Region:Asia

Author(s):Dev

Product Code:KRAB5476

Pages:87

Published On:October 2025

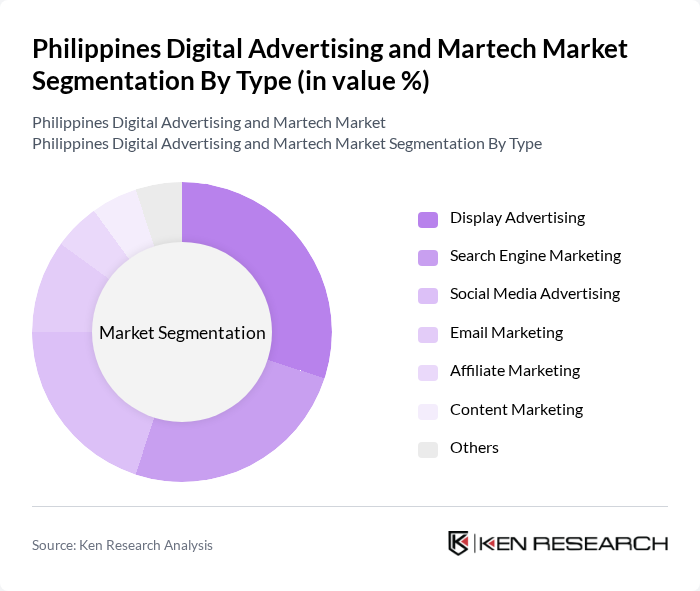

By Type:The digital advertising landscape in the Philippines is diverse, encompassing various types of advertising strategies. Display Advertising, Search Engine Marketing, and Social Media Advertising are among the most prominent types, driven by the increasing use of digital platforms. Display Advertising captures consumer attention through visual content, while Search Engine Marketing focuses on optimizing visibility in search results. Social Media Advertising leverages the vast user base of platforms like Facebook and Instagram, making it a preferred choice for brands aiming to engage with their audience effectively. Email Marketing, Affiliate Marketing, and Content Marketing also play significant roles, catering to different marketing needs and consumer preferences.

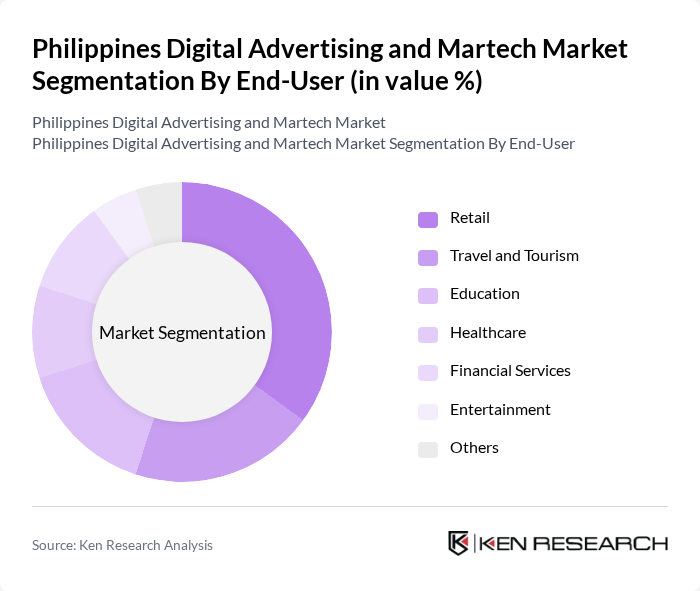

By End-User:The end-user segmentation of the digital advertising market in the Philippines reveals a variety of industries leveraging digital marketing strategies. The Retail sector leads the way, driven by the rapid growth of e-commerce and online shopping. Travel and Tourism also significantly contribute, as businesses in this sector utilize digital advertising to attract customers. Education, Healthcare, Financial Services, and Entertainment are other key sectors, each employing tailored digital marketing strategies to reach their target audiences effectively. The increasing digital literacy among consumers has further propelled the adoption of digital advertising across these industries.

The Philippines Digital Advertising and Martech Market is characterized by a dynamic mix of regional and international players. Leading participants such as AdSpark, Inquirer.net, GMA Network Inc., ABS-CBN Corporation, Globe Telecom, Smart Communications, Facebook Philippines, Google Philippines, Viber Media S.A., TikTok Philippines, Grab Philippines, Lazada Philippines, Shopee Philippines, Unilab, PLDT Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines digital advertising and martech market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As brands increasingly adopt data analytics and artificial intelligence, personalized marketing strategies will become more prevalent. Additionally, the integration of augmented reality in advertising campaigns is expected to enhance user engagement. With the government focusing on improving digital infrastructure, the market is likely to witness accelerated growth, fostering innovation and expanding opportunities for businesses in the digital space.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Email Marketing Affiliate Marketing Content Marketing Others |

| By End-User | Retail Travel and Tourism Education Healthcare Financial Services Entertainment Others |

| By Industry Vertical | FMCG Automotive Technology Real Estate Telecommunications Others |

| By Sales Channel | Direct Sales Online Platforms Agencies Resellers Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Product Launch Campaigns Seasonal Campaigns Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Geographic Targeting Contextual Targeting Others |

| By Budget Size | Small Budget (< PHP 50,000) Medium Budget (PHP 50,000 - PHP 500,000) Large Budget (> PHP 500,000) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 100 | Agency Owners, Account Managers |

| Brand Marketing Teams | 80 | Brand Managers, Digital Marketing Specialists |

| Consumer Insights | 120 | Marketing Analysts, Research Directors |

| Media Buying Firms | 70 | Media Planners, Buying Executives |

| Technology Providers in Martech | 60 | Product Managers, Sales Directors |

The Philippines Digital Advertising and Martech Market is valued at approximately USD 1.5 billion, driven by increased internet penetration, mobile device usage, and a shift in consumer behavior towards digital platforms for shopping and information.