Region:Middle East

Author(s):Shubham

Product Code:KRAD0977

Pages:98

Published On:November 2025

By Type:The dietary supplements market can be segmented into various types, including vitamins, minerals, herbal supplements, protein & amino acid supplements, omega fatty acids, probiotics & prebiotics, fibers & specialty carbohydrates, and others. Among these, vitamins and herbal supplements are particularly popular due to their perceived health benefits and natural origins. The increasing awareness of health and wellness, as well as the demand for clean-label and scientifically-backed products, has led to a surge in demand for these products, making them the leading segments in the market .

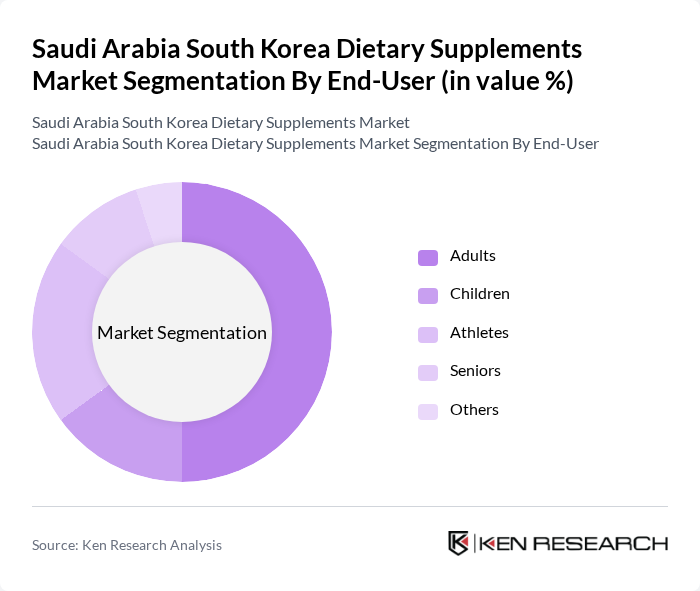

By End-User:The market can also be segmented based on end-users, which include adults, children, athletes, seniors, and others. Adults represent the largest segment, driven by a growing focus on health and wellness, while athletes seek supplements to enhance performance and recovery. The increasing awareness of nutritional needs among different age groups has led to a diversified product offering tailored to specific consumer needs .

The Saudi Arabia South Korea Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, Inc., CJ CheilJedang Corp., Chong Kun Dang Healthcare, Korea Eundan Co., Ltd., NutraQ (NutraQ AS), Abbott Laboratories, Blackmores Limited, Nature's Bounty Co., USANA Health Sciences, Inc., Swisse Wellness Pty Ltd., NOW Foods, Solgar Inc., Garden of Life, LLC, MegaFood, Nature Made, Jarrow Formulas, Inc., Samyang Corporation, Daesang Life Science, Nature Republic Co., Ltd., Pharmavite LLC, Nutraxin (Bionorica SE), Vitabiotics Ltd., Jamjoom Pharma (Saudi Arabia), Tabuk Pharmaceuticals Manufacturing Co., SPIMACO (Saudi Pharmaceutical Industries & Medical Appliances Corporation), Julphar Gulf Pharmaceutical Industries, Pfizer Inc., Bayer AG contribute to innovation, geographic expansion, and service delivery in this space.

The dietary supplements market in Saudi Arabia and South Korea is poised for significant evolution, driven by technological advancements and changing consumer preferences. As personalization becomes a key trend, companies are expected to invest in tailored products that meet individual health needs. Furthermore, the integration of digital health solutions will enhance consumer engagement, allowing for more informed purchasing decisions. This dynamic landscape will likely foster innovation and create new avenues for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein & Amino Acid Supplements Omega Fatty Acids Probiotics & Prebiotics Fibers & Specialty Carbohydrates Others |

| By End-User | Adults Children Athletes Seniors Others |

| By Distribution Channel | Online Retail (e.g., Coupang, Naver Shopping, Noon, Amazon.sa) Supermarkets/Hypermarkets Pharmacies Health & Specialty Stores Department Stores Others |

| By Formulation | Tablets Capsules Powders Liquids Gummies Others |

| By Age Group | Children (0-12 years) Adolescents (13-19 years) Adults (20-59 years) Seniors (60+ years) Others |

| By Region | Central Region (Riyadh, Seoul) Eastern Region (Dammam, Busan) Western Region (Jeddah, Incheon) Southern Region Others |

| By Consumer Preference | Organic Supplements Non-GMO Supplements Gluten-Free Supplements Vegan Supplements Locally Sourced Ingredients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Healthcare Professional Interviews | 80 | Dietitians, General Practitioners |

| Distributor Feedback | 60 | Supply Chain Managers, Product Managers |

| Market Trend Analysis | 40 | Market Analysts, Industry Experts |

The Saudi Arabia South Korea Dietary Supplements Market is valued at approximately USD 4.4 billion, reflecting significant growth driven by increasing health consciousness and preventive healthcare trends among consumers in both regions.