Region:Central and South America

Author(s):Dev

Product Code:KRAB3144

Pages:93

Published On:October 2025

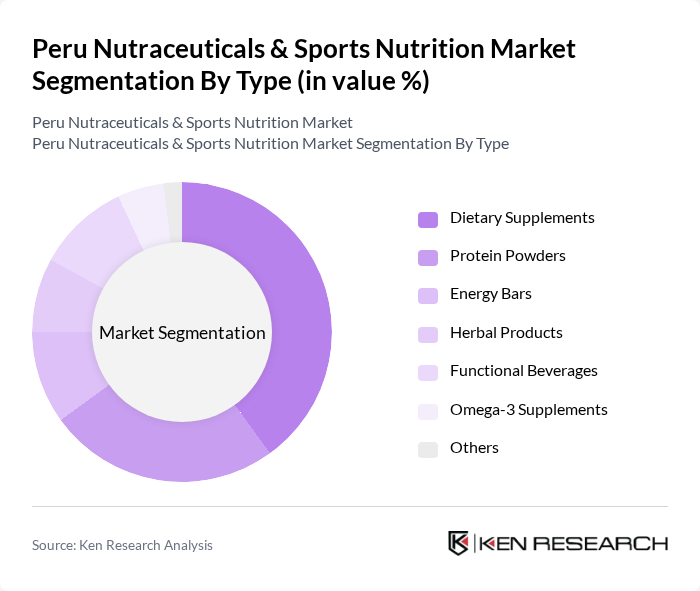

By Type:The market is segmented into various types, including Dietary Supplements, Protein Powders, Energy Bars, Herbal Products, Functional Beverages, Omega-3 Supplements, and Others. Among these, Dietary Supplements are leading the market due to their widespread acceptance and usage among health-conscious consumers. The increasing trend of preventive healthcare and the growing awareness of nutritional benefits are driving the demand for dietary supplements. Protein Powders and Functional Beverages are also gaining traction, particularly among fitness enthusiasts and athletes.

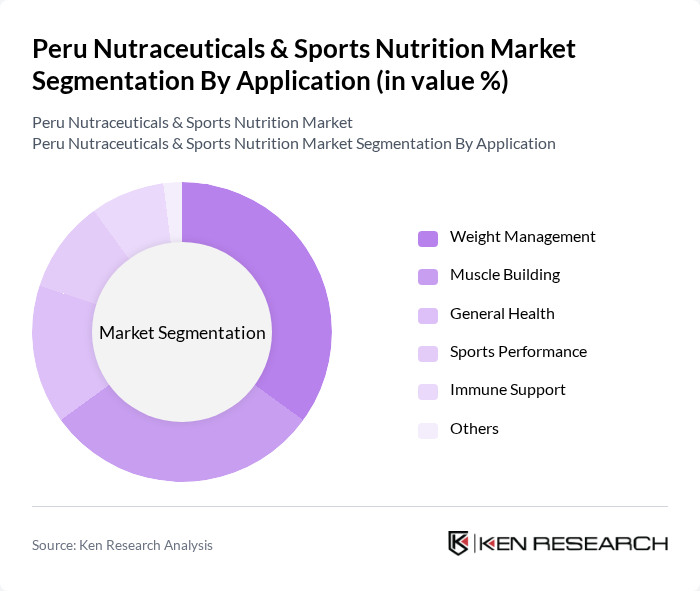

By Application:The applications of nutraceuticals and sports nutrition products include Weight Management, Muscle Building, General Health, Sports Performance, Immune Support, and Others. Weight Management is the leading application segment, driven by the increasing prevalence of obesity and lifestyle-related diseases. Consumers are increasingly seeking products that aid in weight loss and maintenance. Muscle Building and Sports Performance applications are also significant, particularly among athletes and fitness enthusiasts who prioritize protein intake and performance enhancement.

The Peru Nutraceuticals & Sports Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, Inc., Nestlé S.A., Abbott Laboratories, Glanbia plc, USANA Health Sciences, Inc., Nature's Bounty Co., Optimum Nutrition, MusclePharm Corporation, BSN (Bio-Engineered Supplements and Nutrition), EAS (Energy Athletic Supplements), Isagenix International LLC, Garden of Life, LLC, Vega (WhiteWave Services, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Peru nutraceuticals and sports nutrition market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on personalized nutrition is expected to shape product offerings, with companies investing in tailored solutions. Additionally, the integration of technology in product development, such as app-based health tracking, will likely enhance consumer engagement. As health awareness continues to rise, the market is poised for sustained growth, presenting opportunities for innovation and expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Dietary Supplements Protein Powders Energy Bars Herbal Products Functional Beverages Omega-3 Supplements Others |

| By Application | Weight Management Muscle Building General Health Sports Performance Immune Support Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Food Stores Pharmacies Direct Sales Others |

| By Consumer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Gender (Male, Female) Income Level (Low, Middle, High) |

| By Packaging Type | Bottles Sachets Tubs Pouches |

| By Brand Positioning | Premium Brands Mid-Range Brands Budget Brands |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutraceutical Retailers | 100 | Store Managers, Product Buyers |

| Fitness Centers and Gyms | 80 | Gym Owners, Personal Trainers |

| Health Food Manufacturers | 70 | Product Development Managers, Marketing Directors |

| Consumers of Sports Nutrition Products | 150 | Health Enthusiasts, Athletes |

| Healthcare Professionals | 60 | Nutritionists, Dietitians |

The Peru Nutraceuticals & Sports Nutrition Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health consciousness, fitness activities, and the rising popularity of dietary supplements among consumers.