Region:Middle East

Author(s):Dev

Product Code:KRAC1394

Pages:96

Published On:December 2025

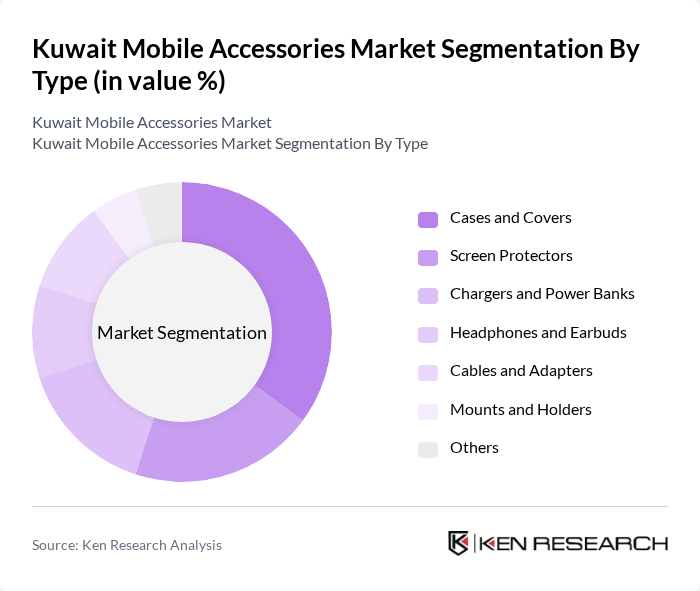

By Type:The mobile accessories market is segmented into various types, including cases and covers, screen protectors, chargers and power banks, headphones and earbuds, cables and adapters, mounts and holders, and others. Among these, cases and covers dominate the market due to their essential role in protecting devices from damage while also allowing for personalization. The increasing trend of smartphone usage has led to a higher demand for protective accessories, making this segment a key player in the market.

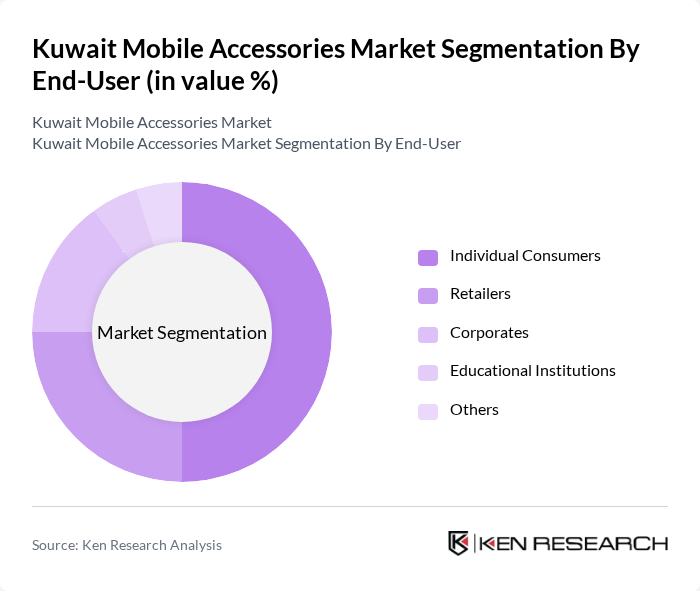

By End-User:The end-user segmentation includes individual consumers, retailers, corporates, educational institutions, and others. Individual consumers represent the largest segment, driven by the growing trend of personalizing mobile devices and the increasing reliance on smartphones for daily activities. Retailers also play a significant role in the market, providing a wide range of products to meet consumer demands. The corporate sector is gradually increasing its share as businesses invest in mobile accessories for employee devices.

The Kuwait Mobile Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics, Apple Inc., Huawei Technologies, Anker Innovations, Belkin International, OtterBox, Jabra, Sony Corporation, Logitech International, ZAGG Inc., Mophie, Razer Inc., Incipio Technologies, Spigen Inc., and UAG (Urban Armor Gear) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait mobile accessories market appears promising, driven by ongoing digital government innovations and the rise of a freelance economy. With the government enhancing digital services and infrastructure, accessory demand is likely to grow as consumers increasingly rely on mobile devices for work and leisure. Additionally, the expansion of IoT technologies will create new opportunities for smart accessories, further stimulating market growth and diversification.

| Segment | Sub-Segments |

|---|---|

| By Type | Cases and Covers Screen Protectors Chargers and Power Banks Headphones and Earbuds Cables and Adapters Mounts and Holders Others |

| By End-User | Individual Consumers Retailers Corporates Educational Institutions Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Price Range | Budget Accessories Mid-Range Accessories Premium Accessories Luxury Accessories Others |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers Others |

| By Material | Plastic Metal Fabric Glass Others |

| By Technology Integration | Smart Accessories Non-Smart Accessories Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Mobile Accessories | 150 | Store Managers, Sales Associates |

| Consumer Preferences for Mobile Accessories | 200 | Mobile Users, Tech Enthusiasts |

| Distribution Channels for Mobile Accessories | 100 | Distributors, Wholesalers |

| Market Trends in E-commerce for Accessories | 120 | E-commerce Managers, Digital Marketing Specialists |

| Product Development Insights | 80 | Product Managers, R&D Specialists |

The Kuwait Mobile Accessories Market is valued at approximately USD 480 million, reflecting significant growth driven by increasing smartphone penetration and consumer preferences for stylish and protective accessories.