Region:Middle East

Author(s):Rebecca

Product Code:KRAB0844

Pages:99

Published On:December 2025

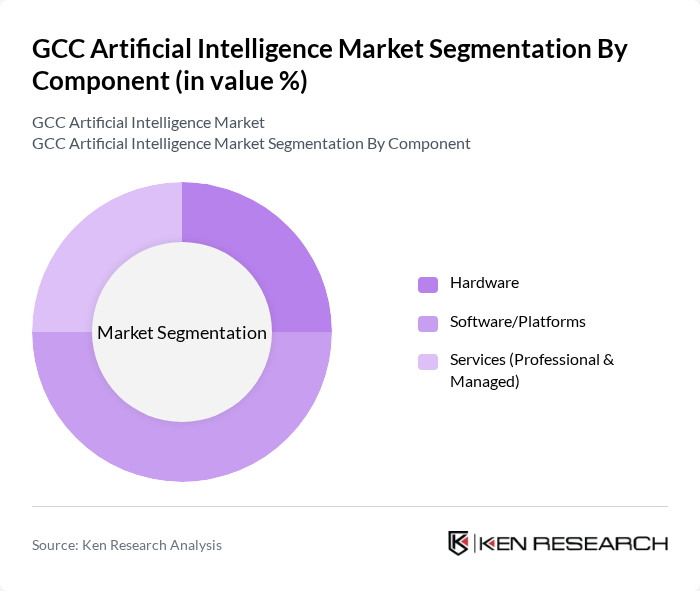

By Component:The GCC Artificial Intelligence Market is segmented into three main components: Hardware, Software/Platforms, and Services (Professional & Managed). Among these, the Software/Platforms segment is currently dominating the market due to the increasing demand for AI applications across various industries. Businesses are increasingly investing in software solutions that leverage AI for enhanced operational efficiency and customer engagement. The growing trend of digital transformation and the need for data-driven decision-making are further propelling the growth of this segment.

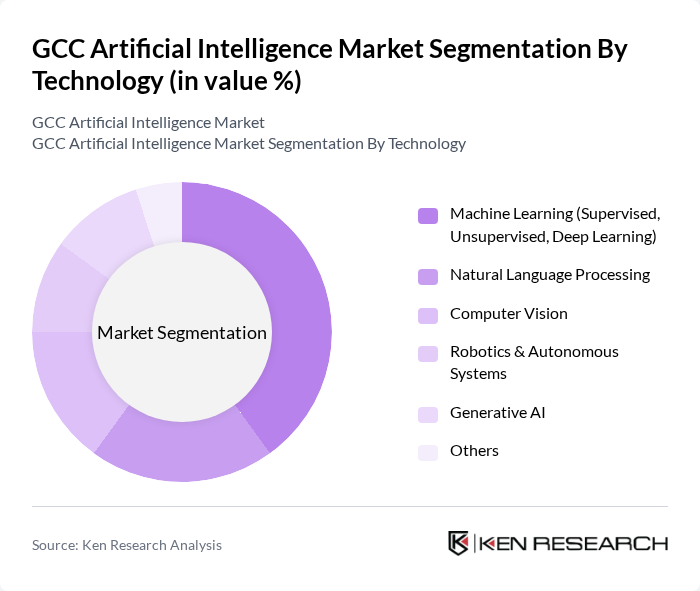

By Technology:The market is also segmented by technology, which includes Machine Learning (Supervised, Unsupervised, Deep Learning), Natural Language Processing, Computer Vision, Robotics & Autonomous Systems, Generative AI, and Others. Machine Learning is the leading technology segment, driven by its wide-ranging applications in predictive analytics, customer service automation, and operational efficiency. The increasing availability of data and advancements in algorithms are further enhancing the adoption of machine learning technologies across various sectors.

The GCC Artificial Intelligence Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accubits Technologies, Amazon Web Services (AWS), Microsoft Corporation, Google LLC (Google Cloud), IBM Corporation, NVIDIA Corporation, Oracle Corporation, SAP Middle East & North Africa LLC, Siemens Middle East Limited, Intel Corporation, Qualcomm Incorporated, Samsung Electronics Co. Ltd, Salesforce Inc., Palantir Technologies, DataRobot contribute to innovation, geographic expansion, and service delivery in this space.

The GCC Artificial Intelligence market is poised for transformative growth driven by strategic investments and technological advancements. With initiatives like Abu Dhabi's Digital Strategy allocating AED 15 billion (USD 4.08 billion) for digital infrastructure, the region is enhancing its AI capabilities. Additionally, the integration of AI in sectors such as energy and healthcare is expected to revolutionize operations, leading to increased productivity and efficiency. As the market matures, collaboration between public and private sectors will be essential for overcoming existing challenges and maximizing opportunities.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware Software/Platforms Services (Professional & Managed) |

| By Technology | Machine Learning (Supervised, Unsupervised, Deep Learning) Natural Language Processing Computer Vision Robotics & Autonomous Systems Generative AI Others |

| By Application | Customer Experience & Virtual Assistants Predictive Analytics & Forecasting Fraud Detection & Risk Management Operations & Process Automation Smart Infrastructure & Smart City Solutions Healthcare Diagnostics & Clinical Decision Support Others |

| By End-Use Industry | BFSI Government & Public Sector Healthcare & Life Sciences Retail & E-commerce Manufacturing & Industrial Transportation & Logistics Energy & Utilities Telecom & IT Education Others |

| By Deployment Mode | Cloud On-Premises Hybrid |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Country | United Arab Emirates Saudi Arabia Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare AI Solutions | 120 | Healthcare IT Managers, Clinical Data Analysts |

| Financial Services AI Applications | 100 | Risk Management Officers, Financial Analysts |

| Retail AI Implementation | 90 | Retail Operations Managers, E-commerce Directors |

| Manufacturing AI Integration | 80 | Production Managers, Supply Chain Analysts |

| Telecommunications AI Innovations | 110 | Network Engineers, Product Development Managers |

The GCC Artificial Intelligence Market is valued at approximately USD 5.4 billion. This valuation reflects the region's growing digital infrastructure, cloud migration, and increasing adoption of AI-powered services across various sectors, particularly healthcare and finance.