Region:Middle East

Author(s):Dev

Product Code:KRAC4870

Pages:92

Published On:October 2025

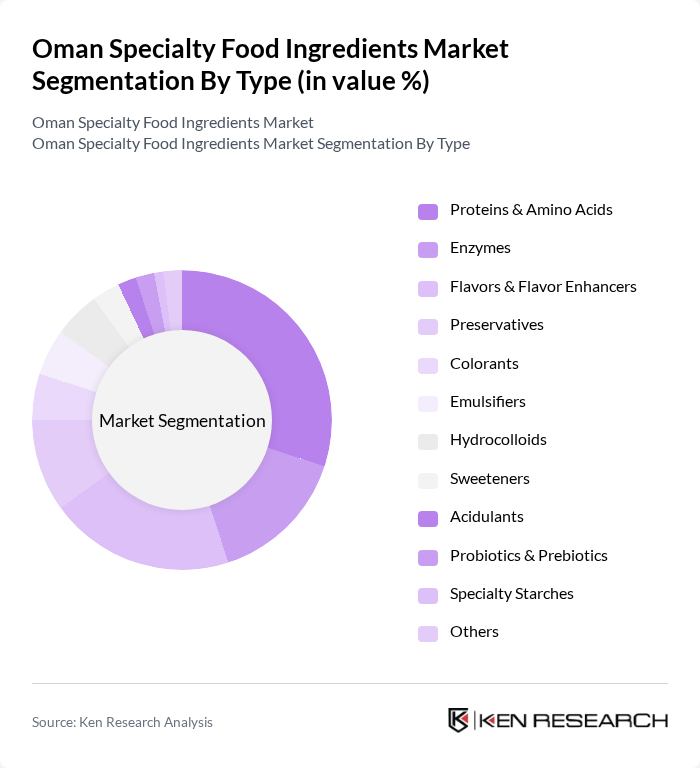

By Type:The market is segmented into various types of specialty food ingredients, including Proteins & Amino Acids, Enzymes, Flavors & Flavor Enhancers, Preservatives, Colorants, Emulsifiers, Hydrocolloids, Sweeteners, Acidulants, Probiotics & Prebiotics, Specialty Starches, and Others. Among these, Proteins & Amino Acids are leading due to the increasing demand for protein-rich foods and supplements, driven by health trends and dietary preferences. Enzymes are also gaining traction globally due to their multifunctional benefits and alignment with health-conscious and environmentally friendly trends. The organic segment is witnessing the fastest growth, fueled by consumer preference for clean-label, natural, and sustainably sourced products.

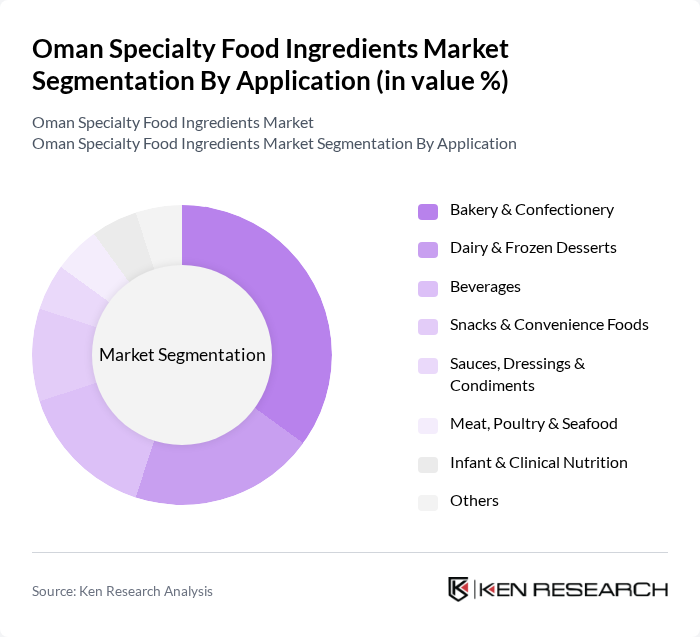

By Application:The applications of specialty food ingredients include Bakery & Confectionery, Dairy & Frozen Desserts, Beverages, Snacks & Convenience Foods, Sauces, Dressings & Condiments, Meat, Poultry & Seafood, Infant & Clinical Nutrition, and Others. The Bakery & Confectionery segment is currently dominating the market due to the rising demand for baked goods and confectionery products, which require various specialty ingredients for improved taste and texture. The growth in convenience and processed foods, along with increasing health awareness, is driving broader adoption across all application segments.

The Oman Specialty Food Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Food Ingredients LLC, Al Haramain Food & Spices LLC, Muscat Food Industries LLC, Gulf Food Industries - California Garden, Oman International Foodstuff Co. LLC, Al Ahlia Food Industries Co. SAOG, Al Jazeera Food Processing Co. LLC, Oman Oilseeds Crushing Company SAOC, Al Mufeed Food Industries LLC, Al Noor Food Products LLC, Al Fajr Food Industries LLC, Oman Natural Ingredients LLC, Al Waha Food Industries LLC, Muscat Gourmet Foods LLC, Oman Organic Products LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Oman specialty food ingredients market is poised for significant growth, driven by evolving consumer preferences and technological advancements. The increasing focus on health and sustainability will likely lead to a surge in demand for clean-label and plant-based products. Additionally, the government's support for local production and food security initiatives will enhance the market landscape. As e-commerce continues to expand, it will provide new avenues for specialty ingredient distribution, further stimulating market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Proteins & Amino Acids Enzymes Flavors & Flavor Enhancers Preservatives Colorants Emulsifiers Hydrocolloids Sweeteners Acidulants Probiotics & Prebiotics Specialty Starches Others |

| By Application | Bakery & Confectionery Dairy & Frozen Desserts Beverages Snacks & Convenience Foods Sauces, Dressings & Condiments Meat, Poultry & Seafood Infant & Clinical Nutrition Others |

| By End-User | Food & Beverage Manufacturers Foodservice Providers Retailers Households |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Al Sharqiyah Others |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturers | 100 | Production Managers, Quality Control Officers |

| Distributors of Specialty Ingredients | 80 | Sales Directors, Supply Chain Managers |

| Retail Sector Buyers | 60 | Category Managers, Procurement Specialists |

| Food Service Operators | 50 | Restaurant Owners, Executive Chefs |

| Health and Wellness Product Developers | 40 | Product Development Managers, Nutritionists |

The Oman Specialty Food Ingredients Market is valued at approximately USD 150 million, based on a five-year historical analysis. This figure reflects the growing consumer demand for natural and organic food products and the increasing health consciousness among the population.