Region:Middle East

Author(s):Shubham

Product Code:KRAD3492

Pages:85

Published On:November 2025

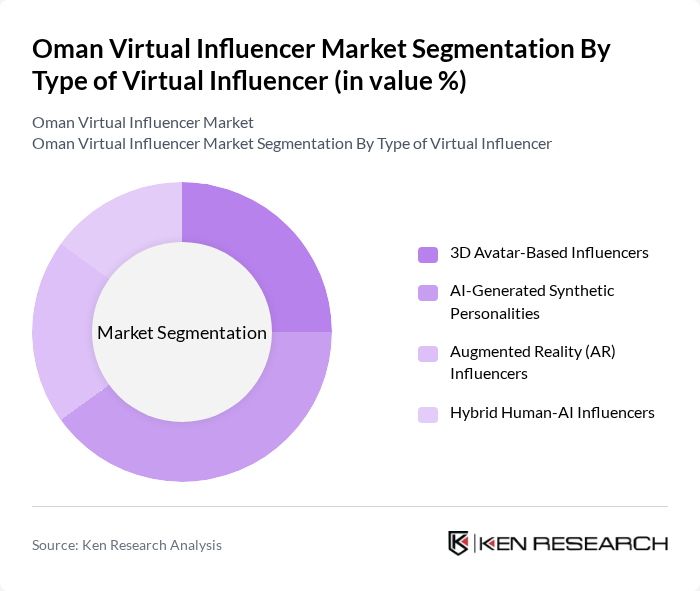

By Type of Virtual Influencer:The market is segmented into various types of virtual influencers, including 3D Avatar-Based Influencers, AI-Generated Synthetic Personalities, Augmented Reality (AR) Influencers, and Hybrid Human-AI Influencers. Among these, AI-Generated Synthetic Personalities are leading the market due to their ability to engage audiences with personalized content and interactive experiences. This segment has gained traction as brands increasingly leverage AI technology to create relatable and engaging virtual personas that resonate with consumers. The advancement in artificial intelligence and deep learning technologies continues to enhance the realism and interactivity of these digital personas.

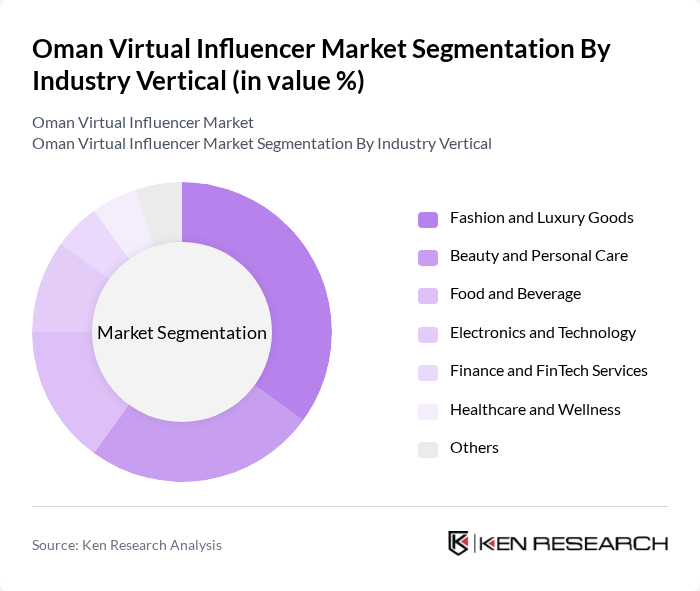

By Industry Vertical:The virtual influencer market is also segmented by industry verticals, including Fashion and Luxury Goods, Beauty and Personal Care, Food and Beverage, Electronics and Technology, Finance and FinTech Services, Healthcare and Wellness, and Others. The Fashion and Luxury Goods sector is currently the dominant segment, driven by the increasing collaboration between brands and virtual influencers to create visually appealing campaigns that attract younger consumers. This trend is fueled by the growing influence of social media on fashion trends and consumer purchasing decisions. The fashion and beauty industries have particularly embraced virtual influencers as trendsetters, leveraging their ability to showcase products and create immersive narratives that resonate with audiences.

The Oman Virtual Influencer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diigitals (UK-based virtual influencer agency), The Influencer Marketing Factory (TIMF), Brud Inc. (Creator of Lil Miquela), Realities.io (Virtual influencer platform), Soul Machines (AI-driven digital humans), Synthesia (AI video generation platform), Unreal Gigs (Virtual talent marketplace), CGI Influencer Studios (Regional virtual influencer creators), AI Persona Labs (Custom AI influencer development), Digital Talent Network (Virtual influencer representation), Metaverse Marketing Solutions (Virtual world influencer campaigns), Avatar Commerce Inc. (E-commerce virtual influencer integration), Neural Influencer Agency (AI-powered influencer management), Virtual Reality Content Studios (VR-based influencer experiences), Digital Persona Collective (Multi-platform virtual influencer network) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman virtual influencer market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As brands increasingly recognize the potential of virtual influencers, we anticipate a surge in innovative marketing campaigns that leverage AI and augmented reality. Additionally, the growing demand for personalized content will likely lead to the emergence of niche virtual influencers, catering to specific audience segments. This dynamic landscape will create new opportunities for brands to engage consumers in more meaningful ways.

| Segment | Sub-Segments |

|---|---|

| By Type of Virtual Influencer | D Avatar-Based Influencers AI-Generated Synthetic Personalities Augmented Reality (AR) Influencers Hybrid Human-AI Influencers |

| By Industry Vertical | Fashion and Luxury Goods Beauty and Personal Care Food and Beverage Electronics and Technology Finance and FinTech Services Healthcare and Wellness Others |

| By Social Media Platform | TikTok YouTube Snapchat Regional Platforms (Weibo, Bilibili, Douyin) |

| By Content Format | Sponsored Product Posts Live Stream Commerce Short-Form Video Content Interactive Stories and Reels Virtual Events and Experiences |

| By Influencer Tier | Mega Influencers (1M+ followers) Macro Influencers (100K-1M followers) Micro Influencers (10K-100K followers) Nano Influencers (1K-10K followers) |

| By Target Audience Demographics | Age Groups (13-24, 25-34, 35-49, 50+) Gender Segmentation Geographic Location (Urban vs Rural) Income Levels |

| By Engagement Metrics | High Engagement (>5% engagement rate) Medium Engagement (2-5% engagement rate) Low Engagement (<2% engagement rate) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Brand Marketing Executives | 45 | Marketing Managers, Brand Strategists |

| Social Media Users | 120 | Active Instagram and TikTok Users |

| Digital Marketing Professionals | 35 | SEO Specialists, Content Creators |

| Advertising Agencies | 40 | Account Managers, Creative Directors |

| Influencer Marketing Platforms | 30 | Platform Managers, Data Analysts |

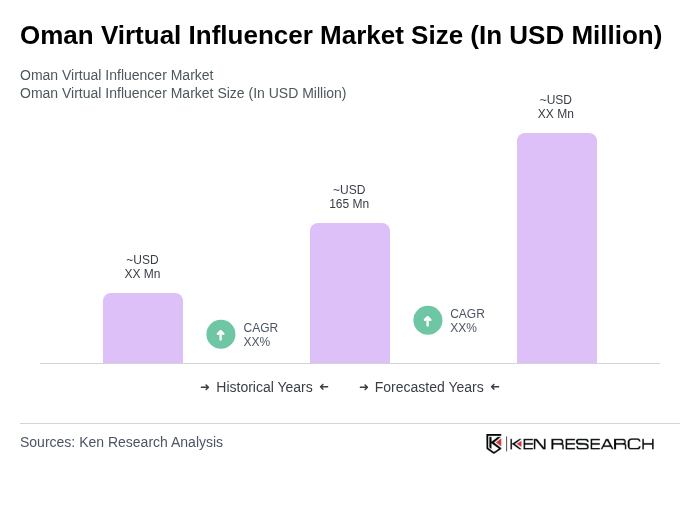

The Oman Virtual Influencer Market is valued at approximately USD 165 million, reflecting significant growth driven by the increasing adoption of digital marketing strategies and the rising popularity of social media among the youth in Oman.