Region:Middle East

Author(s):Rebecca

Product Code:KRAC1081

Pages:99

Published On:October 2025

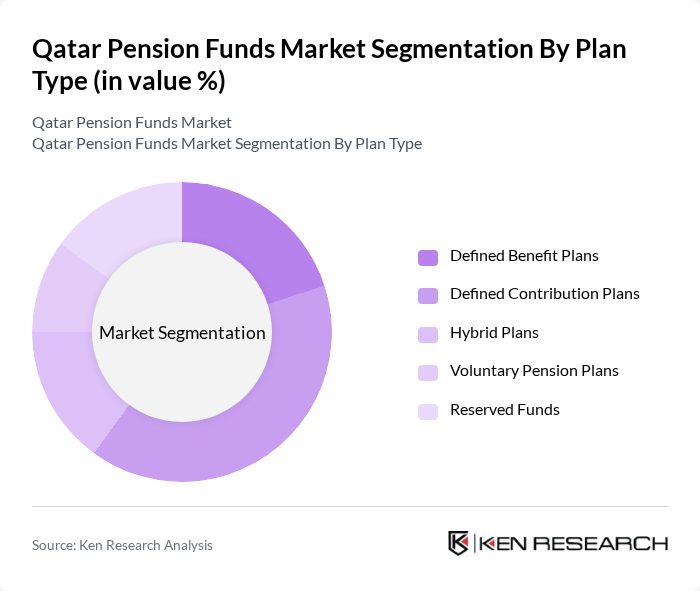

By Plan Type:The pension funds market is segmented into Defined Benefit Plans, Defined Contribution Plans, Hybrid Plans, Voluntary Pension Plans, and Reserved Funds. Defined Contribution Plans are gaining momentum due to their flexibility, portability, and the increasing trend of self-directed retirement savings. This shift reflects a broader preference for personalized financial planning and greater individual control over investment decisions, particularly among younger and expatriate populations .

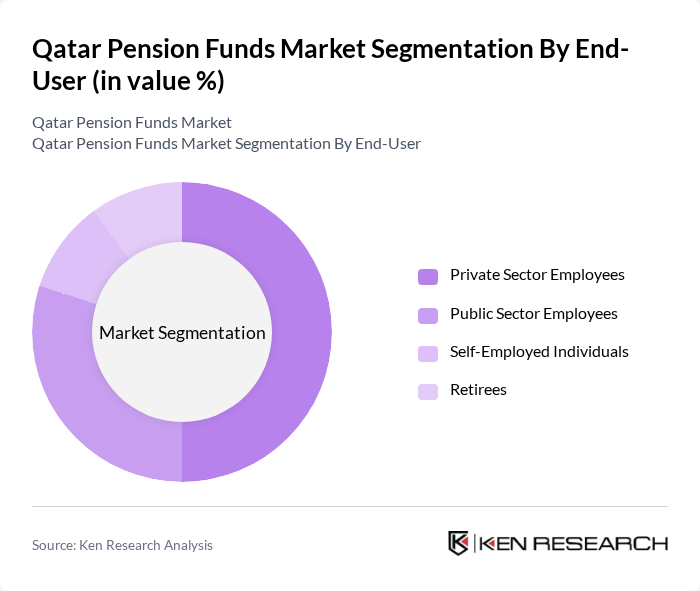

By End-User:The end-user segmentation includes Private Sector Employees, Public Sector Employees, Self-Employed Individuals, and Retirees. The Private Sector Employees segment leads the market, driven by the expanding expatriate workforce and the growing adoption of employer-sponsored retirement plans. This demographic increasingly seeks to secure long-term financial stability, fueling demand for pension products tailored to diverse employment backgrounds .

The Qatar Pension Funds Market is characterized by a dynamic mix of regional and international players. Leading participants such as General Retirement & Social Insurance Authority (GRSIA), Qatar Investment Authority, Qatar National Bank, Doha Bank, Qatar Islamic Bank, Commercial Bank of Qatar, Masraf Al Rayan, Qatar Insurance Company, Qatar Central Bank, Al Khaliji Commercial Bank, Qatar Holding LLC, QInvest, Dukhan Bank, Amwal LLC, Qatar Financial Centre, and Qatar Development Bank contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar pension funds market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital platforms become more prevalent, fund management is expected to become more efficient, enhancing customer engagement. Additionally, the increasing focus on sustainable investments will likely reshape asset allocation strategies, aligning with global trends. These developments will create a more dynamic and responsive pension landscape, catering to the diverse needs of Qatar's growing population.

| Segment | Sub-Segments |

|---|---|

| By Plan Type | Defined Benefit Plans Defined Contribution Plans Hybrid Plans Voluntary Pension Plans Reserved Funds |

| By End-User | Private Sector Employees Public Sector Employees Self-Employed Individuals Retirees |

| By Investment Strategy | Active Management Passive Management Tactical Asset Allocation Alternative Investments |

| By Fund Size | Small Funds (Below QAR 500 Million) Medium Funds (QAR 500 Million – QAR 2 Billion) Large Funds (Above QAR 2 Billion) |

| By Risk Profile | Conservative Moderate Aggressive |

| By Distribution Channel | Direct Sales Financial Advisors Online Platforms |

| By Policy Support | Government Subsidies Tax Exemptions Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Sector Pension Funds | 50 | Fund Managers, Policy Advisors |

| Private Sector Pension Schemes | 40 | HR Managers, Financial Analysts |

| Investment Strategies in Pension Funds | 30 | Investment Directors, Portfolio Managers |

| Regulatory Compliance and Impact | 40 | Compliance Officers, Legal Advisors |

| Future Trends in Pension Fund Management | 50 | Market Analysts, Economic Researchers |

The Qatar Pension Funds Market is valued at approximately USD 1.3 billion, reflecting growth driven by an increasing number of high-net-worth individuals, a growing expatriate workforce, and heightened awareness of retirement planning among both Qatari nationals and expatriates.