Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7145

Pages:99

Published On:December 2025

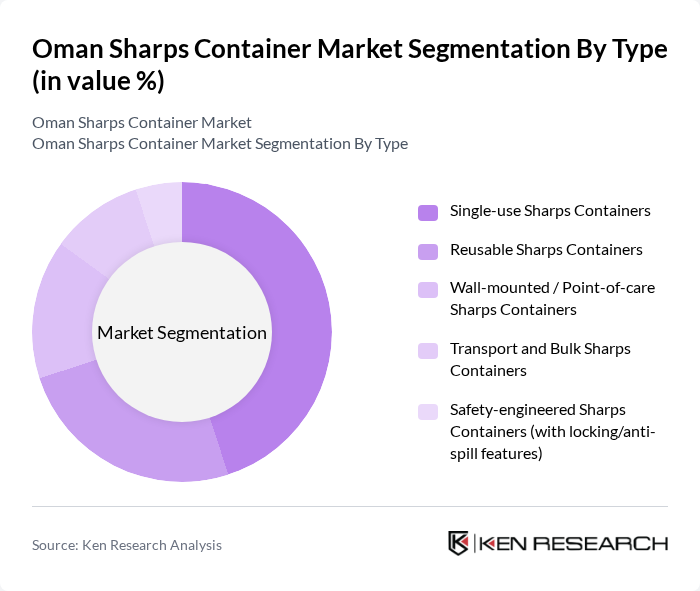

By Type:The market is segmented into various types of sharps containers, including single-use, reusable, wall-mounted, transport and bulk containers, and safety-engineered containers, in line with global product classifications. Each type serves specific needs within healthcare settings, with single-use containers being the most widely adopted due to their convenience, lower upfront cost, and ease of compliance with infection prevention and safety regulations. Reusable containers are gaining traction in facilities focused on sustainability and cost optimization, supported by evidence that reusable systems can reduce carbon emissions and needlestick injuries compared with conventional disposable containers.

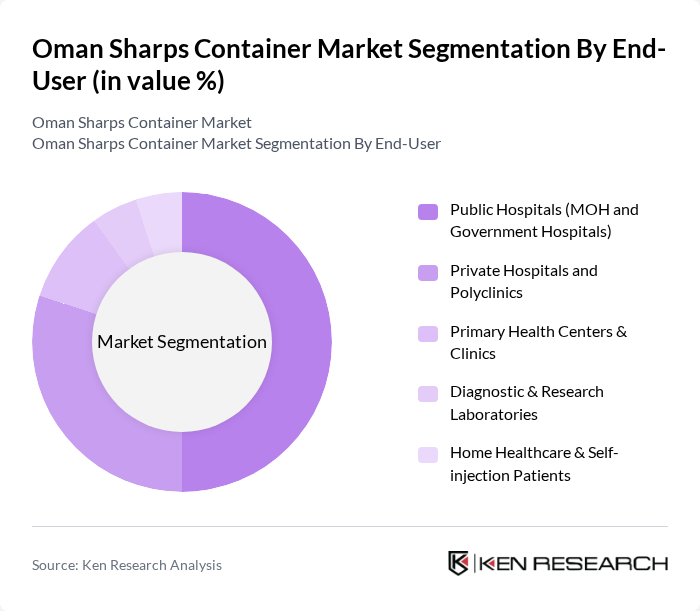

By End-User:The end-user segmentation includes public hospitals, private hospitals, primary health centers, diagnostic laboratories, and home healthcare, consistent with regional market structures where hospitals and clinics are the primary users of sharps containers. Public hospitals dominate the market due to their large patient volumes, higher surgical and inpatient case loads, and stringent waste management protocols mandated under national healthcare waste rules. Private hospitals and clinics are also significant contributors, driven by the increasing number of accredited healthcare facilities, growth in outpatient and day-care procedures, vaccination campaigns, and the growing trend of home healthcare services and self-injection therapies for diabetes and other chronic diseases.

The Oman Sharps Container Market is characterized by a dynamic mix of regional and international players. Leading participants such as Becton, Dickinson and Company (BD), Daniels Health, Stericycle, Inc., Veolia Environmental Services, SUEZ Group, Al Haya Medical Company LLC (Oman), Muscat Pharmacy & Stores LLC (Medical Supplies Division), Apex Medical Group / Oman International Hospital (procurement benchmark), National Medical Supplies Company LLC, Al Farsi Medical Supplies LLC, Oman Environmental Services Holding Company SAOC (be’ah), Al Buraimi Medical Supplies Trading, Gulf Medical Company (Gulf Medical Co. Ltd – Oman operations), Al Hashar Pharmacy LLC (Healthcare & Medical Products), Al Bahja Group – Healthcare & Waste Management Ventures contribute to innovation, geographic expansion, and service delivery in this space.

The Oman sharps container market is poised for significant growth as healthcare infrastructure continues to expand and regulatory frameworks become more stringent. The integration of smart technology in disposal systems is expected to enhance efficiency and safety in waste management. Additionally, the increasing emphasis on sustainability will drive demand for eco-friendly sharps containers, aligning with global trends towards greener healthcare practices. These factors will collectively shape a robust market landscape in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-use Sharps Containers Reusable Sharps Containers Wall-mounted / Point-of-care Sharps Containers Transport and Bulk Sharps Containers Safety-engineered Sharps Containers (with locking/anti-spill features) |

| By End-User | Public Hospitals (MOH and Government Hospitals) Private Hospitals and Polyclinics Primary Health Centers & Clinics Diagnostic & Research Laboratories Home Healthcare & Self-injection Patients |

| By Material | Rigid Plastics (Polypropylene / HDPE) Cardboard-based / Composite Containers Metal-based Containers Bio-based / Recycled Plastics |

| By Capacity | Small Capacity (?1 L) Medium Capacity (>1 L to 5 L) Large Capacity (>5 L to 20 L) Extra-large Capacity (>20 L, bulk and transport) |

| By Distribution Channel | Direct Tenders to Government Hospitals Medical Device Distributors & Local Agents Hospital Group Purchasing & Framework Contracts Online / E-procurement Portals |

| By Region | Muscat Dhofar Al Batinah (North & South) Al Dakhiliyah Other Governorates (Al Sharqiyah, Al Dhahirah, Al Buraimi, Musandam) |

| By Application | Hospital & Clinical Sharps Waste Management Pharmaceutical & Pharmacy-based Sharps Collection Occupational Health & Vaccination Programs Home-care, Dialysis & Chronic Disease Management Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospitals and Clinics | 120 | Facility Managers, Infection Control Officers |

| Pharmacies and Retail Outlets | 80 | Pharmacy Managers, Compliance Officers |

| Waste Management Companies | 50 | Operations Managers, Environmental Compliance Specialists |

| Public Health Organizations | 60 | Public Health Officials, Policy Makers |

| Manufacturers of Sharps Containers | 40 | Product Development Managers, Sales Directors |

The Oman Sharps Container Market is valued at approximately USD 14 million, reflecting a significant growth trend driven by expanding healthcare infrastructure and increasing awareness of safe medical waste disposal practices.