Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8189

Pages:94

Published On:December 2025

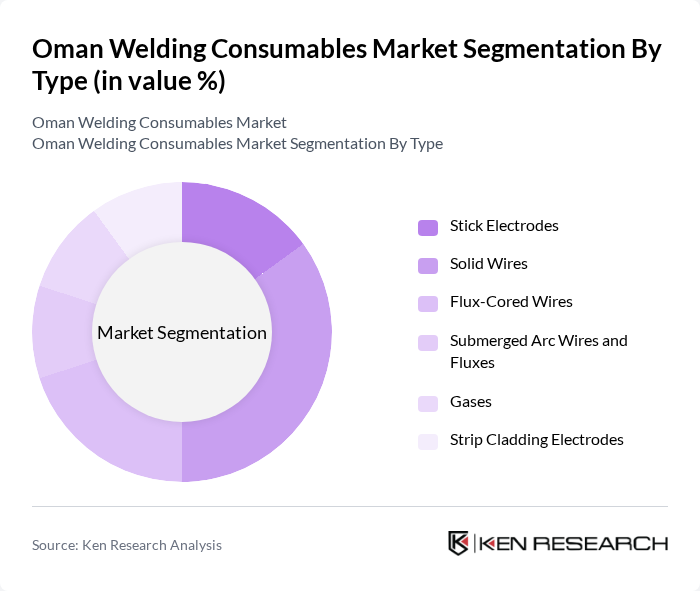

By Type:The market is segmented into various types of welding consumables, including Stick Electrodes, Solid Wires, Flux-Cored Wires, Submerged Arc Wires and Fluxes, Gases, and Strip Cladding Electrodes. Among these, Solid Wires are currently dominating the market due to their versatility and efficiency in various welding applications. The increasing adoption of advanced welding techniques in industries such as automotive and construction has further propelled the demand for Solid Wires. Additionally, the trend towards automation in welding processes has led to a higher preference for Solid Wires, which are compatible with automated welding systems.

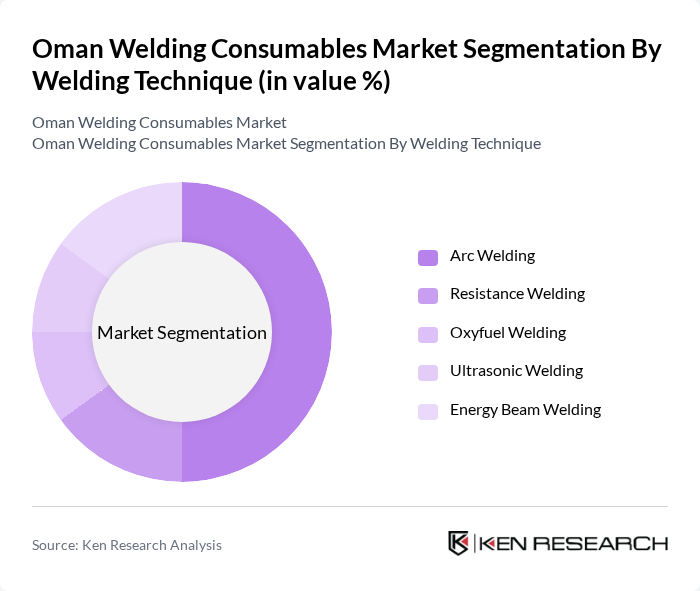

By Welding Technique:The welding techniques segment includes Arc Welding, Resistance Welding, Oxyfuel Welding, Ultrasonic Welding, and Energy Beam Welding. Arc Welding is the leading technique in the market, primarily due to its widespread application in various industries, including construction and manufacturing. The simplicity and effectiveness of Arc Welding make it a preferred choice for many welders. Additionally, the growing trend of automation in welding processes has led to advancements in Arc Welding technologies, further solidifying its dominance in the market. Laser beam welding is emerging as a high-growth segment, driven by its precision and suitability for advanced manufacturing applications in aerospace and automotive sectors.

The Oman Welding Consumables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Welding Company, Al Ghubra Welding and Engineering, Gulf Welding Industries, Al-Futtaim Engineering and Trading, Oman Metal Industries LLC, Al Jazeera Steel Products, Muscat Welding and Fabrication, Oman Cables Industry SAOC, Al Mufeed Welding Supplies, Al Muna Welding and Trading, Oman International Engineering Services, Al Harthy Welding and Construction, Al Shanfari Group, Al Mufeed Industrial Group, Oman Engineering and Construction Group contribute to innovation, geographic expansion, and service delivery in this space.

The Oman welding consumables market is poised for significant transformation, driven by technological advancements and a strong focus on sustainability. As industries increasingly adopt automation and advanced welding techniques, the demand for high-quality consumables will rise. Additionally, government initiatives aimed at promoting local manufacturing and reducing import dependency will further enhance market dynamics. The emphasis on eco-friendly practices will also shape product development, ensuring that the market aligns with global sustainability trends while meeting local industrial needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Stick Electrodes Solid Wires Flux-Cored Wires Submerged Arc Wires and Fluxes Gases Strip Cladding Electrodes |

| By Welding Technique | Arc Welding Resistance Welding Oxyfuel Welding Ultrasonic Welding Energy Beam Welding |

| By End-User Industry | Construction Automotive Oil and Gas Shipbuilding Aerospace and Defense Heavy Engineering Industrial Equipment |

| By Application | Structural Welding Pipe and Tank Fabrication Maintenance and Repair Fabrication Offshore Drilling Platforms |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Stores |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Customer Type | Large Enterprises SMEs Government Agencies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Welding Applications | 100 | Project Managers, Site Engineers |

| Automotive Manufacturing Welding Processes | 80 | Production Supervisors, Quality Control Managers |

| Oil & Gas Sector Welding Standards | 70 | Safety Officers, Operations Managers |

| Shipbuilding and Marine Welding Techniques | 60 | Marine Engineers, Fabrication Managers |

| Welding Equipment Distribution Channels | 90 | Sales Managers, Supply Chain Coordinators |

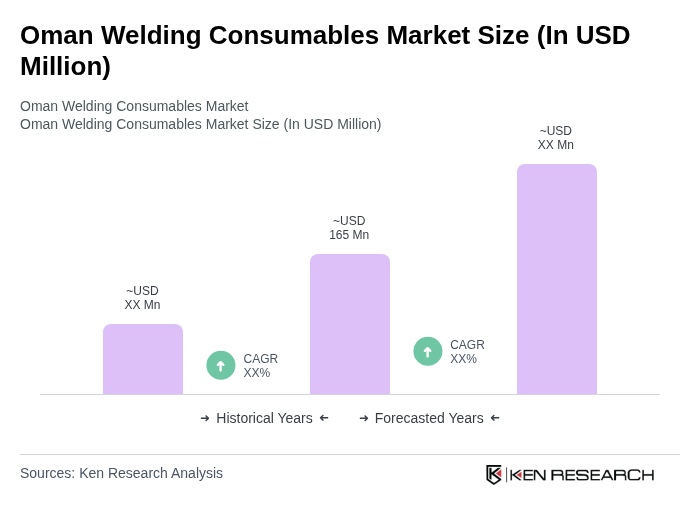

The Oman Welding Consumables Market is valued at approximately USD 165 million, driven by increasing demand in sectors such as construction, automotive, and oil and gas, along with the expansion of infrastructure projects and manufacturing activities.