Region:Middle East

Author(s):Shubham

Product Code:KRAC2185

Pages:85

Published On:October 2025

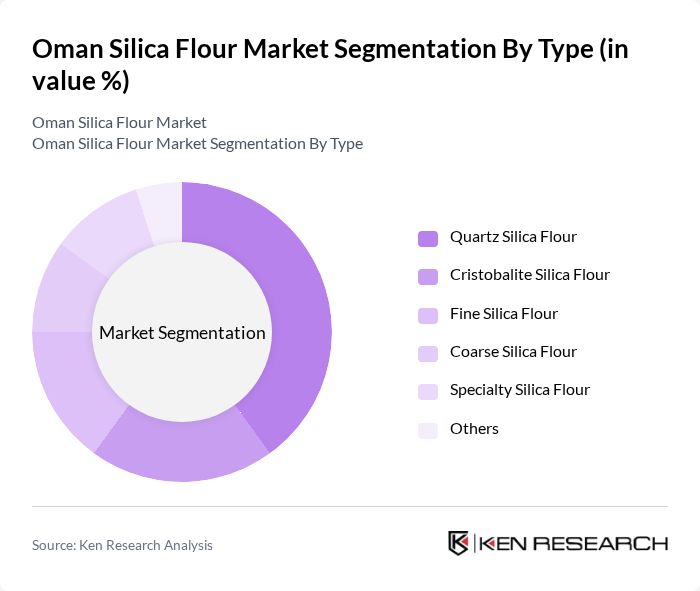

By Type:The market is segmented into Quartz Silica Flour, Cristobalite Silica Flour, Fine Silica Flour, Coarse Silica Flour, Specialty Silica Flour, and Others. Quartz Silica Flour dominates the market due to its superior purity and versatility, supporting applications in construction, glass manufacturing, and oil well cementing. The demand for high-purity quartz is rising, particularly for advanced glass and specialty coatings, as manufacturers seek materials that meet stringent performance and durability standards .

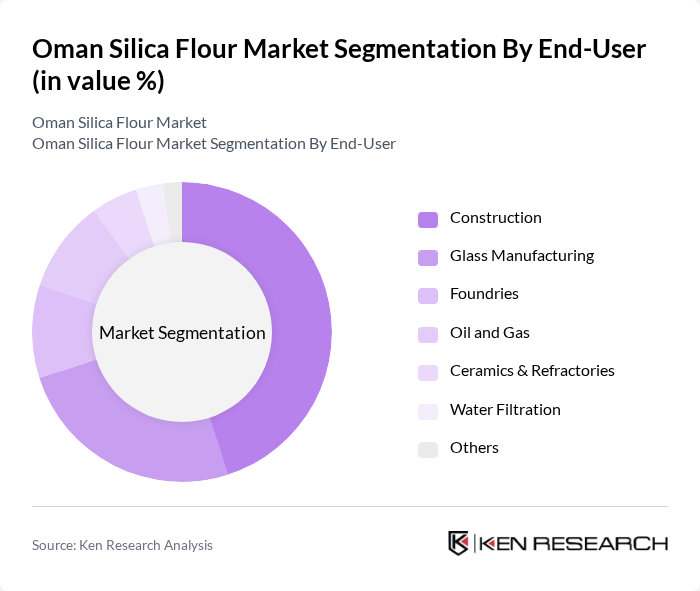

By End-User:The end-user segments include Construction, Glass Manufacturing, Foundries, Oil and Gas, Ceramics & Refractories, Water Filtration, and Others. The Construction sector is the leading end-user, driven by ongoing infrastructure development and the adoption of silica flour in high-strength concrete and specialty mortars. Glass manufacturing remains a major segment, with silica flour essential for clarity and durability in glass products. Oil and gas applications are expanding, as silica flour is increasingly used in drilling fluids and cement slurries to enhance borehole stability .

The Oman Silica Flour Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Silica Industries LLC, Gulf Mining Materials Company LLC, Al Jazeera Steel Products Co. SAOG, National Silica Company, Oman Mining Company, Al Waha Mining & Industrial Co., Muscat Overseas Group, Al Hooqani International Group, Oman Silica Flour Factory, Al Fajar Al Alamia Company SAOG, Al Muna Group, Al Mufeed Trading LLC, Al Mufeed Silica Flour Factory, Al Muna Silica Flour Co., Oman Silica Flour Manufacturing Co. contribute to innovation, geographic expansion, and service delivery in this space.

The Oman silica flour market is poised for growth, driven by increasing demand from key sectors such as construction and glass manufacturing. As companies adapt to environmental regulations and invest in sustainable practices, the market is likely to see innovations in production techniques. Additionally, the expansion of the oil and gas sector will further enhance demand for silica flour, creating a favorable environment for market players. Overall, the outlook remains positive, with opportunities for growth and development in specialty silica products.

| Segment | Sub-Segments |

|---|---|

| By Type | Quartz Silica Flour Cristobalite Silica Flour Fine Silica Flour Coarse Silica Flour Specialty Silica Flour Others |

| By End-User | Construction Glass Manufacturing Foundries Oil and Gas Ceramics & Refractories Water Filtration Others |

| By Application | Concrete Production Oil Well Cementing Glass & Fiberglass Manufacturing Ceramic Frits & Glaze Coatings and Paints Water Filtration Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Packaging Type | Bulk Packaging Bagged Packaging Others |

| By Quality Grade | Industrial Grade Food Grade High-Purity Grade Others |

| By Price Range | Low Price Medium Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Usage | 120 | Project Managers, Procurement Officers |

| Glass Manufacturing Sector | 90 | Production Managers, Quality Control Supervisors |

| Foundry Applications | 80 | Operations Managers, Technical Directors |

| Silica Flour Export Market | 60 | Export Managers, Trade Compliance Officers |

| Research and Development in Silica Applications | 40 | R&D Managers, Product Development Specialists |

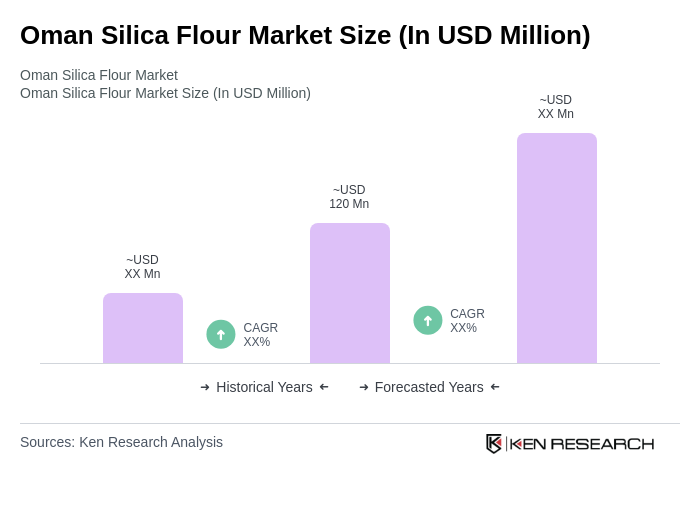

The Oman Silica Flour Market is valued at approximately USD 120 million, reflecting strong demand driven by sectors such as construction, glass manufacturing, and oil and gas, supported by infrastructure investments and the need for high-performance materials.