Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4179

Pages:100

Published On:December 2025

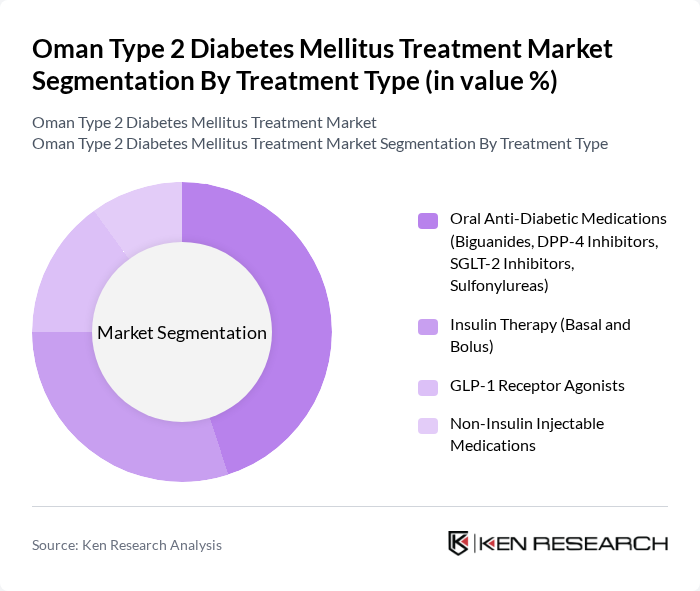

By Treatment Type:The treatment type segmentation includes various methods used to manage Type 2 Diabetes Mellitus. The subsegments are Oral Anti-Diabetic Medications (Biguanides, DPP-4 Inhibitors, SGLT-2 Inhibitors, Sulfonylureas), Insulin Therapy (Basal and Bolus), GLP-1 Receptor Agonists, and Non-Insulin Injectable Medications. Each of these treatment types plays a crucial role in managing blood glucose levels and improving patient outcomes.

The Oral Anti-Diabetic Medications segment is currently dominating the market due to their widespread acceptance and effectiveness in managing Type 2 Diabetes, consistent with evidence that oral agents account for the majority of diabetes drug use in Oman. Biguanides, particularly Metformin, are the most commonly prescribed medications, as they are effective in lowering blood sugar levels and have a favorable safety profile, and are identified as the leading therapy in the national diabetes drugs market. The increasing prevalence of diabetes and the growing awareness of treatment options are driving the demand for these medications, supported by Ministry of Health initiatives to improve access to essential diabetes medicines. Additionally, the affordability and accessibility of oral medications compared to some injectable therapies, along with ease of use and established reimbursement in public facilities, contribute to their market leadership.

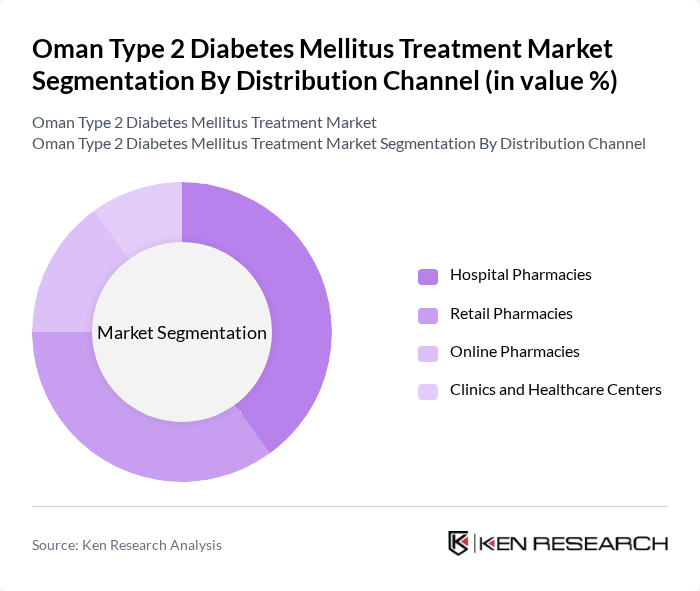

By Distribution Channel:The distribution channel segmentation includes various avenues through which diabetes treatment products are made available to patients. The subsegments are Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Clinics and Healthcare Centers. Each channel plays a vital role in ensuring that patients have access to necessary medications and treatments, with hospitals and clinics noted as key end-users for diabetes drugs in Oman.

Hospital Pharmacies are leading the distribution channel segment due to their integral role in patient care and management, aligning with the concentration of diabetes care within public and private hospitals and specialist centers. They provide immediate access to medications for hospitalized patients and those attending outpatient services, ensuring continuity of therapy for insulin and complex regimens. The presence of healthcare professionals in hospitals ensures that patients receive appropriate medications tailored to their specific needs, with close monitoring and adjustment of treatment plans. Additionally, the growing trend of integrated healthcare services within hospitals, including diabetes clinics and multidisciplinary care programs, enhances the distribution of diabetes treatments, making them more accessible to patients and supporting adherence and education.

The Oman Type 2 Diabetes Mellitus Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novo Nordisk A/S, Sanofi Aventis, Merck & Co., Inc., AstraZeneca PLC, Eli Lilly and Company, Boehringer Ingelheim GmbH, Janssen Pharmaceuticals (Johnson & Johnson), Pfizer Inc., Takeda Pharmaceutical Company Limited, Astellas Pharma Inc., Bristol Myers Squibb, Zydus Lifesciences Limited, Julphar (Gulf Pharmaceutical Industries), Novartis AG, Bayer AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman Type 2 Diabetes Mellitus treatment market appears promising, driven by increasing government initiatives and technological advancements. The focus on personalized medicine and digital health solutions is expected to enhance patient engagement and treatment adherence. Furthermore, the integration of preventive healthcare strategies will likely reduce the incidence of diabetes, ultimately leading to a healthier population and decreased healthcare costs in the long term.

| Segment | Sub-Segments |

|---|---|

| By Treatment Type | Oral Anti-Diabetic Medications (Biguanides, DPP-4 Inhibitors, SGLT-2 Inhibitors, Sulfonylureas) Insulin Therapy (Basal and Bolus) GLP-1 Receptor Agonists Non-Insulin Injectable Medications |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Clinics and Healthcare Centers |

| By Patient Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Socioeconomic Status (Low, Middle, High) Obesity Status |

| By Region | Muscat (Primary Market Hub) Dhofar Al Batinah Other Governorates |

| By Age of Onset | Early Onset (Under 30) Middle Age Onset (30-60) Late Onset (Over 60) Others |

| By Treatment Setting | Inpatient Care Outpatient Care Home Care Telemedicine |

| By Insurance Coverage | Public Insurance Private Insurance Uninsured Government Subsidized Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologists and Diabetes Specialists | 60 | Healthcare Providers, Medical Directors |

| Pharmacists in Urban Areas | 80 | Pharmacy Managers, Retail Pharmacists |

| Diabetes Patients on Medication | 120 | Type 2 Diabetes Patients, Caregivers |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Public Health Experts |

| Diabetes Support Groups | 70 | Patient Advocates, Group Leaders |

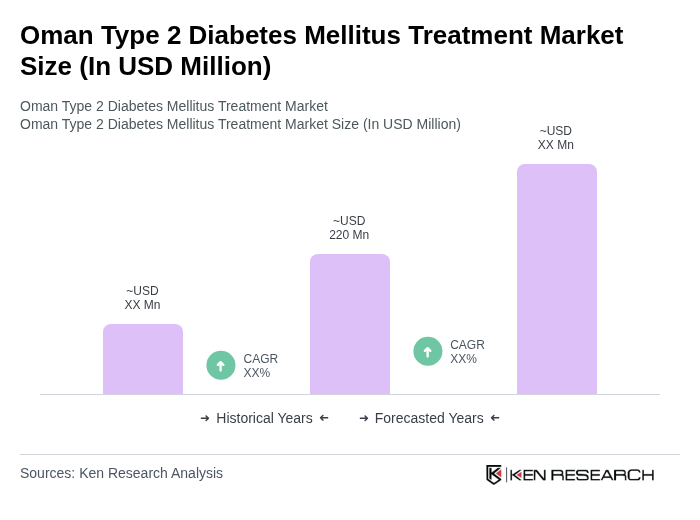

The Oman Type 2 Diabetes Mellitus Treatment Market is valued at approximately USD 220 million, reflecting a significant share of the national diabetes drugs market, primarily driven by the increasing prevalence of diabetes and advancements in treatment options.