Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8308

Pages:82

Published On:November 2025

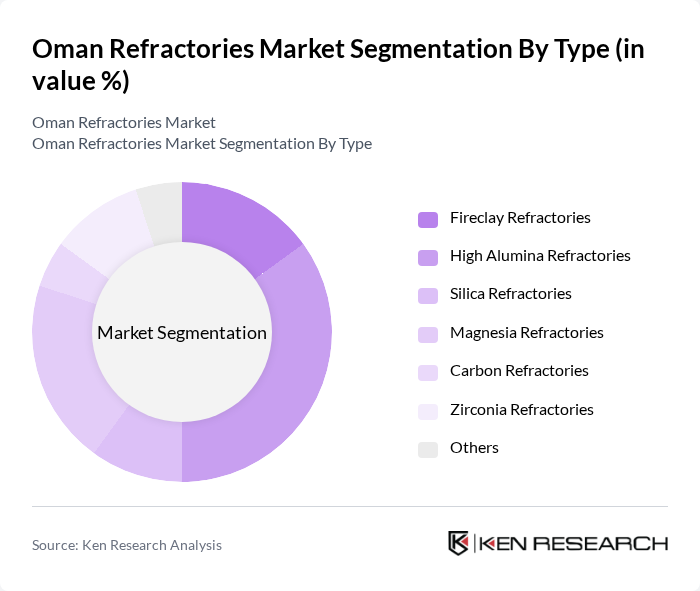

By Type:The refractories market can be segmented into various types, including Fireclay Refractories, High Alumina Refractories, Silica Refractories, Magnesia Refractories, Carbon Refractories, Zirconia Refractories, and Others. Among these, High Alumina Refractories are currently dominating the market due to their superior thermal stability and resistance to chemical corrosion, making them highly sought after in industries such as iron and steel, cement, and petrochemicals.

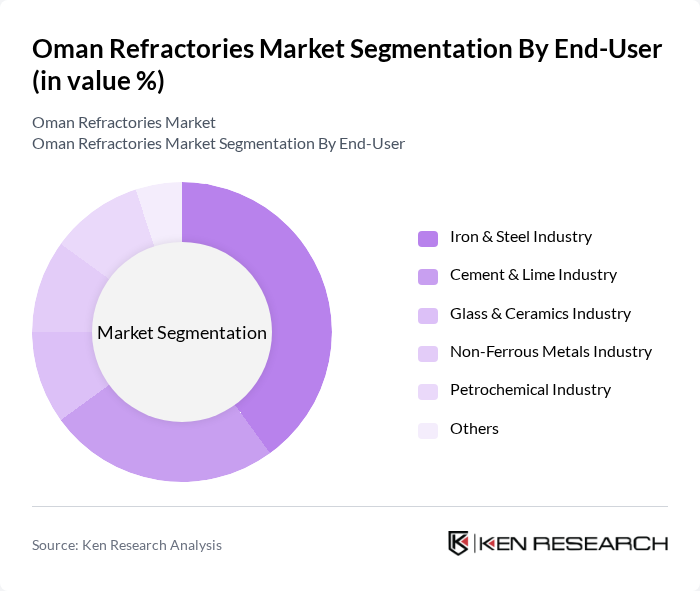

By End-User:The refractories market is segmented by end-user industries, including Iron & Steel Industry, Cement & Lime Industry, Glass & Ceramics Industry, Non-Ferrous Metals Industry, Petrochemical Industry, and Others. The Iron & Steel Industry is the leading segment, driven by the high demand for refractories in steel production processes, where they are essential for furnace linings and other high-temperature applications.

The Oman Refractories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Refractories LLC, Gulf Refractories LLC, Al Jazeera Refractories LLC, Oman Cement Company SAOG, Raysut Cement Company SAOG, Oman Mining Company LLC, Al Anwar Ceramic Tiles Co. SAOG, Sohar Refractories LLC, National Refractories LLC, Al Batinah Refractories LLC, Muscat Refractories LLC, Salalah Refractories LLC, Dhofar Refractories LLC, Al Dakhiliyah Refractories LLC, Industrial Ceramics Middle East (ICLME) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman refractories market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. As the construction and oil sectors expand, the demand for innovative and eco-friendly refractory solutions will rise. Companies are likely to invest in research and development to create products that meet stringent environmental standards while enhancing performance. Additionally, the integration of automation in manufacturing processes will streamline operations, reduce costs, and improve product quality, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fireclay Refractories High Alumina Refractories Silica Refractories Magnesia Refractories Carbon Refractories Zirconia Refractories Others |

| By End-User | Iron & Steel Industry Cement & Lime Industry Glass & Ceramics Industry Non-Ferrous Metals Industry Petrochemical Industry Others |

| By Application | Furnace Linings Kiln Linings Incinerators & Boilers Insulation Castables Precast Shapes Others |

| By Manufacturing Process | Pressing Casting Extrusion Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Product Form | Shaped Refractories (Bricks, Blocks) Unshaped Refractories (Monolithics, Castables) Precast Shapes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Steel Manufacturing Sector | 100 | Production Managers, Procurement Officers |

| Cement Industry Applications | 80 | Quality Control Managers, Operations Directors |

| Glass and Ceramics Production | 60 | Technical Managers, R&D Specialists |

| Energy Sector Utilization | 70 | Plant Managers, Maintenance Supervisors |

| Refractory Product Distributors | 50 | Sales Managers, Distribution Coordinators |

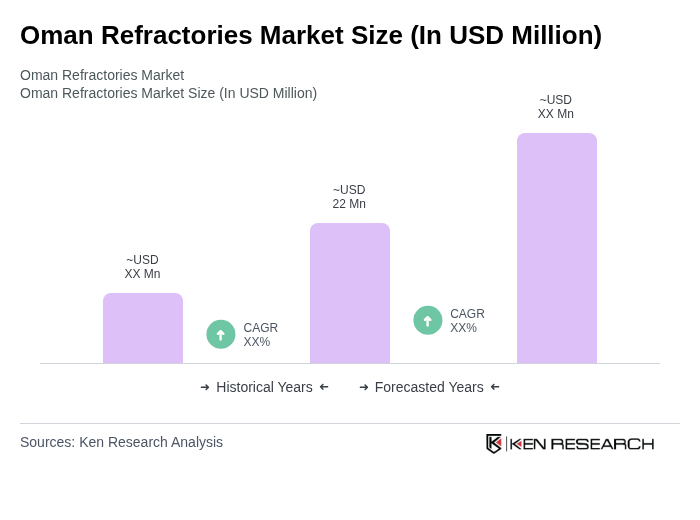

The Oman Refractories Market is valued at approximately USD 22 million, reflecting a five-year historical analysis. This growth is primarily driven by increasing demand from the iron and steel industry, as well as the expansion of the cement and petrochemical sectors.