine, online consultations, and digital health services .

The Oman Payment as a Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Arab Bank, Bank Muscat, Bank Dhofar, National Bank of Oman, Sohar International Bank, PayFort (an Amazon company), Thawani Technologies, Fatora, Ooredoo Oman, Omantel, Zain Group, Mastercard, Visa, PayPal, Stripe, CBO (Central Bank of Oman), Meethaq Islamic Banking, OPay, National Finance Company, and EdfaPay contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman Payment as a Service market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in payment processing is expected to enhance transaction efficiency and security. Additionally, the growing trend of contactless payments is likely to reshape consumer behavior, making cashless transactions more prevalent. As the market matures, innovative payment solutions will emerge, catering to diverse consumer needs and further driving market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Payment Solutions Online Payment Gateways Digital Wallets Payment Processing Platforms Remittance Platforms Buy Now Pay Later (BNPL) Services Others |

| By End-User | Retail Hospitality Transportation Healthcare Government Financial Services Others |

| By Payment Method | Credit Cards Debit Cards Bank Transfers Mobile Wallets Cash Pickup Prepaid Cards Cryptocurrency Payments Others |

| By Industry Vertical | E-commerce Telecommunications Financial Services Government Services Oil, Gas, and Utilities Travel and Hospitality Healthcare Others |

| By Transaction Size | Micro Transactions Small Transactions Medium Transactions Large Transactions Others |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Enterprises Government Entities Non-Governmental Organizations (NGOs) Others |

| By Geographic Distribution | Urban Areas Rural Areas Coastal Regions Inland Regions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Payment Preferences | 120 | General Consumers, Tech-Savvy Users |

| Merchant Acceptance of Payment Services | 90 | Small Business Owners, Retail Managers |

| Financial Institutions' Perspectives | 60 | Banking Executives, Payment Strategy Managers |

| Regulatory Insights | 40 | Policy Makers, Regulatory Analysts |

| Technology Providers' Input | 50 | Fintech Developers, IT Managers |

The Oman Payment as a Service Market is valued at approximately USD 1.4 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions and a preference for cashless transactions among consumers and businesses.