Region:Middle East

Author(s):Dev

Product Code:KRAC3458

Pages:98

Published On:October 2025

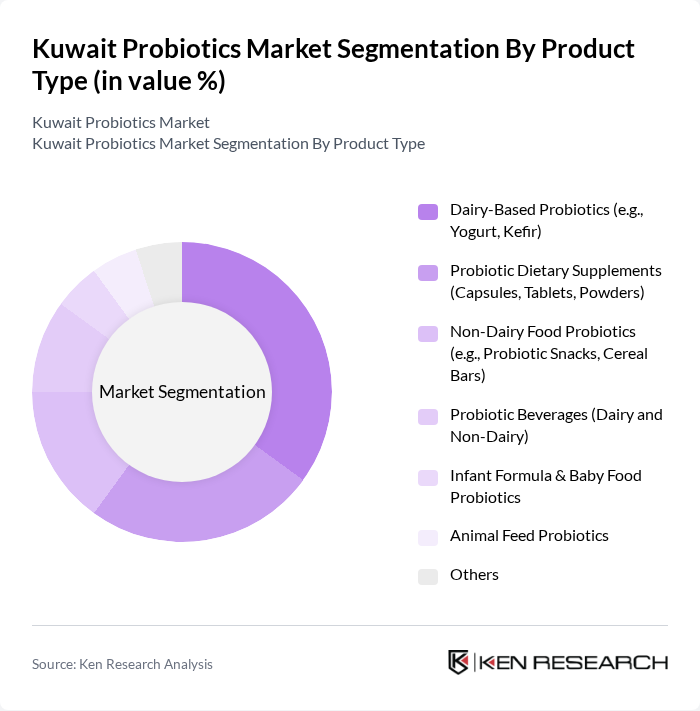

By Product Type:The product type segmentation includes various categories such as Dairy-Based Probiotics, Probiotic Dietary Supplements, Non-Dairy Food Probiotics, Probiotic Beverages, Infant Formula & Baby Food Probiotics, Animal Feed Probiotics, and Others. Among these, Dairy-Based Probiotics, particularly yogurt and kefir, dominate the market due to their established consumer base and proven health benefits. The increasing trend of incorporating probiotics into daily diets has led to a surge in demand for these products. Non-dairy and supplement formats are also gaining traction as consumers seek diverse delivery mechanisms for probiotic benefits.

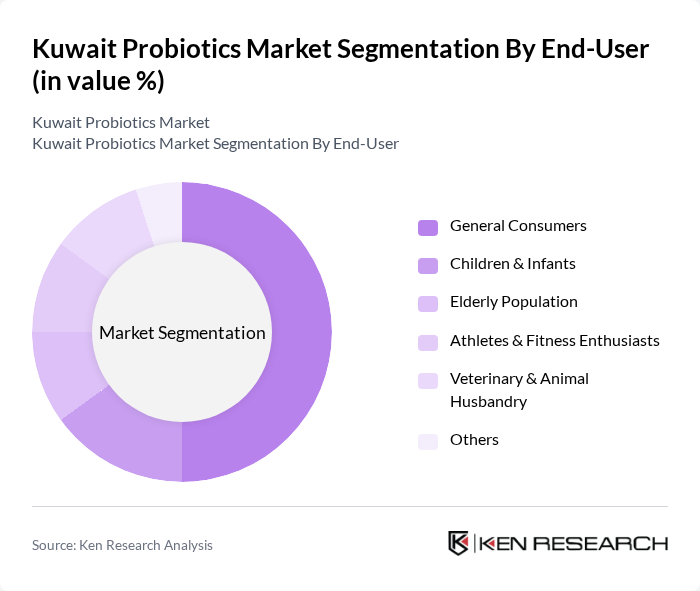

By End-User:The end-user segmentation encompasses General Consumers, Children & Infants, Elderly Population, Athletes & Fitness Enthusiasts, Veterinary & Animal Husbandry, and Others. The General Consumers segment leads the market, driven by a growing awareness of health benefits associated with probiotics. This segment's dominance is fueled by the increasing incorporation of probiotics into everyday diets, particularly among health-conscious individuals. Children, infants, and the elderly are also key demographics, with targeted products addressing specific health needs. The animal feed segment remains niche but is supported by growing interest in livestock health and productivity.

The Kuwait Probiotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Danone S.A., Nestlé S.A., Yakult Honsha Co., Ltd., Arla Foods amba, BioGaia AB, Chr. Hansen Holding A/S, Probi AB, DuPont Nutrition & Biosciences (IFF), Lallemand Inc., Kerry Group plc, Meiji Holdings Co., Ltd., Lifeway Foods, Inc., General Mills, Inc., Morinaga Milk Industry Co., Ltd., Valio Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the probiotics market in Kuwait appears promising, driven by increasing health awareness and a growing preference for functional foods. Innovations in product formulations, such as plant-based probiotics, are expected to attract a broader consumer base. Additionally, the expansion of e-commerce platforms will facilitate easier access to probiotic products, enhancing market penetration. As consumers continue to prioritize health, the demand for probiotics is likely to rise, creating opportunities for both established and new brands in the market.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Dairy-Based Probiotics (e.g., Yogurt, Kefir) Probiotic Dietary Supplements (Capsules, Tablets, Powders) Non-Dairy Food Probiotics (e.g., Probiotic Snacks, Cereal Bars) Probiotic Beverages (Dairy and Non-Dairy) Infant Formula & Baby Food Probiotics Animal Feed Probiotics Others |

| By End-User | General Consumers Children & Infants Elderly Population Athletes & Fitness Enthusiasts Veterinary & Animal Husbandry Others |

| By Distribution Channel | Supermarkets & Hypermarkets Pharmacies & Drug Stores Health & Wellness Stores Online Retail Direct Sales (Practitioner/Clinic) Others |

| By Packaging Type | Bottles Sachets Blister Packs Jars Pouches Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Formulation | Multi-Strain Probiotics Single-Strain Probiotics Synbiotics (Probiotics + Prebiotics) Others |

| By Target Health Benefit | Digestive Health Immune Support Women’s Health Weight Management Mental Health Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 80 | Dietitians, Gastroenterologists, General Practitioners |

| Consumer Insights | 120 | Health-conscious Individuals, Parents, Fitness Enthusiasts |

| Retail Sector Feedback | 60 | Store Managers, Health Food Retailers |

| Manufacturers and Distributors | 40 | Product Managers, Sales Directors |

| Market Analysts | 40 | Industry Analysts, Market Researchers |

The Kuwait Probiotics Market is valued at approximately USD 18 million, reflecting a significant growth trend driven by increasing consumer awareness of gut health and the rising demand for functional foods and preventive healthcare solutions.