Region:Asia

Author(s):Shubham

Product Code:KRAD2481

Pages:98

Published On:January 2026

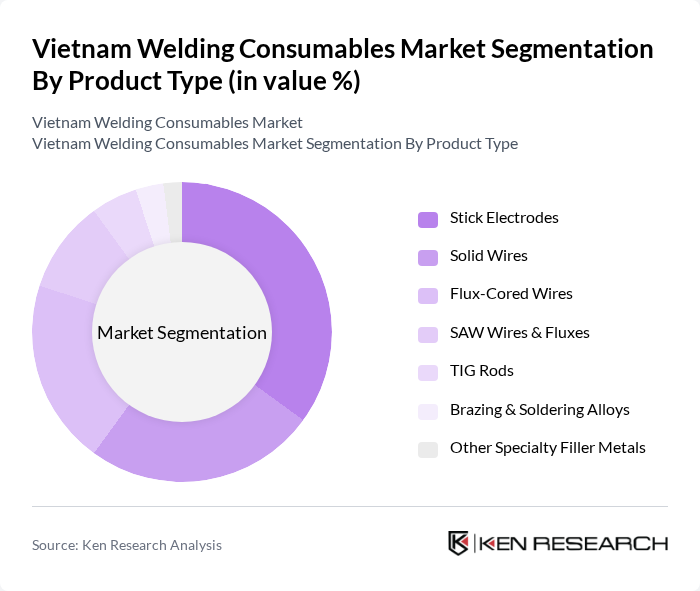

By Product Type:The product type segmentation includes various categories of welding consumables that cater to different welding processes and applications. The dominant sub-segment in this category is Stick Electrodes, which remain widely used due to their versatility, portability, and suitability for outdoor and on-site construction and maintenance welding. Solid Wires and Flux-Cored Wires also hold significant market shares, driven by their higher deposition rates, suitability for semi-automatic and robotic welding, and efficiency in industrial fabrication, automotive, and shipbuilding applications. The demand for these products is influenced by the growing construction, manufacturing, and metal fabrication sectors in Vietnam, which require reliable, high-productivity, and high-performance welding materials tailored to carbon steel, low-alloy steel, and stainless-steel applications.

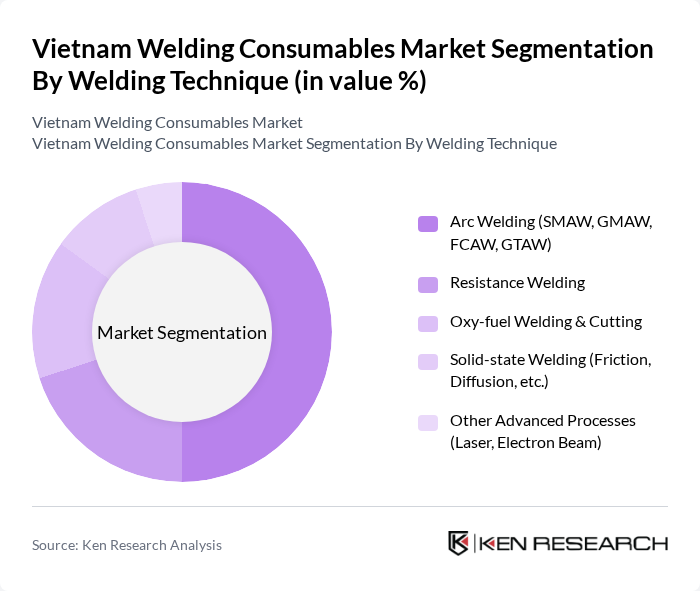

By Welding Technique:The welding technique segmentation encompasses various methods employed in the welding process. Arc Welding, particularly Shielded Metal Arc Welding (SMAW) and Gas Metal Arc Welding (GMAW), dominates this segment due to its widespread application in construction, steel fabrication, shipbuilding, and general manufacturing in Asia-Pacific, including Vietnam. Flux-Cored Arc Welding (FCAW) and Gas Tungsten Arc Welding (GTAW/TIG) are increasingly used where higher productivity or precision and better weld quality are required. Resistance Welding and Oxy-fuel Welding are also significant, catering to specific industrial needs such as automotive body assembly, metal furniture, and on-site cutting and repair. The increasing adoption of advanced welding techniques, such as Laser and Electron Beam welding, is gradually gaining traction in high-value fabrication, electronics, and precision engineering, driven by the demand for tighter tolerances, automation, and improved efficiency in high-tech industries and export-oriented manufacturing.

The Vietnam Welding Consumables Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Lincoln Electric Company (Vietnam operations), ESAB Group (Vietnam operations), Kobe Steel (Kobelco Welding) Vietnam, Voestalpine Böhler Welding (regional presence serving Vietnam), Hyundai Welding Vietnam, Dai Dong Tieng Welding Materials JSC, Kim Tin Group (welding consumables division), Weldcom Industry JSC, Hubei Jiuqiang Welding Material, Hunan Yujing Welding Material, Hubei Huazhong Welding Material, Hunan Jinxin Welding Material, Hubei Yihua Welding Material, Other Notable Regional and Local Players contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam welding consumables market is poised for significant growth, driven by increasing investments in infrastructure and technological advancements. As the government continues to prioritize infrastructure projects, the demand for high-quality welding consumables will rise. Additionally, the integration of automation and digital technologies in manufacturing processes will further enhance efficiency. Companies that adapt to these trends and focus on sustainability will likely capture a larger market share, positioning themselves favorably in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Stick Electrodes Solid Wires Flux-Cored Wires SAW Wires & Fluxes TIG Rods Brazing & Soldering Alloys Other Specialty Filler Metals |

| By Welding Technique | Arc Welding (SMAW, GMAW, FCAW, GTAW) Resistance Welding Oxy-fuel Welding & Cutting Solid-state Welding (Friction, Diffusion, etc.) Other Advanced Processes (Laser, Electron Beam) |

| By End-user Industry | Building & Construction Automotive & Auto Components Shipbuilding & Marine Oil & Gas, Pipeline & Petrochemical Power Generation & Energy (incl. Renewables) Heavy Engineering & General Manufacturing Aerospace & Defense Maintenance, Repair & Overhaul (MRO) Others |

| By Material Type | Carbon Steel Low Alloy & High-strength Steel Stainless Steel Aluminum & Aluminum Alloys Nickel & Nickel Alloys Copper & Copper Alloys Other Alloys & Special Materials |

| By Distribution Channel | Direct Sales to Key Accounts & Projects Industrial Distributors & Dealers Welding Equipment & Tool Retailers E-commerce & Online Channels Others |

| By Region | Northern Vietnam (incl. Hanoi & industrial clusters) Central Vietnam (incl. Da Nang & coastal industrial zones) Southern Vietnam (incl. Ho Chi Minh City & Mekong region) Other Emerging Industrial Provinces |

| By Customer Type | Large Enterprises & EPC Contractors SMEs & Local Fabricators Government & State-owned Enterprises (SOEs) Trading Houses & Stockists Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Welding Consumables | 120 | Production Managers, Quality Control Supervisors |

| Construction Industry Welding Applications | 100 | Site Managers, Project Engineers |

| Automotive Welding Processes | 80 | Manufacturing Engineers, Procurement Specialists |

| Welding Equipment Distributors | 90 | Sales Managers, Product Line Managers |

| Research & Development in Welding Technologies | 60 | R&D Engineers, Technical Directors |

The Vietnam Welding Consumables Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by industrialization and infrastructure development across various sectors, including construction, automotive, and shipbuilding.