Region:Middle East

Author(s):Rebecca

Product Code:KRAC8538

Pages:88

Published On:November 2025

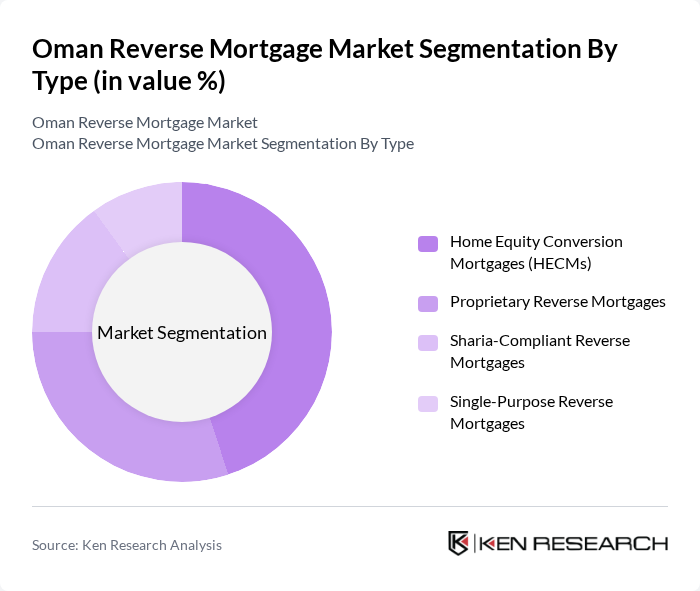

By Type:The reverse mortgage market can be segmented into various types, including Home Equity Conversion Mortgages (HECMs), Proprietary Reverse Mortgages, Sharia-Compliant Reverse Mortgages, and Single-Purpose Reverse Mortgages. Among these, Home Equity Conversion Mortgages (HECMs) are gaining traction due to their flexibility and government backing, making them a preferred choice for many seniors. Proprietary Reverse Mortgages are also emerging as a popular option, particularly for homeowners with higher-value properties, while Sharia-Compliant options cater to the local population's religious preferences. Recent trends indicate an increasing interest in Sharia-Compliant and single-purpose products as financial institutions tailor offerings to meet diverse retirement needs .

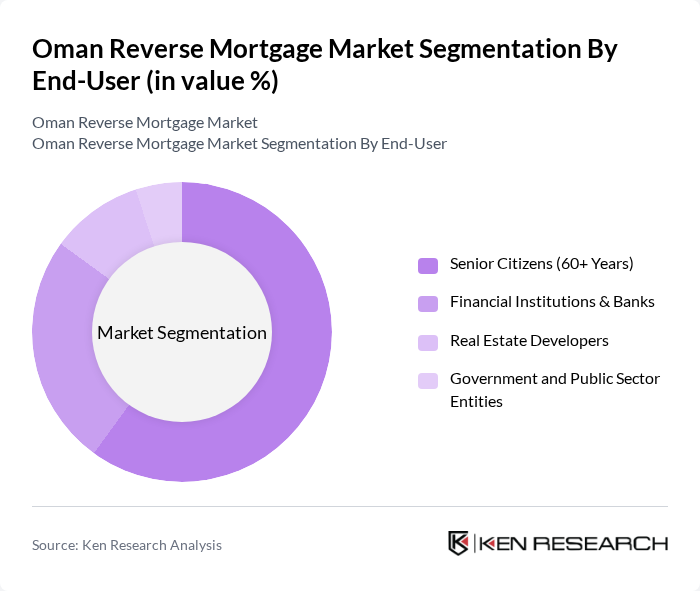

By End-User:The end-user segmentation includes Senior Citizens (60+ Years), Financial Institutions & Banks, Real Estate Developers, and Government and Public Sector Entities. Senior citizens represent the largest segment, driven by the increasing need for financial solutions that allow them to maintain their lifestyle in retirement. Financial institutions are also significant players, providing the necessary funding and support for reverse mortgage products, while real estate developers are increasingly recognizing the potential of these products to enhance property sales. The government and public sector entities are involved in promoting financial literacy and supporting regulatory frameworks .

The Oman Reverse Mortgage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Muscat, Oman Housing Bank, National Bank of Oman, Bank Dhofar, Oman Arab Bank, Alizz Islamic Bank, Sohar International, Muscat Finance, Oman Investment and Finance Company (OIFC), Dhofar International Development & Investment Holding Company (DIDIC), Oman United Insurance Company, Al Izz Islamic Bank, Oman National Engineering & Investment Company (ONEIC), Taageer Finance Company, United Finance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman reverse mortgage market appears promising, driven by demographic shifts and increasing property values. As the aging population grows, financial institutions are likely to innovate and expand their offerings to meet the needs of retirees. Additionally, the integration of technology in financial services will enhance accessibility and streamline the application process, making reverse mortgages more attractive to potential borrowers. Increased government support could further bolster market growth, creating a more favorable environment for reverse mortgage products.

| Segment | Sub-Segments |

|---|---|

| By Type | Home Equity Conversion Mortgages (HECMs) Proprietary Reverse Mortgages Sharia-Compliant Reverse Mortgages Single-Purpose Reverse Mortgages |

| By End-User | Senior Citizens (60+ Years) Financial Institutions & Banks Real Estate Developers Government and Public Sector Entities |

| By Property Type | Single-Family Homes Multi-Family Residences Villas Apartments/Flats |

| By Loan Amount | Up to OMR 50,000 OMR 50,001 – OMR 150,000 Above OMR 150,000 Custom/Negotiated Amounts |

| By Duration | Up to 5 Years –15 Years Above 15 Years Flexible/Other Terms |

| By Interest Rate Type | Fixed Interest Rate Variable Interest Rate Sharia-Compliant Profit Rate |

| By Geographic Distribution | Muscat Governorate Dhofar Governorate Al Batinah Region Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Potential Reverse Mortgage Clients | 150 | Retirees, Senior Citizens, Homeowners |

| Financial Advisors and Planners | 70 | Financial Advisors, Retirement Planners |

| Banking Sector Stakeholders | 60 | Bank Managers, Product Development Heads |

| Regulatory Bodies | 40 | Policy Makers, Regulatory Officials |

| Real Estate Professionals | 50 | Real Estate Agents, Appraisers |

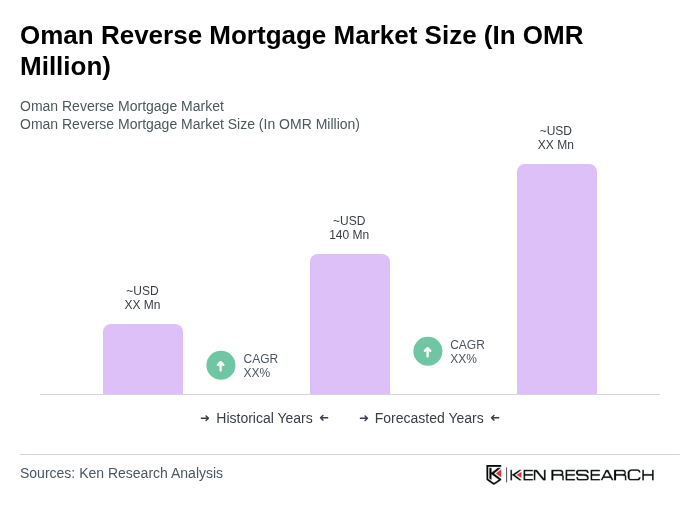

The Oman Reverse Mortgage Market is valued at approximately OMR 140 million, driven by factors such as an increasing aging population, rising property values, and a growing awareness of reverse mortgage products among potential borrowers.