Region:Middle East

Author(s):Geetanshi

Product Code:KRAE3510

Pages:101

Published On:December 2025

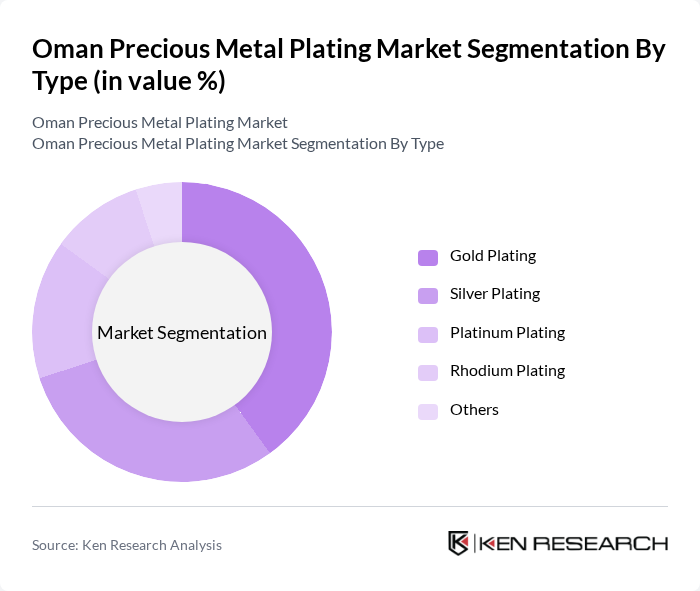

By Type:The market is segmented into various types of precious metal plating, including Gold Plating, Silver Plating, Platinum Plating, Rhodium Plating, and Others. Gold plating is the most dominant segment due to its extensive use in jewelry and electronics, driven by its excellent conductivity and resistance to corrosion. Silver plating follows closely, favored for its affordability and aesthetic appeal in decorative applications.

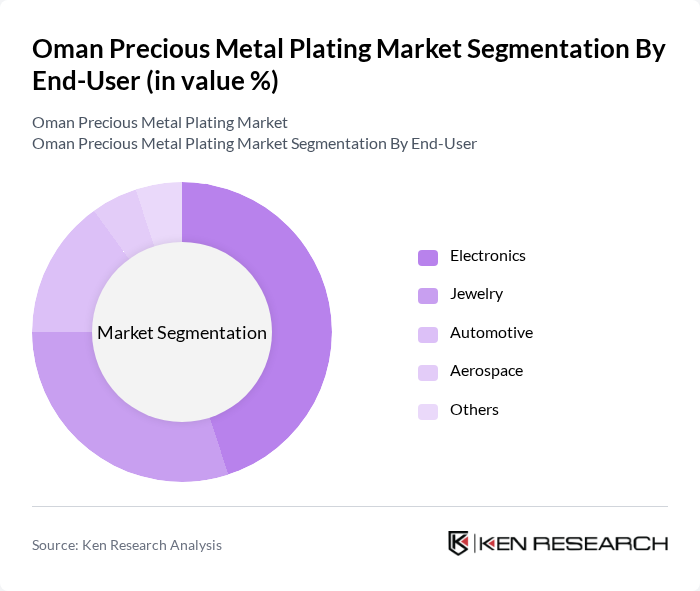

By End-User:The end-user segmentation includes Electronics, Jewelry, Automotive, Aerospace, and Others. The electronics sector is the leading end-user, driven by the demand for high-performance components that require reliable and conductive coatings. The jewelry segment also plays a significant role, as consumers increasingly seek luxurious and durable pieces, further propelling the market.

The Oman Precious Metal Plating Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omani Gold and Silver Plating Co., Al-Fahim Plating Solutions, Gulf Metal Finishing, Oman Electroplating Services, Muscat Precious Metals, Al-Mahra Plating Technologies, Sultanate Plating Works, Oman Surface Finishing, Al-Batinah Metal Coatings, Dhofar Plating Industries, Muscat Metal Coating, Al-Dakhiliyah Plating Solutions, Oman Gold Plating Services, Al-Sharq Plating Co., Oman Precious Metal Coatings contribute to innovation, geographic expansion, and service delivery in this space.

The Oman precious metal plating market is poised for growth, driven by technological advancements and increasing consumer demand for high-quality finishes. As industries continue to expand, particularly in electronics and jewelry, the need for innovative plating solutions will rise. Companies are likely to invest in automation and eco-friendly practices to enhance efficiency and sustainability. Additionally, the integration of IoT technologies in plating operations will streamline processes, improve quality control, and reduce costs, positioning the market for robust development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Gold Plating Silver Plating Platinum Plating Rhodium Plating Others |

| By End-User | Electronics Jewelry Automotive Aerospace Others |

| By Application | Decorative Coatings Functional Coatings Industrial Applications Medical Devices Others |

| By Process Type | Electroplating Electroless Plating Vacuum Plating Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Market Channel | Direct Sales Distributors Online Sales Others |

| By Customer Type | B2B B2C Government Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronics Industry Plating | 120 | Manufacturing Managers, Quality Control Supervisors |

| Jewelry Sector Plating | 100 | Jewelry Designers, Production Managers |

| Automotive Component Plating | 90 | Procurement Managers, Engineering Leads |

| Industrial Applications of Plating | 80 | Operations Managers, Technical Directors |

| Research & Development in Plating Technologies | 70 | R&D Managers, Process Engineers |

The Oman Precious Metal Plating Market is valued at approximately USD 12 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for high-quality metal finishes across various industries, including electronics, jewelry, and automotive.