Region:Middle East

Author(s):Shubham

Product Code:KRAE0415

Pages:84

Published On:December 2025

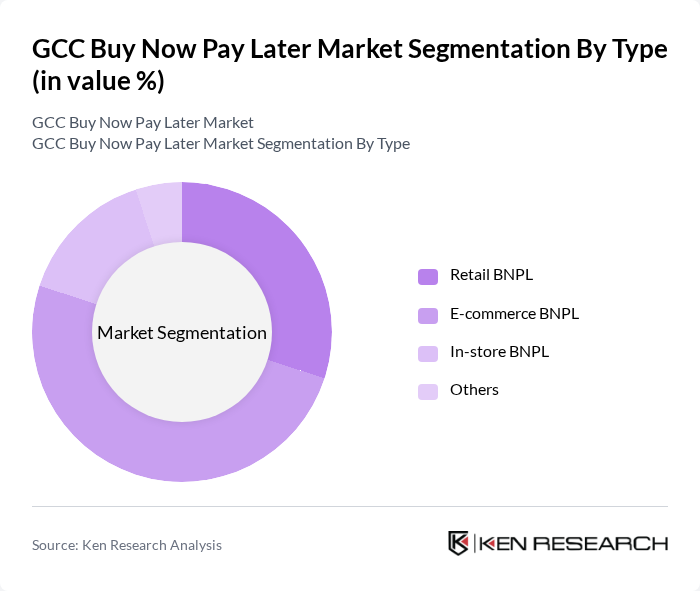

By Type:The Buy Now Pay Later market can be segmented into various types, including Retail BNPL, E-commerce BNPL, In-store BNPL, and Others. Among these, E-commerce BNPL is currently dominating the market due to the surge in online shopping, especially during the pandemic. Consumers are increasingly opting for BNPL options while shopping online, as it allows them to manage their finances better and make purchases without immediate payment. Retail BNPL is also significant, particularly in physical stores, but the convenience of online shopping has given E-commerce BNPL a competitive edge.

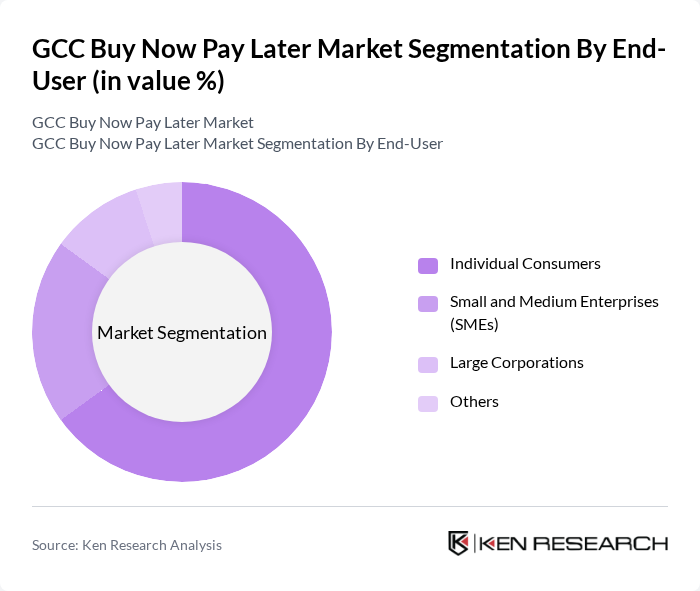

By End-User:The market can also be segmented by end-users, which include Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Others. Individual Consumers are the primary users of BNPL services, driven by the need for flexible payment options for personal purchases. SMEs are increasingly adopting BNPL to enhance customer purchasing power, while Large Corporations utilize these services to facilitate employee benefits and improve sales. The trend towards consumer-centric financial solutions is propelling the growth of BNPL among individual users.

The GCC Buy Now Pay Later Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tabby, Tamara, Postpay, Spotii, PayFort, Cashew, ZoodPay, RAK Bank, Emirates NBD, Al-Futtaim Group, Souq.com, Carrefour, Noon.com, Ounass, and Namshi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC Buy Now Pay Later market appears promising, driven by technological advancements and increasing consumer acceptance. As e-commerce continues to expand, BNPL services are likely to become integral to online shopping experiences. Additionally, the integration of AI in risk assessment will enhance credit evaluation processes, reducing default rates. However, providers must navigate regulatory challenges while educating consumers about responsible usage to ensure sustainable growth in this dynamic market.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail BNPL E-commerce BNPL In-store BNPL Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Others |

| By Region | United Arab Emirates Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Industry | Retail Travel and Hospitality Electronics Fashion Others |

| By Payment Method | Credit Card Debit Card Digital Wallets Bank Transfers Others |

| By Customer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Income Level (Low, Middle, High) Geographic Location (Urban, Suburban, Rural) Others |

| By Customer Experience | User Interface and Experience Customer Support Services Feedback and Review Mechanisms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Purchases | 150 | Consumers aged 18-45 who have used BNPL |

| Fashion Retail Transactions | 120 | Fashion Retail Managers, Marketing Executives |

| Travel and Hospitality Services | 100 | Travel Agency Owners, Customer Experience Managers |

| Home Appliances Sector | 80 | Retail Store Managers, Product Category Managers |

| Online Marketplace Transactions | 130 | E-commerce Platform Managers, Digital Marketing Specialists |

The GCC Buy Now Pay Later market is valued at approximately USD 185 million, driven by the increasing adoption of e-commerce and consumer preference for flexible, interest-free payment options.