GCC Industrial Coatings Market Overview

- The GCC Industrial Coatings Market is valued at USD 3.2 billion, based on a five-year historical analysis. This growth is primarily driven by the rapid expansion of the construction and automotive sectors, alongside increasing investments in infrastructure development across the region. The demand for high-performance coatings that offer durability and protection against harsh environmental conditions has significantly contributed to the market's expansion. Additionally, the market is benefitting from a rising emphasis on eco-friendly and sustainable coatings, as well as technological advancements in coating formulations and application methods, including the development of self-healing and anti-microbial coatings .

- Key players in this market include Saudi Arabia, the UAE, and Qatar, which dominate due to their robust industrial base and significant investments in infrastructure projects. The UAE, in particular, has seen a surge in construction activities, while Saudi Arabia's Vision 2030 initiative is driving demand for industrial coatings in various sectors, including oil and gas and construction. The region’s ongoing urbanization and industrialization, combined with large-scale real estate, hospitality, and urban development projects, continue to fuel demand for both protective and decorative coatings .

- In 2023, the GCC governments implemented stricter regulations on VOC emissions from industrial coatings to promote environmental sustainability. For example, the “Technical Regulation for Paints and Varnishes” (SASO 2879:2016) issued by the Saudi Standards, Metrology and Quality Organization (SASO) sets binding limits on VOC content in coatings, requiring manufacturers to comply with maximum allowable VOC levels and to obtain product certification for market access. These regulations encourage the development of eco-friendly coatings and enhance the overall quality of industrial coatings in the region .

GCC Industrial Coatings Market Segmentation

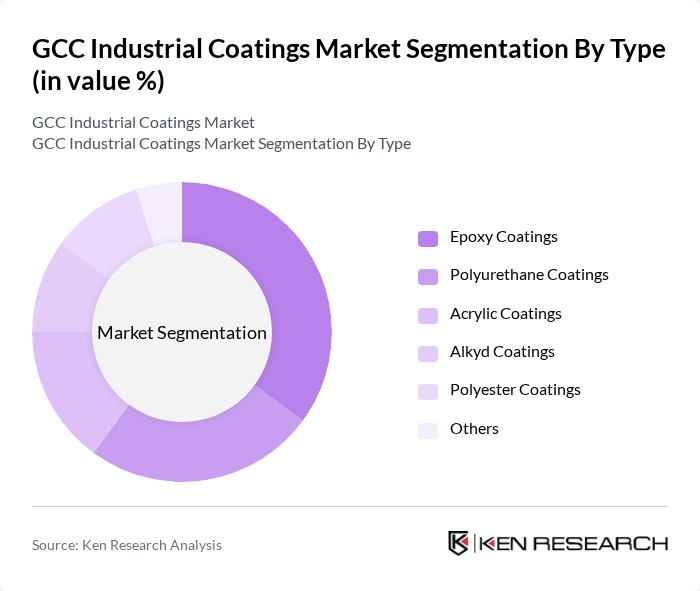

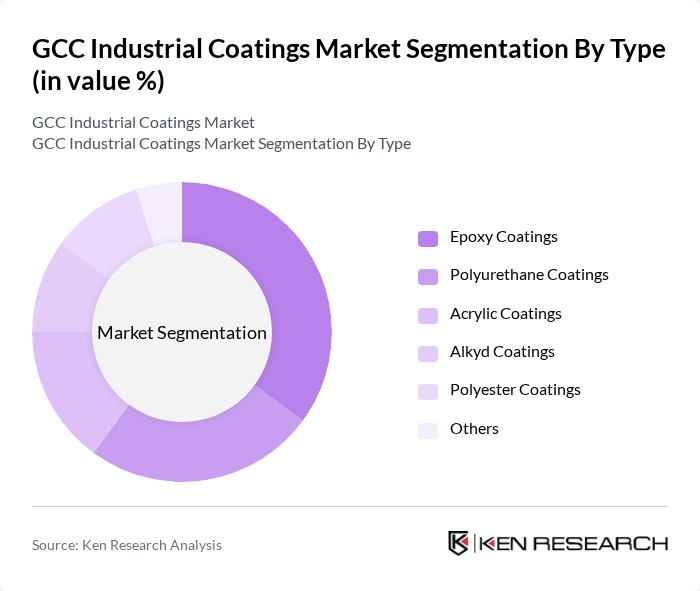

By Type:The market is segmented into various types of coatings, including epoxy, polyurethane, acrylic, alkyd, polyester, and others. Each type serves specific applications and industries, with varying properties such as durability, chemical resistance, and aesthetic appeal. Among these, epoxy coatings are particularly dominant due to their excellent adhesion and resistance to corrosion, making them a preferred choice in industrial applications. Polyurethane and acrylic coatings are also widely adopted for their versatility and performance in demanding environments .

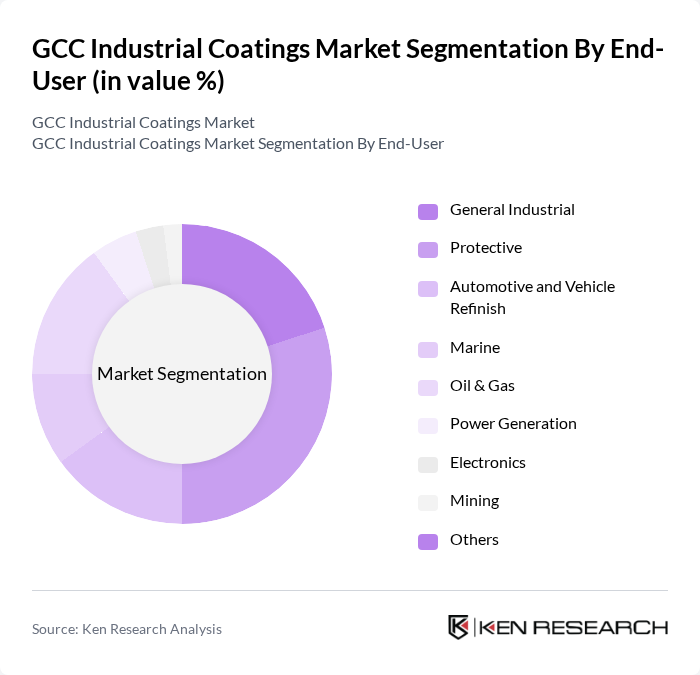

By End-User:The end-user segmentation includes general industrial, protective, automotive and vehicle refinish, marine, oil & gas, power generation, electronics, mining, and others. The protective segment is leading due to the increasing need for corrosion protection and surface durability in various industries, particularly in oil and gas and construction sectors. General industrial and automotive applications are also significant contributors, reflecting the region’s industrial diversification and continued investments in manufacturing and infrastructure .

GCC Industrial Coatings Market Competitive Landscape

The GCC Industrial Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as AkzoNobel, PPG Industries, Sherwin-Williams, BASF SE, RPM International Inc., Jotun A/S, Hempel A/S, Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Asian Paints Ltd., Berger Paints Emirates Ltd., Tikkurila Oyj, Valspar (now part of Sherwin-Williams), DuPont de Nemours, Inc., Henkel AG & Co. KGaA, Al Jazeera Paints, Caparol Arabia, Beckers Group, Terraco UAE Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

GCC Industrial Coatings Market Industry Analysis

Growth Drivers

- Increasing Demand from Construction and Infrastructure Projects:The GCC region is witnessing a construction boom, with investments projected to reach $1 trillion in the near future. Major projects like NEOM in Saudi Arabia and the Qatar World Cup infrastructure are driving demand for industrial coatings. The construction sector's growth is expected to contribute significantly to the coatings market, with an estimated increase in demand for protective and decorative coatings by 15 million liters annually, reflecting a robust growth trajectory.

- Technological Advancements in Coating Formulations:Innovations in coating technologies, such as the development of high-performance and durable coatings, are enhancing product offerings in the GCC market. For instance, the introduction of waterborne and solvent-free coatings is projected to increase market penetration by 20% in the near future. These advancements not only improve application efficiency but also cater to the growing demand for sustainable solutions, aligning with the region's environmental goals and regulations.

- Rising Awareness of Environmental Regulations:The GCC countries are increasingly implementing stringent environmental regulations, leading to a shift towards eco-friendly coatings. The market for low-VOC and zero-VOC coatings is expected to grow by 30% in the near future, driven by regulatory frameworks aimed at reducing emissions. This shift is supported by government initiatives promoting sustainable practices, which are expected to enhance the adoption of environmentally compliant products across various sectors, including construction and automotive.

Market Challenges

- Fluctuating Raw Material Prices:The industrial coatings market in the GCC faces challenges due to volatile raw material prices, particularly for petrochemicals and resins. In the near future, the price of key raw materials surged by 25%, impacting production costs and profit margins. This volatility can hinder manufacturers' ability to maintain competitive pricing, potentially leading to reduced market share and profitability as companies struggle to pass on costs to consumers.

- Competition from Low-Cost Alternatives:The GCC industrial coatings market is increasingly challenged by low-cost alternatives, particularly from Asian manufacturers. These competitors often offer similar quality products at significantly lower prices, with some products priced 15-20% less than local offerings. This price competition can erode market share for established brands, forcing them to innovate or reduce prices, which may impact overall profitability and market stability.

GCC Industrial Coatings Market Future Outlook

The GCC industrial coatings market is poised for significant transformation, driven by technological advancements and a strong focus on sustainability. As the region continues to invest in infrastructure and construction, the demand for innovative and eco-friendly coatings will rise. Additionally, the integration of smart coatings technology and digitalization in manufacturing processes will enhance product performance and efficiency. Companies that adapt to these trends and invest in research and development will likely capture a larger market share, positioning themselves for long-term success.

Market Opportunities

- Expansion into Emerging Markets:The GCC industrial coatings market has significant opportunities for expansion into emerging markets in Africa and Southeast Asia. With projected growth rates of 8-10% in these regions, GCC manufacturers can leverage their expertise and technology to capture new customer bases, enhancing revenue streams and diversifying market risks.

- Development of Eco-Friendly Coatings:There is a growing market opportunity for the development of eco-friendly coatings, driven by increasing consumer demand for sustainable products. The GCC region's commitment to reducing carbon footprints presents a chance for manufacturers to innovate and introduce low-VOC and bio-based coatings, potentially increasing market share by 15% as businesses seek compliance with environmental regulations.