Oman Smart TV Market Overview

- The Oman Smart TV market is valued at USD 15 million, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for high-definition content, the proliferation of streaming services, and advancements in smart technology integration. The rise in disposable income and urbanization has also contributed significantly to the market's expansion. Enhanced broadband penetration, a tech-savvy population, and the adoption of smart home technologies are further accelerating market growth, with leading brands offering diverse product portfolios to meet evolving consumer preferences.

- Muscat, the capital city, is a dominant player in the Oman Smart TV market due to its higher population density and urban lifestyle, which fosters a greater demand for advanced entertainment solutions. Other cities like Salalah and Sohar are also emerging markets, driven by increasing internet penetration and a growing middle class that seeks modern home entertainment options. Improved digital infrastructure and rising adoption of OTT platforms in these regions are contributing to the expansion of smart TV usage.

- In 2023, the Omani government implemented the “Energy Efficiency Labeling and Standards Regulations for Electrical Appliances, 2023” issued by the Ministry of Commerce, Industry and Investment Promotion. This regulation mandates that all electronic devices, including smart TVs, sold in Oman must comply with specific energy consumption thresholds and display an official energy efficiency label. Manufacturers are required to ensure product compliance through third-party certification, driving innovation in energy-efficient models and supporting sustainability in the consumer electronics sector.

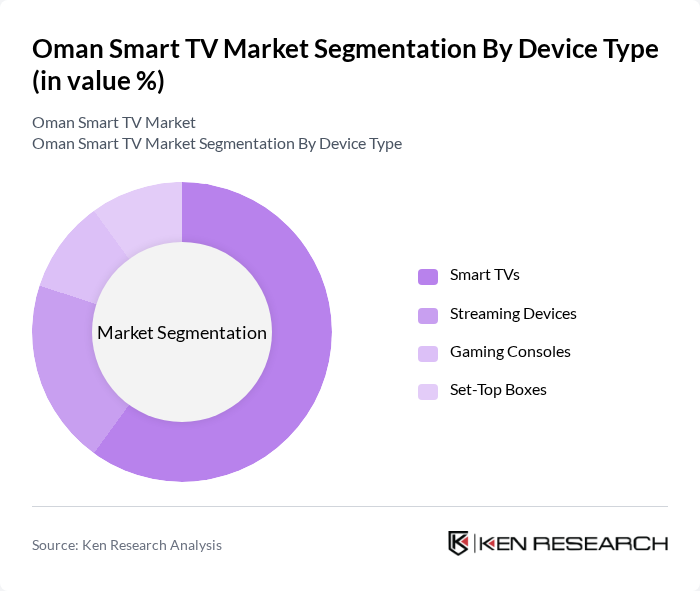

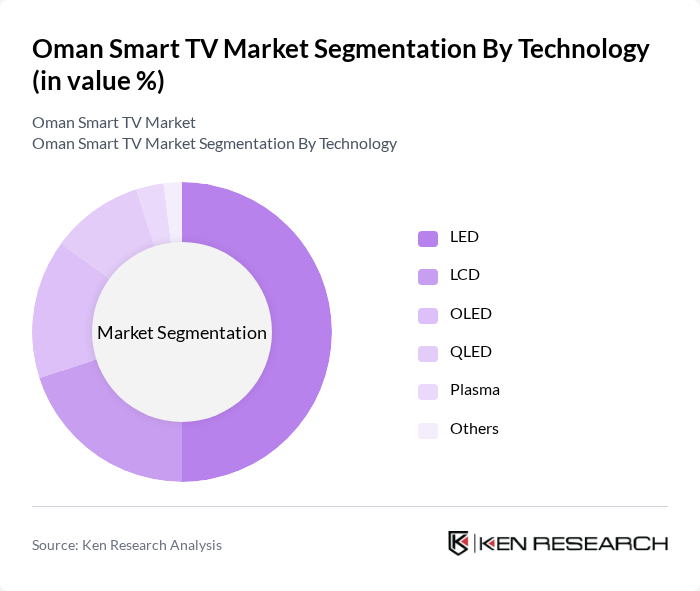

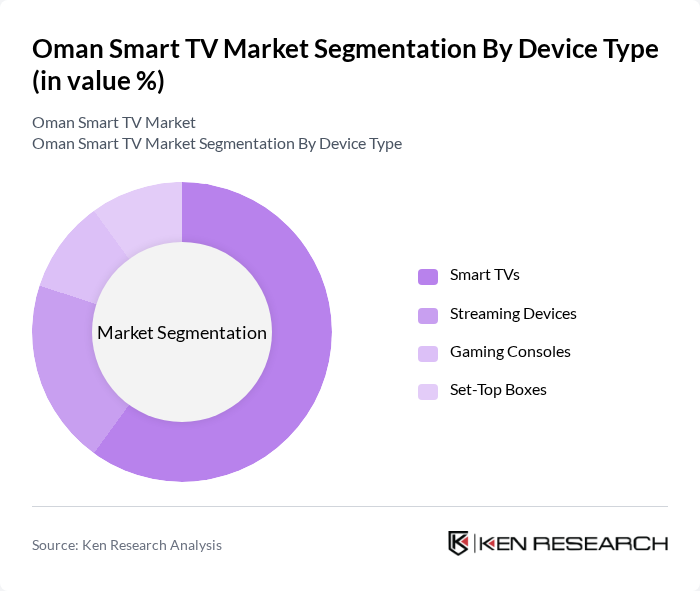

Oman Smart TV Market Segmentation

By Device Type:The device type segmentation includes Smart TVs, Streaming Devices, Gaming Consoles, and Set-Top Boxes. Among these, Smart TVs dominate the market due to their multifunctionality, allowing users to access streaming services, browse the internet, and connect with other smart devices. The increasing trend of cord-cutting and the preference for on-demand content have further propelled the demand for Smart TVs, making them the leading choice for consumers. Integrated OTT platform compatibility and user-friendly interfaces continue to reinforce Smart TVs’ leadership in the market.

By Technology:The technology segmentation encompasses LED, LCD, OLED, QLED, Plasma, and Others. LED technology is the most prevalent in the market, favored for its energy efficiency, brightness, and affordability. The growing consumer preference for high-quality visuals has also led to an increase in the adoption of OLED and QLED technologies, which offer superior picture quality and color accuracy, thus enhancing the viewing experience. LCD remains a significant segment due to its cost-effectiveness, while Plasma and other technologies hold minor shares as consumers shift towards advanced display options.

Oman Smart TV Market Competitive Landscape

The Oman Smart TV Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics, LG Electronics, Sony Corporation, TCL Technology, Hisense Group, Panasonic Corporation, Sharp Corporation, Philips (TP Vision), Xiaomi Corporation, Vizio Inc., JVC (JVCKENWOOD Corporation), Skyworth Group, Haier Group, Toshiba Corporation, BPL Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Oman Smart TV Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:As of future, Oman boasts an internet penetration rate of approximately 98%, with around 4.5 million active internet users. This widespread access facilitates the adoption of smart TVs, as consumers increasingly seek online content. The growth of mobile broadband, which reached 90% coverage, further supports this trend, enabling seamless streaming and connectivity. Enhanced internet infrastructure is crucial for the smart TV market, driving demand for devices that can leverage high-speed connections.

- Rising Disposable Income:The average disposable income in Oman is projected to reach OMR 1,200 (approximately USD 3,120) per capita in future, reflecting a steady increase in consumer purchasing power. This economic growth allows households to invest in premium electronics, including smart TVs. As more consumers prioritize home entertainment, the demand for high-quality smart TVs is expected to rise, driven by the desire for enhanced viewing experiences and advanced features.

- Expansion of Streaming Services:The number of streaming service subscriptions in Oman is anticipated to exceed 1.2 million by future, driven by platforms like Netflix and local providers. This surge in content availability encourages consumers to invest in smart TVs that offer seamless access to these services. With the average household spending on entertainment increasing by 15% annually, the demand for smart TVs capable of supporting diverse streaming options is set to grow significantly.

Market Challenges

- High Initial Costs:The average price of smart TVs in Oman ranges from OMR 200 to OMR 800 (USD 520 to USD 2,080), which can be a barrier for many consumers. Despite rising disposable incomes, the high upfront costs deter potential buyers, particularly in lower-income households. This challenge is compounded by the availability of cheaper traditional TVs, which continue to dominate the market, limiting the growth potential of smart TV sales.

- Limited Local Content:The lack of localized content on streaming platforms poses a significant challenge for the smart TV market in Oman. Currently, only 20% of available content is tailored to local tastes and preferences, which can hinder consumer interest in smart TVs. Without a robust library of relevant content, potential buyers may opt for traditional TVs, limiting the growth of smart TV adoption in the region.

Oman Smart TV Market Future Outlook

The Oman Smart TV market is poised for significant growth, driven by technological advancements and changing consumer preferences. As internet speeds improve and more households gain access to high-quality streaming services, the demand for smart TVs will likely increase. Additionally, the integration of AI and voice control features will enhance user experiences, making smart TVs more appealing. The focus on energy efficiency and sustainability will also shape future product offerings, aligning with global trends toward eco-friendly technology.

Market Opportunities

- Growth of E-commerce Platforms:The rise of e-commerce in Oman, with online sales projected to reach OMR 500 million (USD 1.3 billion) in future, presents a significant opportunity for smart TV manufacturers. By leveraging online platforms, companies can reach a broader audience, facilitating easier access to smart TVs and enhancing sales potential in a competitive market.

- Partnerships with Content Providers:Collaborating with local content providers can enhance the appeal of smart TVs in Oman. By offering exclusive content tailored to local audiences, manufacturers can differentiate their products and attract more consumers. Such partnerships can also drive subscription growth for streaming services, creating a mutually beneficial ecosystem that supports the smart TV market.