Region:Middle East

Author(s):Dev

Product Code:KRAD3311

Pages:85

Published On:November 2025

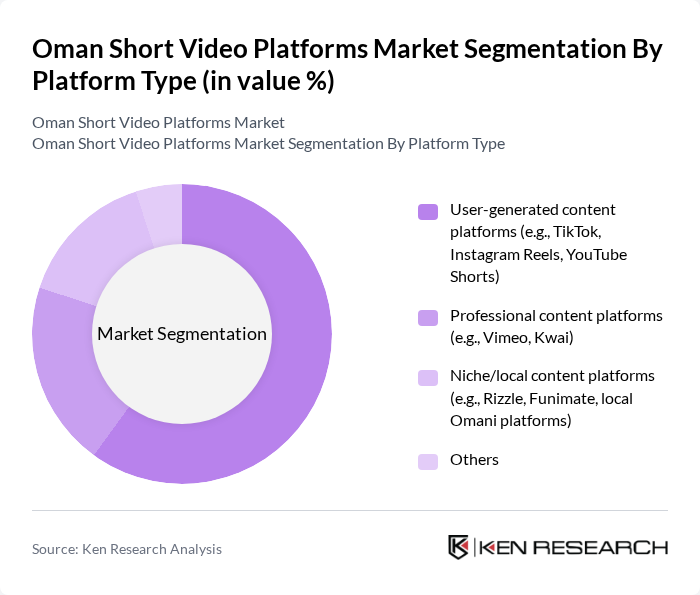

By Platform Type:The segmentation of the market by platform type includes user-generated content platforms, professional content platforms, niche/local content platforms, and others. User-generated content platforms, such as TikTok and Instagram Reels, dominate the market due to their widespread popularity and ease of use, allowing individuals to create and share content effortlessly. Professional content platforms, while significant, cater to a more niche audience, focusing on high-quality video production. Niche/local content platforms are gaining traction as they cater specifically to regional tastes and preferences .

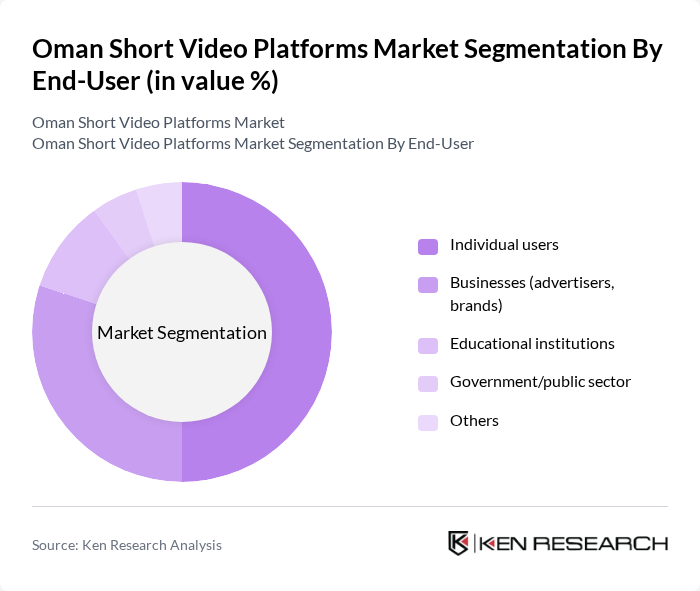

By End-User:The market segmentation by end-user includes individual users, businesses (advertisers, brands), educational institutions, government/public sector, and others. Individual users represent the largest segment, driven by the popularity of short video content among the youth. Businesses are increasingly leveraging these platforms for advertising and brand engagement, while educational institutions are exploring innovative ways to use video content for learning. The government and public sector are also utilizing these platforms for outreach and information dissemination .

The Oman Short Video Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as TikTok (ByteDance Ltd.), Instagram Reels (Meta Platforms, Inc.), YouTube Shorts (Google LLC), Snapchat Spotlight (Snap Inc.), Kwai (Beijing Kuaishou Technology Co. Ltd.), Triller (Triller, Inc.), Vimeo (Vimeo.com, Inc.), Rizzle (Silverlabs Technologies Inc.), Funimate (AVCR Inc.), Dubsmash (acquired by Reddit, Inc.; note: service discontinued in 2022), Cheez (Yixia Technology), Clapper (Clapper Media Group Inc.), Likee (YY Inc./Joyy Inc.), Lomotif (Lomotif Private Limited), Local Omani Platforms (e.g., Shasha, Omani Creators Network) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman short video platforms market appears promising, driven by technological advancements and evolving consumer preferences. As internet connectivity improves, with broadband penetration projected to reachover 95% in future, platforms will likely see increased user engagement. Additionally, the integration of innovative features such as augmented reality and interactive content is expected to enhance user experience, attracting a broader audience. The market is poised for growth as platforms adapt to these trends and capitalize on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Platform Type | User-generated content platforms (e.g., TikTok, Instagram Reels, YouTube Shorts) Professional content platforms (e.g., Vimeo, Kwai) Niche/local content platforms (e.g., Rizzle, Funimate, local Omani platforms) Others |

| By End-User | Individual users Businesses (advertisers, brands) Educational institutions Government/public sector Others |

| By Content Genre | Entertainment Education News and information Lifestyle and vlogs Others |

| By Monetization Model | Ad-supported (free with ads) Subscription-based (premium content) Pay-per-view Creator tipping/gifting Others |

| By Device Type | Mobile devices (smartphones) Tablets Smart TVs Desktop/laptop Others |

| By Geographic Reach | Local Omani platforms Regional (GCC/MENA) platforms Global platforms Others |

| By User Demographics | Age groups (Gen Z, Millennials, Gen X, etc.) Gender Income levels Urban vs rural Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Short Video Content Creators | 60 | Influencers, Videographers, Content Strategists |

| End Users of Short Video Platforms | 120 | General Users, Youth Demographics, Social Media Enthusiasts |

| Advertisers and Marketers | 50 | Digital Marketing Managers, Brand Strategists |

| Industry Experts and Analysts | 40 | Market Researchers, Digital Media Analysts |

| Regulatory Bodies and Policy Makers | 40 | Government Officials, Regulatory Analysts |

The Oman Short Video Platforms Market is valued at approximately USD 120 million, reflecting significant growth driven by smartphone penetration, social media usage, and the demand for engaging video content, particularly among the youth demographic.