Region:Asia

Author(s):Rebecca

Product Code:KRAB5268

Pages:84

Published On:October 2025

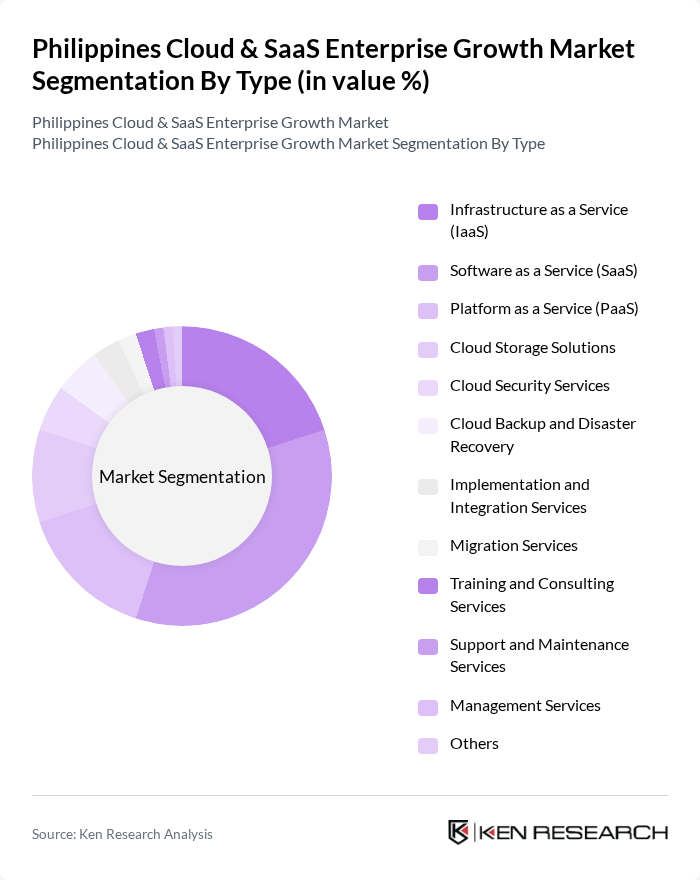

By Type:The market is segmented into various types, including Infrastructure as a Service (IaaS), Software as a Service (SaaS), Platform as a Service (PaaS), Cloud Storage Solutions, Cloud Security Services, Cloud Backup and Disaster Recovery, Implementation and Integration Services, Migration Services, Training and Consulting Services, Support and Maintenance Services, Management Services, and Others. These segments address a wide range of business needs, from scalable infrastructure and application delivery to advanced security, compliance, and operational management. SaaS remains the largest segment, driven by demand for subscription-based software, while data storage and backup solutions are experiencing rapid growth due to increased digitalization and regulatory requirements .

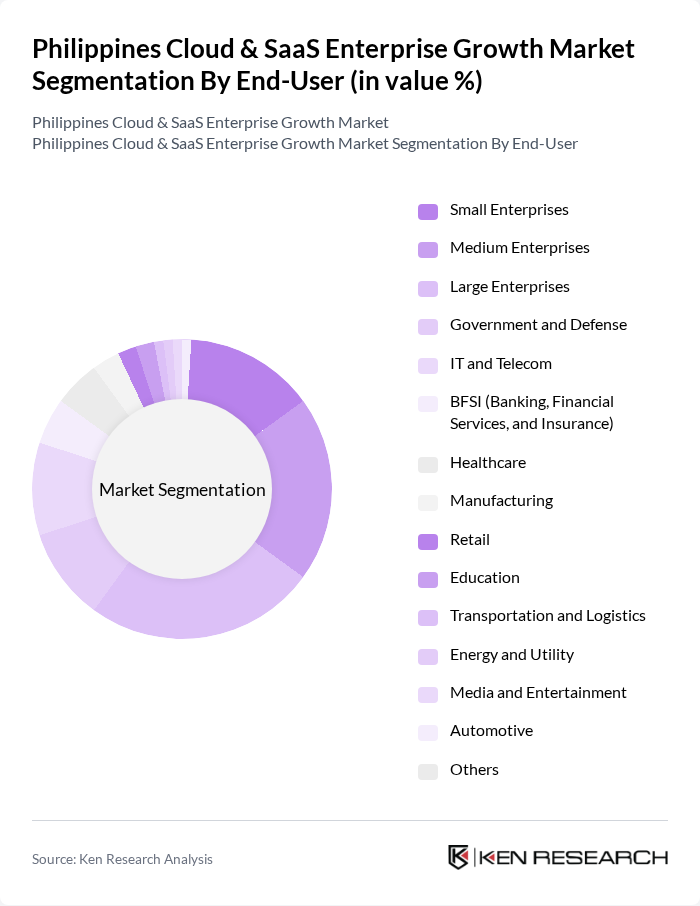

By End-User:The end-user segmentation includes Small Enterprises, Medium Enterprises, Large Enterprises, Government and Defense, IT and Telecom, BFSI (Banking, Financial Services, and Insurance), Healthcare, Manufacturing, Retail, Education, Transportation and Logistics, Energy and Utility, Media and Entertainment, Automotive, and Others. Cloud and SaaS solutions are widely adopted across these sectors to enhance operational efficiency, ensure regulatory compliance, and support digital transformation. Large enterprises and government agencies are leading adopters, while small and medium enterprises increasingly utilize cloud services for scalability and cost management .

The Philippines Cloud & SaaS Enterprise Growth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation, Amazon Web Services, Inc., Google Cloud Platform, IBM Corporation, Oracle Corporation, Salesforce.com, Inc., SAP SE, Cisco Systems, Inc., Alibaba Cloud, DigitalOcean, Inc., Rackspace Technology, Inc., Zoho Corporation, Freshworks Inc., HubSpot, Inc., Veeam Software, Globe Telecom, Inc., PLDT Enterprise (Philippine Long Distance Telephone Company), ePLDT, Inc., Pointwest Technologies Corporation, Yondu, Inc., Exist Software Labs, Inc., Stratpoint Technologies, Inc., CloudSwyft Global Systems, Inc., Sprout Solutions, Dragonpay Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Cloud & SaaS market in the Philippines appears promising, driven by ongoing digital transformation and increased internet connectivity. As businesses continue to embrace remote work and digital solutions, the demand for cloud services is expected to rise significantly. Furthermore, government initiatives aimed at enhancing digital infrastructure and promoting technology adoption will likely create a conducive environment for growth. The focus on cybersecurity and data privacy will also shape the market landscape, ensuring that businesses can operate securely in a digital-first world.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure as a Service (IaaS) Software as a Service (SaaS) Platform as a Service (PaaS) Cloud Storage Solutions Cloud Security Services Cloud Backup and Disaster Recovery Implementation and Integration Services Migration Services Training and Consulting Services Support and Maintenance Services Management Services Others |

| By End-User | Small Enterprises Medium Enterprises Large Enterprises Government and Defense IT and Telecom BFSI (Banking, Financial Services, and Insurance) Healthcare Manufacturing Retail Education Transportations and Logistics Energy and Utility Media and Entertainment Automotive Others |

| By Application | Data Storage and Backup Big Data Analytics Web Hosting and Development Content Delivery Networks (CDNs) Online Gaming and Streaming Video Conferencing and Collaboration Tools Internet of Things (IoT) Artificial Intelligence and Machine Learning Virtual Desktop Infrastructure (VDI) Disaster Recovery and Business Continuity Scientific Research and Simulations Customer Relationship Management (CRM) Enterprise Resource Planning (ERP) Human Resource Management (HRM) Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Community Cloud |

| By Industry Vertical | Information Technology Retail Manufacturing Telecommunications Transportation and Logistics Healthcare BFSI Education Government and Defense Energy and Utility Media and Entertainment Automotive Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing Freemium Model Others |

| By Service Level Agreement (SLA) | Standard SLA Premium SLA Customized SLA Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Large Enterprises in Finance | 60 | IT Managers, Chief Technology Officers |

| Healthcare Providers | 50 | Healthcare IT Directors, Operations Managers |

| Retail Sector SaaS Adoption | 40 | eCommerce Managers, IT Directors |

| SMEs Across Various Industries | 70 | Business Owners, IT Consultants |

| Government Agencies Utilizing Cloud Solutions | 40 | IT Officers, Digital Transformation Leads |

The Philippines Cloud & SaaS Enterprise Growth Market is valued at approximately USD 3.2 billion, reflecting significant growth driven by digital transformation initiatives, remote work trends, and the demand for scalable IT solutions across various sectors.