Region:Middle East

Author(s):Dev

Product Code:KRAD5130

Pages:88

Published On:December 2025

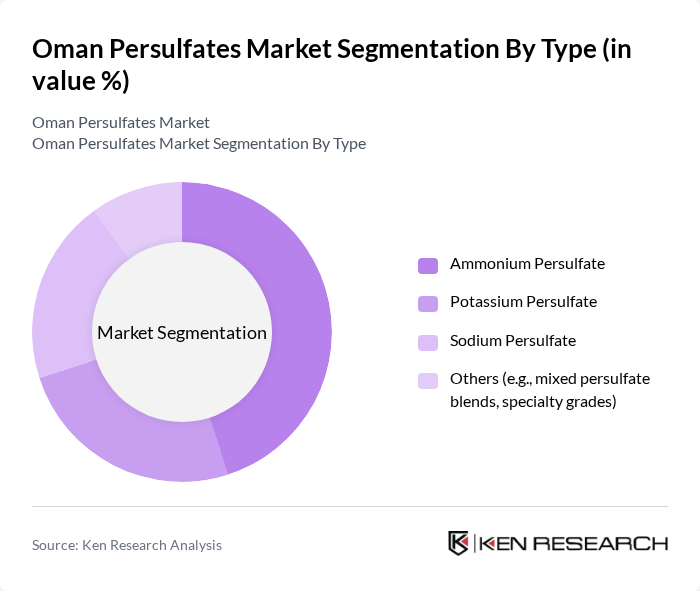

By Type:The market is segmented into four main types: Ammonium Persulfate, Potassium Persulfate, Sodium Persulfate, and Others (including mixed persulfate blends and specialty grades). At a global level, sodium persulfate typically accounts for the largest share owing to its broad use in polymer initiators and cleaning formulations, while ammonium and potassium persulfates are widely used in polymerization, etching, and cosmetic bleaching applications. In Oman, Ammonium Persulfate holds a leading position within specialty and performance applications due to its established use as a polymerization initiator in plastics and synthetic rubber, as well as its role in cosmetics and electronics processing, supported by growing demand for high-performance polymers, printed circuit boards, and professional hair bleaching products.

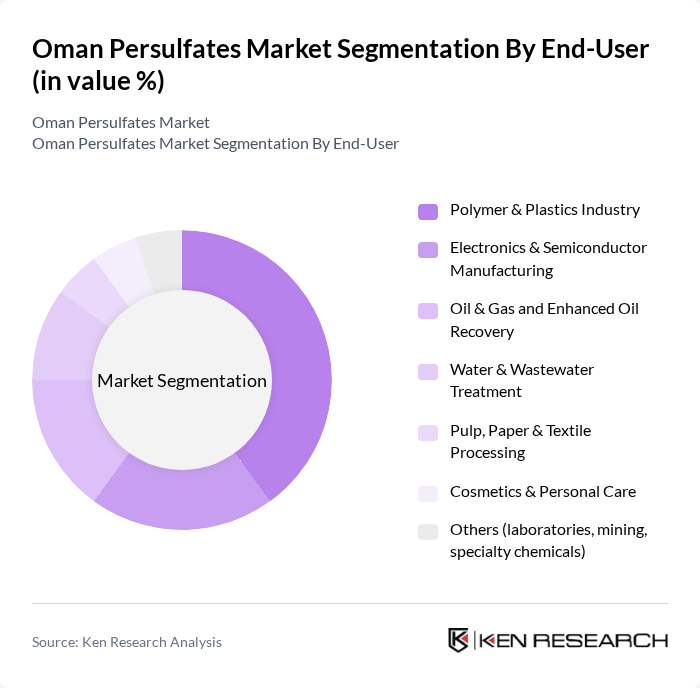

By End-User:The end-user segmentation includes the Polymer & Plastics Industry, Electronics & Semiconductor Manufacturing, Oil & Gas and Enhanced Oil Recovery, Water & Wastewater Treatment, Pulp, Paper & Textile Processing, Cosmetics & Personal Care, and Others (laboratories, mining, specialty chemicals). Persulfates are extensively used as radical initiators in polymer and plastics production, as etching and cleaning agents in electronics manufacturing, as oxidants for reservoir stimulation and desulfurization in oil and gas, and for advanced oxidation processes in water and wastewater treatment. In Oman, the Polymer & Plastics Industry is the dominant segment, underpinned by the expansion of petrochemical and downstream plastics capacity, the increasing use of polymer-based materials in construction and infrastructure, and the growing role of persulfates in formulations for coatings, adhesives, and performance plastics.

The Oman Persulfates Market is characterized by a dynamic mix of regional and international players. Leading participants such as Solvay S.A., Evonik Industries AG, Akzo Nobel N.V., Mitsubishi Gas Chemical Company, Inc., United Initiators GmbH, Fujian Zhanhua Chemical Co., Ltd., Hubei Yihua Chemical Industry Co., Ltd., Shandong Sanyuan Chemical Co., Ltd., Jiangsu Jintan Jianxin Chemical Co., Ltd., Fujian Aone Chemical Co., Ltd., Gulf Petrochemical Industries Company (GPIC), Oman Oil Marketing Company SAOG (chemicals & industrial supplies), Oman Chemical & Pharmaceuticals LLC, Mohsin Haider Darwish LLC – Chemicals Division, Bahwan Engineering Group – Industrial & Chemical Supplies contribute to innovation, geographic expansion, and service delivery in this space.

The Oman persulfates market is poised for significant growth, driven by increasing demand for sustainable products and innovations in formulation technologies. As consumer preferences shift towards eco-friendly solutions, manufacturers are likely to invest in research and development to create advanced persulfate formulations. Additionally, the expansion of the cosmetics and food sectors will further enhance market opportunities, positioning Oman as a key player in the regional persulfates landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Ammonium Persulfate Potassium Persulfate Sodium Persulfate Others (e.g., mixed persulfate blends, specialty grades) |

| By End-User | Polymer & Plastics Industry Electronics & Semiconductor Manufacturing Oil & Gas and Enhanced Oil Recovery Water & Wastewater Treatment Pulp, Paper & Textile Processing Cosmetics & Personal Care Others (laboratories, mining, specialty chemicals) |

| By Application | Polymerization Initiator Oxidizing Agent for Water & Soil Remediation Bleaching & Desizing Agent (textile, pulp, hair bleaching) Etching & Cleaning (electronics, metal surface treatment) Oilfield Chemicals (stimulation, desulfurization) Others (laboratory reagents, specialty formulations) |

| By Packaging Type | Bulk Packaging (bags, supersacks, IBCs) Small & Intermediate Industrial Packs (drums, pails) Others (custom and private-label packaging) |

| By Distribution Channel | Direct Sales to Industrial Customers Chemical Distributors & Traders Online & E-procurement Platforms Others (agency, tender-based, and regional brokers) |

| By Geography | Muscat Governorate Dhofar (incl. Salalah) North & South Al Batinah (incl. Sohar) Interior & Other Regions |

| By Customer Type | B2B – Large Industrial & Institutional Buyers B2B – SMEs & Contract Manufacturers B2G – Government & Municipal Utilities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Industry Applications | 100 | Production Managers, Quality Control Supervisors |

| Water Treatment Facilities | 80 | Plant Operators, Environmental Compliance Officers |

| Cosmetics and Personal Care | 70 | Product Development Managers, Regulatory Affairs Specialists |

| Food Processing Sector | 60 | Food Safety Managers, Supply Chain Coordinators |

| Electronics Manufacturing | 90 | Manufacturing Engineers, R&D Managers |

The Oman Persulfates Market is valued at approximately USD 40 million, reflecting a five-year historical analysis and triangulation from global data, indicating significant growth driven by various industrial applications.