Oman Phenolic Resins Market Overview

- The Oman Phenolic Resins Market is valued at USD 2 million, based on a five-year historical analysis, with a notable decline observed in 2024 due to reduced demand in key end-use sectors such as construction and automotive. The market has been driven by the increasing demand for high-performance materials, particularly in construction, automotive, and electrical industries. Phenolic resins are valued for their versatility in applications such as adhesives, coatings, and insulation materials, which has supported their adoption despite recent market contraction .

- Key players in this market include Muscat Chemical Industries LLC, Oman Resins LLC, and Gulf Resins Company SAOC. These companies dominate the market due to their strong manufacturing capabilities, extensive distribution networks, and commitment to innovation, which allows them to meet the diverse needs of end-users across various sectors.

- In 2023, the Omani government implemented the Construction Materials Environmental Standards, 2023, issued by the Ministry of Housing and Urban Planning. This regulation mandates the use of eco-friendly and low-emission materials in public and private construction projects, encouraging the adoption of phenolic resins for their durability and low environmental impact. This initiative supports sustainable development goals and aligns with broader regional trends toward green building practices .

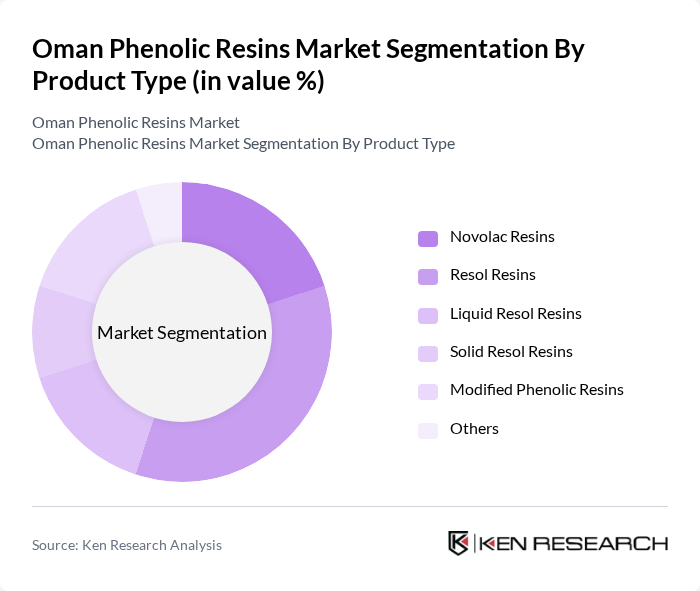

Oman Phenolic Resins Market Segmentation

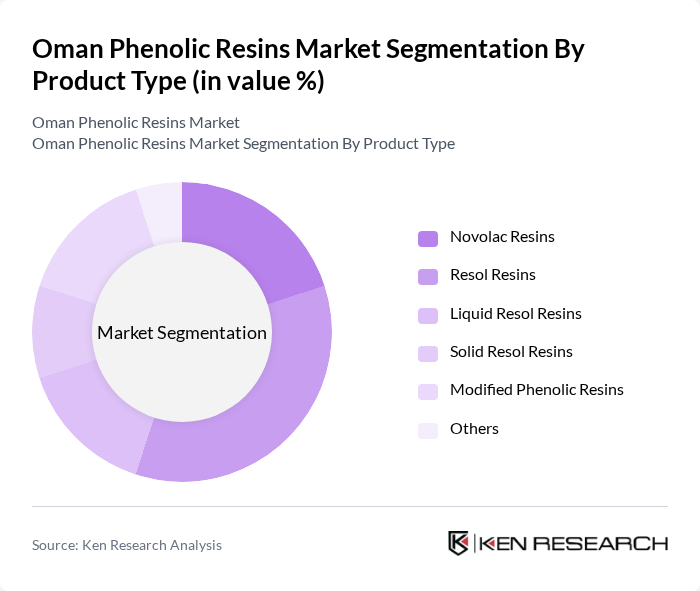

By Product Type:The phenolic resins market is segmented into various product types, including Novolac Resins, Resol Resins, Liquid Resol Resins, Solid Resol Resins, Modified Phenolic Resins, and Others. Among these, Resol Resins are the most dominant due to their widespread use in adhesives and coatings, driven by their excellent thermal stability and chemical resistance. The increasing demand for high-performance materials in the automotive and construction sectors further propels the growth of this sub-segment.

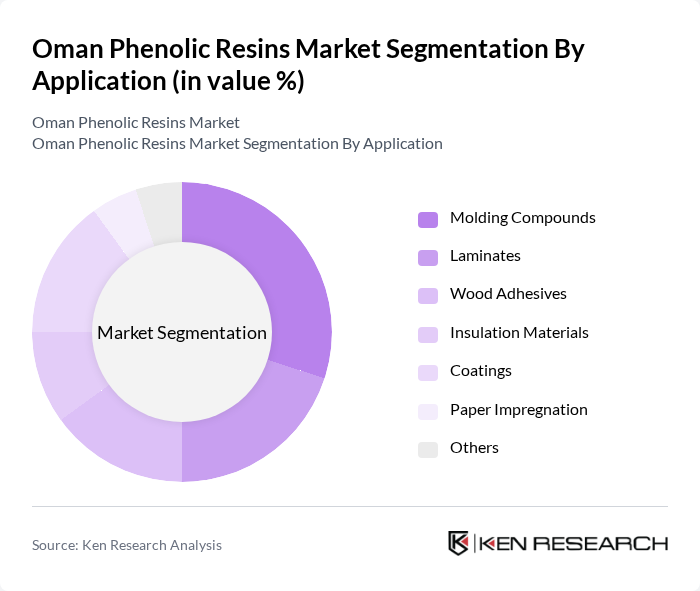

By Application:The applications of phenolic resins are diverse, including Molding Compounds, Laminates, Wood Adhesives, Insulation Materials, Coatings, Paper Impregnation, and Others. Molding Compounds are the leading application segment, primarily due to their extensive use in the automotive and electrical industries, where high strength and thermal stability are crucial. The growing automotive sector in Oman is a significant driver for this application, as manufacturers seek durable and efficient materials.

Oman Phenolic Resins Market Competitive Landscape

The Oman Phenolic Resins Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Resins LLC, Gulf Resins Company SAOC, Al Jazeera Chemical Products LLC, OQ Chemicals (OQ SAOC), National Chemical Industries LLC, Muscat Chemical Industries LLC, Al-Futtaim Group, Oman International Petrochemical Industries, Dhofar Chemicals LLC, Oman Polypropylene LLC, Al Maha Chemicals LLC, Oman Petrochemicals LLC, Salalah Methanol Company LLC, Oman National Engineering & Investment Company (ONEIC), Oman Chemical Industries LLC contribute to innovation, geographic expansion, and service delivery in this space.

Oman Phenolic Resins Market Industry Analysis

Growth Drivers

- Increasing Demand from Automotive and Construction Industries:The automotive sector in Oman is projected to grow by 4.5% annually, reaching a market value of OMR 1.2 billion in future. This growth is driven by rising vehicle production and infrastructure projects, which significantly increase the demand for phenolic resins used in adhesives and coatings. Similarly, the construction industry is expected to expand by 6% in the same period, further boosting the consumption of phenolic resins in various applications.

- Rising Awareness of Eco-Friendly Materials:The global shift towards sustainability is influencing Oman's market, with a reported 30% increase in demand for eco-friendly materials in construction and manufacturing. This trend is supported by government initiatives promoting green building practices, which encourage the use of phenolic resins that are less harmful to the environment. As a result, manufacturers are increasingly focusing on developing sustainable phenolic resin products to meet this growing consumer preference.

- Technological Advancements in Manufacturing Processes:The introduction of advanced manufacturing technologies, such as automation and process optimization, is enhancing the production efficiency of phenolic resins. In future, it is estimated that these innovations could reduce production costs by up to 15%, making phenolic resins more competitive against alternative materials. This technological progress is crucial for meeting the increasing demand while maintaining product quality and sustainability standards in the market.

Market Challenges

- Fluctuating Raw Material Prices:The volatility in the prices of key raw materials, such as phenol and formaldehyde, poses a significant challenge for manufacturers in Oman. In future, the price of phenol surged by 20% due to supply chain disruptions, impacting production costs and profit margins. This unpredictability makes it difficult for companies to maintain stable pricing strategies and can lead to reduced competitiveness in the market.

- Competition from Alternative Materials:The phenolic resins market faces stiff competition from alternative materials like epoxy and polyurethane, which are gaining traction due to their superior properties. In future, the market share of these alternatives is expected to increase by 10%, driven by their versatility and performance in various applications. This trend challenges phenolic resin manufacturers to innovate and differentiate their products to retain market relevance.

Oman Phenolic Resins Market Future Outlook

The Oman phenolic resins market is poised for significant transformation, driven by increasing demand for sustainable materials and technological advancements. As industries prioritize eco-friendly solutions, the market is likely to see a rise in bio-based phenolic resins, aligning with global sustainability goals. Additionally, strategic partnerships with local manufacturers will enhance production capabilities and market reach, fostering innovation and competitiveness. Overall, the market is expected to adapt to evolving consumer preferences and regulatory frameworks, ensuring long-term growth and stability.

Market Opportunities

- Expansion into Emerging Markets:Oman's strategic location offers access to emerging markets in the Middle East and North Africa, where demand for phenolic resins is increasing. By targeting these regions, manufacturers can tap into new customer bases and enhance their market presence, potentially increasing sales by 25% over the next few years.

- Development of Bio-Based Phenolic Resins:The growing trend towards sustainability presents an opportunity for the development of bio-based phenolic resins. With a projected market growth of 15% for bio-based materials in future, investing in R&D for these products can position manufacturers as leaders in eco-friendly solutions, catering to environmentally conscious consumers and industries.