Region:Asia

Author(s):Geetanshi

Product Code:KRAD6043

Pages:95

Published On:December 2025

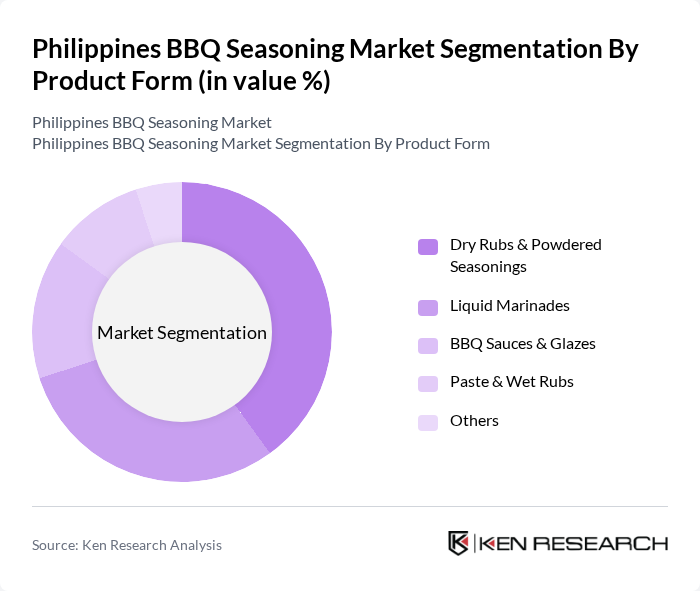

By Product Form:The BBQ seasoning market can be segmented into various product forms, including dry rubs & powdered seasonings, liquid marinades, BBQ sauces & glazes, paste & wet rubs, and others. Among these, dry rubs & powdered seasonings are particularly popular due to their convenience and versatility in enhancing the flavor of grilled meats. Liquid marinades also hold a significant share as they provide moisture and flavor infusion, appealing to consumers looking for easy-to-use options.

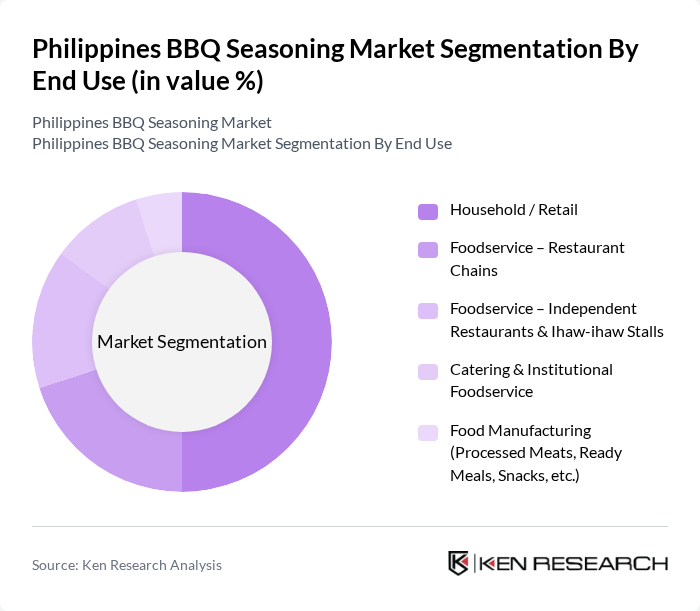

By End Use:The market is also segmented by end use, which includes household/retail, foodservice – restaurant chains, foodservice – independent restaurants & ihaw-ihaw stalls, catering & institutional foodservice, and food manufacturing (processed meats, ready meals, snacks, etc.). The household/retail segment is the largest, driven by the growing trend of home cooking and grilling among Filipino families. Foodservice segments are also significant, particularly independent restaurants and ihaw-ihaw stalls, which are integral to Filipino dining culture.

The Philippines BBQ Seasoning Market is characterized by a dynamic mix of regional and international players. Leading participants such as McCormick Philippines, Inc. (McCormick & Company), Unilever Philippines, Inc. (Knorr, Lady’s Choice), Nestlé Philippines, Inc. (Maggi), Mama Sita’s (Marigold Manufacturing Corporation), NutriAsia, Inc. (Datu Puti, UFC, Golden Fiesta), San Miguel Foods, Inc. (Magnolia, Purefoods), CDO Foodsphere, Inc., Del Monte Philippines, Inc., Kikkoman Corporation (Philippines), Ajinomoto Philippines Corporation, Lee Kum Kee (Philippines), Mama Nems Barbecue Marinade & Sauce (Local Brand), Barrio Fiesta Manufacturing Corporation, Philippine Foodservice Equipment & Supplies / Private Label Seasoning Suppliers, Emerging Local Artisanal BBQ Seasoning Brands (SME Segment) contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines BBQ seasoning market is poised for dynamic growth, driven by evolving consumer preferences towards convenience and health-conscious options. As the trend of home cooking continues to rise, particularly among millennials, there is an increasing demand for ready-to-use and organic seasonings. Additionally, the expansion of e-commerce platforms is expected to enhance product accessibility, allowing brands to reach a broader audience and cater to diverse culinary tastes, further stimulating market growth.

| Segment | Sub-Segments |

|---|---|

| By Product Form | Dry Rubs & Powdered Seasonings Liquid Marinades BBQ Sauces & Glazes Paste & Wet Rubs Others |

| By End Use | Household / Retail Foodservice – Restaurant Chains Foodservice – Independent Restaurants & Ihaw-ihaw Stalls Catering & Institutional Foodservice Food Manufacturing (Processed Meats, Ready Meals, Snacks, etc.) |

| By Packaging Type | Bottles & Shakers Sachets & Pouches Jars & Tubs Bulk / Foodservice Packs Others |

| By Distribution Channel | Supermarkets / Hypermarkets Convenience Stores & Sari-sari Stores Grocery & Specialty Stores Online Retail & Marketplaces Direct to Foodservice / HoReCa |

| By Flavor Profile | Spicy / Chili-based Sweet & Honey-based Savory / Umami-rich Smoky & Char-grilled Filipino-inspired (Adobo, Inihaw, Sinigang, etc.) |

| By Region | Luzon Visayas Mindanao |

| By Price Range | Premium Mid-range Economy Private Label / Value Packs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 150 | BBQ Enthusiasts, Home Cooks |

| Food Service Sector Analysis | 100 | Restaurant Owners, Chefs |

| Distribution Channel Feedback | 80 | Wholesalers, Distributors |

| Market Trend Evaluation | 90 | Food Industry Analysts, Market Researchers |

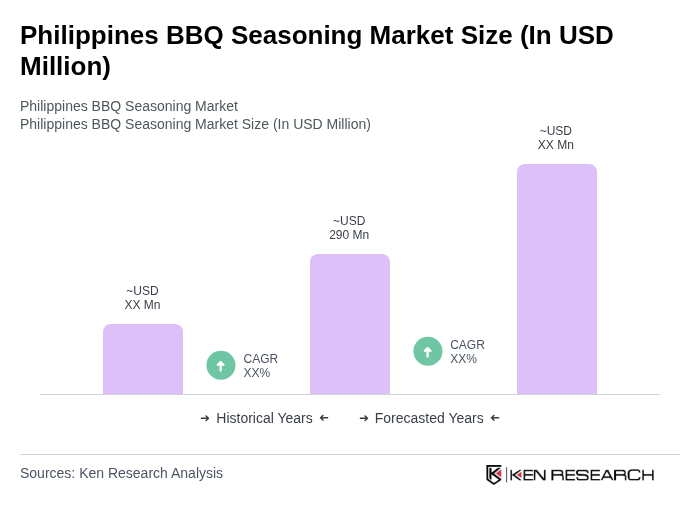

The Philippines BBQ seasoning market is valued at approximately USD 290 million, reflecting a growing trend in grilling and outdoor cooking, as well as an increasing demand for diverse and bold flavors among consumers.