Region:Asia

Author(s):Geetanshi

Product Code:KRAD1090

Pages:99

Published On:November 2025

By Type:The airway management devices market is segmented into Endotracheal Tubes, Laryngeal Masks, Supraglottic Airway Devices, Oropharyngeal Airways, Nasopharyngeal Airways, Suction Devices, Bag-Valve-Mask Devices, and Others. Endotracheal Tubes remain the most widely used due to their essential role in airway protection during surgeries and emergencies. The growing volume of surgical interventions and increasing incidence of respiratory conditions such as pneumonia and chronic obstructive pulmonary disease are key drivers for these devices.

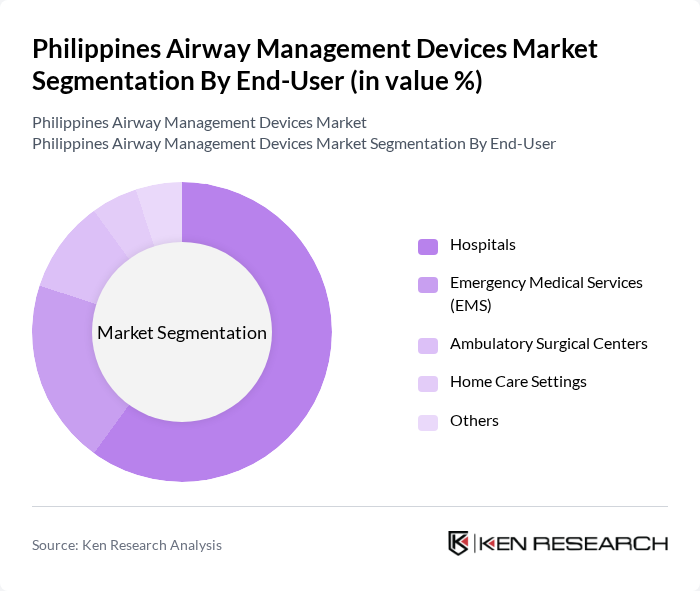

By End-User:The market is segmented by end-users into Hospitals, Emergency Medical Services (EMS), Ambulatory Surgical Centers, Home Care Settings, and Others. Hospitals are the leading end-users, accounting for the majority of airway management device utilization due to their central role in surgical, emergency, and intensive care procedures. The continuous expansion of hospital infrastructure and the rising number of healthcare facilities in the Philippines further accelerate demand for airway management devices.

The Philippines Airway Management Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Medtronic, Smiths Medical (now part of ICU Medical), Teleflex Incorporated, Ambu A/S, GE Healthcare, Becton, Dickinson and Company (BD), Fisher & Paykel Healthcare, Vyaire Medical, Halyard Health (now part of Owens & Minor), ZOLL Medical Corporation, 3M Health Care, Medline Industries, ConvaTec Group PLC, Cardinal Health, Draegerwerk AG & Co. KGaA, Mindray Medical International, LMA Philippines Inc., Metro Drug Inc., United Laboratories (Unilab) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the airway management devices market in the Philippines appears promising, driven by ongoing technological innovations and a growing emphasis on patient-centered care. As healthcare providers increasingly adopt telemedicine and remote monitoring solutions, the integration of advanced airway management devices will likely enhance patient outcomes. Additionally, collaborations with international healthcare organizations are expected to facilitate knowledge transfer and improve training programs, ultimately addressing the current workforce shortages and enhancing the overall quality of care in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Endotracheal Tubes Laryngeal Masks Supraglottic Airway Devices Oropharyngeal Airways Nasopharyngeal Airways Suction Devices Bag-Valve-Mask Devices Others |

| By End-User | Hospitals Emergency Medical Services (EMS) Ambulatory Surgical Centers Home Care Settings Others |

| By Application | Emergency Care Anesthesia Critical Care Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Region | Luzon Visayas Mindanao |

| By Device Features | Disposable Devices Reusable Devices Smart/Connected Devices Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Airway Management Practices | 100 | Respiratory Therapists, Anesthesiologists |

| Device Procurement Strategies | 80 | Procurement Managers, Supply Chain Managers |

| Emergency Care Device Utilization | 70 | Emergency Room Physicians, Paramedics |

| Clinical Trials and Research Studies | 50 | Clinical Researchers, Medical Device Researchers |

| Market Trends and Innovations | 90 | Healthcare Analysts, Medical Device Sales Representatives |

The Philippines Airway Management Devices Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by the increasing prevalence of respiratory diseases and the adoption of advanced airway management technologies.