Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4895

Pages:94

Published On:December 2025

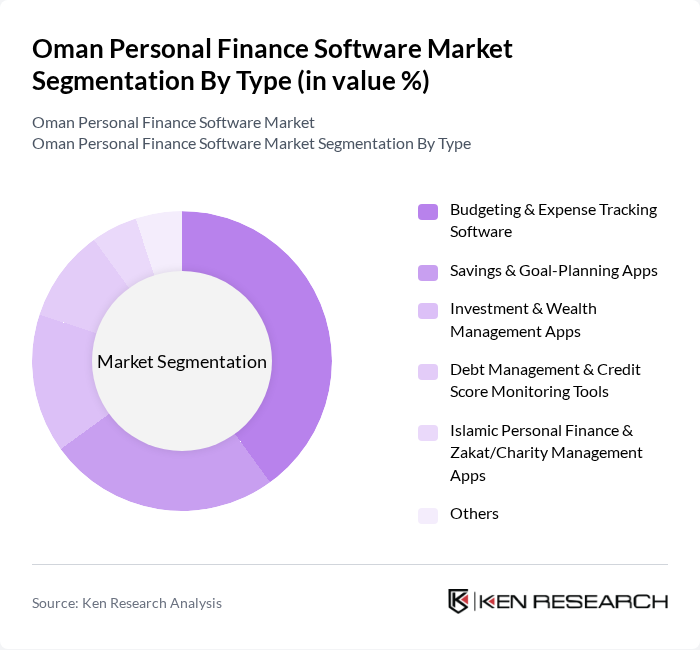

By Type:The market is segmented into various types of personal finance software, including budgeting and expense tracking software, savings and goal-planning apps, investment and wealth management apps, debt management and credit score monitoring tools, Islamic personal finance and Zakat/charity management apps, and others. This structure aligns with global personal finance software and apps markets, which commonly distinguish between budgeting, savings, investment, and debt-related tools. Among these, budgeting and expense tracking software is the most popular due to its essential role in helping users manage their daily finances effectively and its lower barrier to adoption compared with investment or advisory solutions. The increasing need for financial discipline and awareness among consumers, together with rising interest in financial literacy and money?management education, continues to drive demand for these tools.

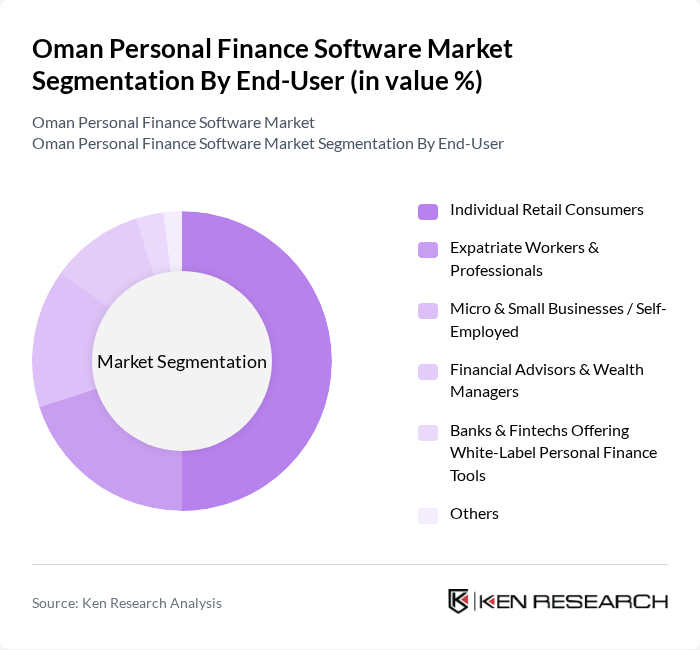

By End-User:The end-user segmentation includes individual retail consumers, expatriate workers and professionals, micro and small businesses/self-employed, financial advisors and wealth managers, banks and fintechs offering white-label personal finance tools, and others. This reflects the global pattern in which individual consumers are the primary users of personal finance software, with additional uptake among small businesses and financial institutions using embedded or white-label tools. Individual retail consumers represent the largest segment, driven by the increasing number of tech-savvy individuals seeking to manage their finances more effectively through mobile and web-based applications. The growing trend of financial independence among younger generations, combined with higher smartphone penetration and digital banking usage in Oman, further fuels this demand.

The Oman Personal Finance Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intuit Inc. (Mint, Credit Karma), YNAB (You Need A Budget), Wally Global Inc. (Wally), Spendee a.s. (Spendee), Monefy LLC (Monefy), Goodbudget (Dayspring Partners), PocketGuard Inc. (PocketGuard), Emma Technologies Ltd (Emma), FMBE Fintech Ltd (Zeta), Tiller Money, Inc. (Tiller), Acorns Grow Incorporated (Acorns), BankDhofar SAOG (Omani Bank PFM & Budgeting Tools), Bank Muscat SAOG (Personal Finance & Money Management App Features), National Bank of Oman SAOG (Digital Banking & Personal Finance Tools), Oman Arab Bank SAOC (Mobile Banking with Personal Finance Features) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman personal finance software market appears promising, driven by technological advancements and increasing consumer demand for financial management tools. As more users seek personalized financial insights, software providers are likely to enhance their offerings with AI-driven features. Additionally, the integration of banking services into personal finance applications will streamline user experiences, making financial management more accessible. These trends indicate a robust growth trajectory for the market, with significant opportunities for innovation and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Budgeting & Expense Tracking Software Savings & Goal-Planning Apps Investment & Wealth Management Apps Debt Management & Credit Score Monitoring Tools Islamic Personal Finance & Zakat/Charity Management Apps Others |

| By End-User | Individual Retail Consumers Expatriate Workers & Professionals Micro & Small Businesses / Self-Employed Financial Advisors & Wealth Managers Banks & Fintechs Offering White-Label Personal Finance Tools Others |

| By Deployment Model | Web-Based Mobile App-Based Hybrid (Web + Mobile) Others |

| By User Demographics | Age Group (18–24, 25–34, 35–49, 50+) Income Level (Low, Middle, High) Nationality (Omani Nationals, Expatriates) Employment Status (Salaried, Self-Employed, Students, Retired) Others |

| By Geographic Distribution | Muscat Governorate Dhofar (Salalah and Surrounding Areas) Interior & Northern Governorates (e.g., Al Batinah, Ad Dakhiliyah) Remote & Rural Areas Others |

| By Payment Model | Subscription-Based (Monthly / Annual) One-Time License Purchase Freemium with In-App Purchases Ad-Supported Free Apps Others |

| By Integration Capability | Open Banking / Bank Account Aggregation Card & Wallet Integration (Debit, Credit, Prepaid, Mobile Wallets) Integration with Local Payment Systems (e.g., QR / Instant Payments) Accounting & ERP / Third-Party Software Integration Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Users of Personal Finance Software | 120 | Young Professionals, Middle-Income Families |

| Small Business Owners Utilizing Financial Tools | 90 | Entrepreneurs, Small Business Managers |

| Financial Advisors and Consultants | 60 | Certified Financial Planners, Investment Advisors |

| Students and Young Adults Interested in Finance | 60 | University Students, Recent Graduates |

| Tech-Savvy Users of Financial Apps | 80 | IT Professionals, Digital Natives |

The Oman Personal Finance Software Market is valued at approximately USD 40 million, reflecting a growing demand for digital financial solutions among consumers, driven by increased smartphone penetration and fintech adoption in the region.