Region:Middle East

Author(s):Dev

Product Code:KRAB7054

Pages:100

Published On:October 2025

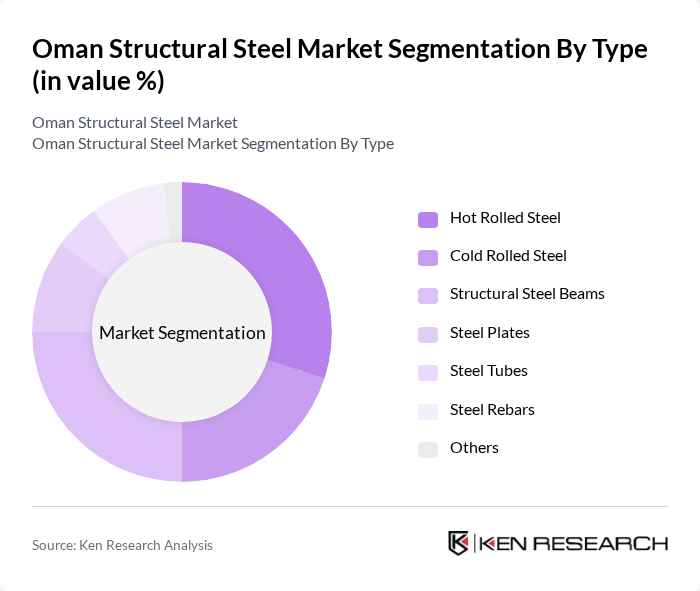

By Type:The structural steel market can be segmented into various types, including Hot Rolled Steel, Cold Rolled Steel, Structural Steel Beams, Steel Plates, Steel Tubes, Steel Rebars, and Others. Each of these subsegments plays a crucial role in different construction applications, with specific characteristics that cater to various structural requirements.

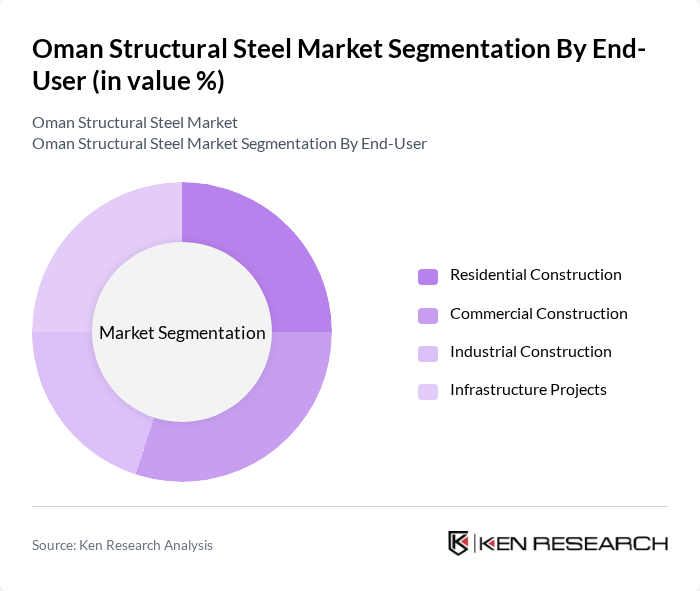

By End-User:The end-user segmentation includes Residential Construction, Commercial Construction, Industrial Construction, and Infrastructure Projects. Each of these sectors has distinct requirements for structural steel, influenced by factors such as project scale, design specifications, and regulatory standards.

The Oman Structural Steel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Structural Steel LLC, Gulf Steel Industries LLC, Al Jazeera Steel Products Co. SAOG, Muscat Steel Industries LLC, Oman Metal Industries LLC, Al Anwar Holdings SAOG, National Steel Fabrication LLC, Al Batinah Steel LLC, Oman Cables Industry SAOG, Al Hodaifi Group, Al Mufeedh Steel LLC, Al Muna Steel LLC, Al Falah Steel LLC, Al Jazeera Metal Products LLC, Oman International Engineering Company SAOG contribute to innovation, geographic expansion, and service delivery in this space.

The Oman structural steel market is poised for significant growth, driven by ongoing infrastructure projects and government initiatives aimed at economic diversification. As urbanization continues, the demand for high-quality steel products will increase, particularly in construction and renewable energy sectors. Technological advancements in steel production will enhance efficiency and sustainability, while the focus on smart city initiatives will create new opportunities for innovation and investment in the market, ensuring a robust future landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hot Rolled Steel Cold Rolled Steel Structural Steel Beams Steel Plates Steel Tubes Steel Rebars Others |

| By End-User | Residential Construction Commercial Construction Industrial Construction Infrastructure Projects |

| By Application | Building Construction Bridge Construction Oil & Gas Infrastructure Power Generation Facilities |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Wholesale Distribution Retail Distribution |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Construction Projects | 100 | Project Managers, Architects |

| Residential Building Developments | 80 | Construction Supervisors, Developers |

| Industrial Infrastructure Projects | 70 | Procurement Managers, Engineers |

| Government Infrastructure Initiatives | 60 | Policy Makers, Project Coordinators |

| Steel Distribution and Supply Chain | 90 | Supply Chain Managers, Sales Directors |

The Oman Structural Steel Market is valued at approximately USD 1.2 billion, driven by increasing demand for infrastructure development, particularly in the construction and oil & gas sectors.