Region:Middle East

Author(s):Dev

Product Code:KRAC3438

Pages:86

Published On:October 2025

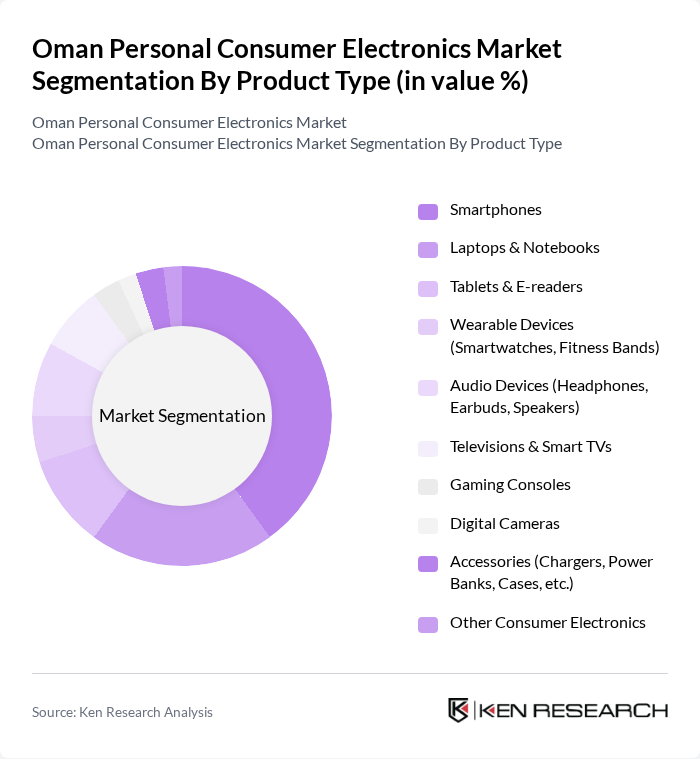

By Product Type:The product type segmentation includes smartphones, laptops & notebooks, tablets & e-readers, wearable devices, audio devices, televisions & smart TVs, gaming consoles, digital cameras, accessories, and other consumer electronics. Among these, smartphones hold the largest market share, driven by widespread adoption, integration into daily life, and consumer preferences for multifunctional devices. The market is also witnessing strong growth in smart TVs, wearable devices, and audio products, reflecting trends toward home entertainment, health monitoring, and connected lifestyles .

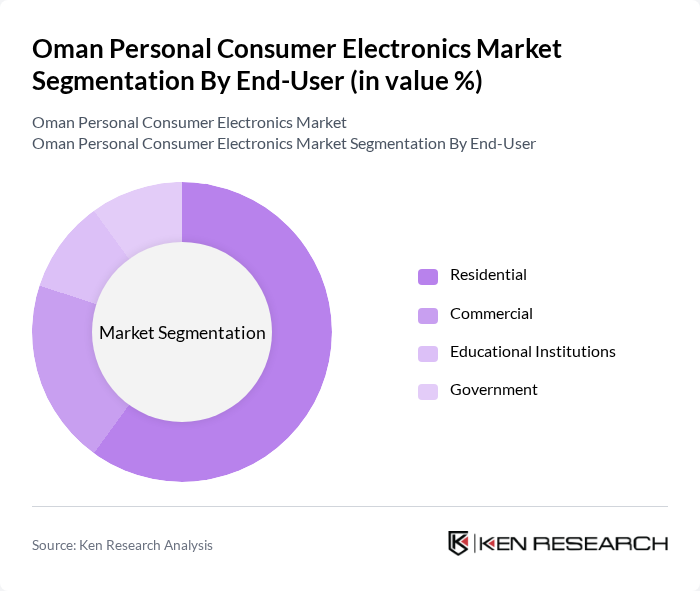

By End-User:The end-user segmentation covers residential, commercial, educational institutions, and government sectors. The residential segment leads the market, driven by demand for personal devices, smart home technologies, and home entertainment systems. Commercial and institutional demand is supported by digital transformation initiatives and increased investment in workplace technology, while government procurement focuses on modernization and public sector efficiency .

The Oman Personal Consumer Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., Apple Inc., Huawei Technologies Co., Ltd., Sony Group Corporation, LG Electronics Inc., Xiaomi Corporation, Lenovo Group Limited, Dell Technologies Inc., HP Inc., Panasonic Holdings Corporation, AsusTek Computer Inc., Microsoft Corporation, TCL Technology Group Corporation, Realme Chongqing Mobile Telecommunications Corp., Ltd., Oppo Guangdong Mobile Communications Co., Ltd., Philips (Koninklijke Philips N.V.), Geepas, Super General Company, Hisense Group, Toshiba Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Oman personal consumer electronics market is poised for significant transformation in the coming years, driven by technological advancements and changing consumer preferences. The increasing adoption of smart home technologies and wearable devices will likely reshape the market landscape. Additionally, the expansion of 5G networks is expected to enhance connectivity, enabling new applications and services. As consumers become more environmentally conscious, demand for sustainable products will also rise, prompting manufacturers to innovate and adapt to these evolving trends.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Smartphones Laptops & Notebooks Tablets & E-readers Wearable Devices (Smartwatches, Fitness Bands) Audio Devices (Headphones, Earbuds, Speakers) Televisions & Smart TVs Gaming Consoles Digital Cameras Accessories (Chargers, Power Banks, Cases, etc.) Other Consumer Electronics |

| By End-User | Residential Commercial Educational Institutions Government |

| By Sales Channel | Online Retail Offline Retail (Electronics Stores, Hypermarkets) Direct Sales Distributors & Dealers |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers |

| By Product Features | High-Performance Features Eco-Friendly Features Smart Features (IoT, AI-enabled, etc.) |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 100 | Store Managers, Sales Executives |

| End-User Consumer Insights | 120 | Tech Enthusiasts, General Consumers |

| Distributors and Wholesalers | 80 | Distribution Managers, Supply Chain Analysts |

| Market Trend Analysts | 40 | Market Researchers, Industry Analysts |

| Retail Technology Providers | 40 | Product Managers, Business Development Executives |

The Oman Personal Consumer Electronics Market is valued at approximately USD 500 million, reflecting significant growth driven by rising disposable incomes, urbanization, and a tech-savvy young population increasingly adopting consumer electronics.