Region:Europe

Author(s):Geetanshi

Product Code:KRAA5002

Pages:80

Published On:September 2025

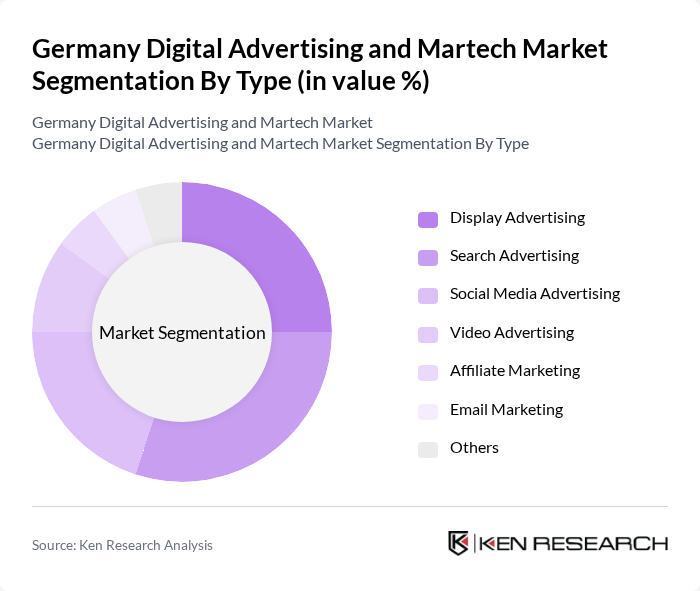

By Type:The digital advertising market in Germany is segmented into various types, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Affiliate Marketing, Email Marketing, and Others. Each of these segments plays a crucial role in the overall market dynamics, catering to different advertising needs and consumer behaviors.

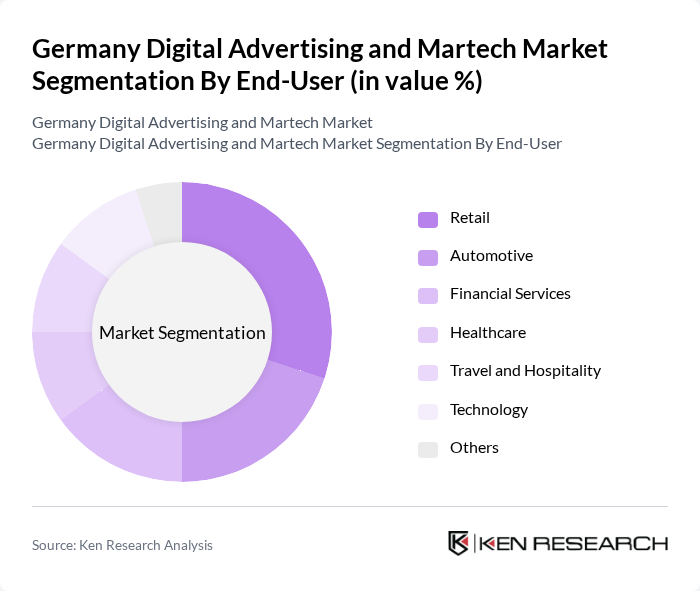

By End-User:The end-user segmentation of the digital advertising market includes Retail, Automotive, Financial Services, Healthcare, Travel and Hospitality, Technology, and Others. Each sector utilizes digital advertising differently, reflecting their unique marketing strategies and target audiences.

The Germany Digital Advertising and Martech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google Germany GmbH, Facebook Germany GmbH, Amazon Advertising Germany, Adform A/S, Criteo S.A., Adobe Systems GmbH, HubSpot, Inc., Salesforce.com, Inc., SAP SE, Ströer SE & Co. KGaA, eBay Advertising, XING SE, LinkedIn Corporation, Outbrain Inc., Taboola.com contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital advertising and martech market in Germany appears promising, driven by technological advancements and evolving consumer behaviors. As businesses increasingly adopt omnichannel marketing strategies, the integration of AI and machine learning will enhance targeting and personalization efforts. Additionally, the growing emphasis on sustainability in advertising practices will shape brand strategies, as consumers demand more ethical and environmentally friendly approaches. These trends will likely foster innovation and create new opportunities for growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Affiliate Marketing Email Marketing Others |

| By End-User | Retail Automotive Financial Services Healthcare Travel and Hospitality Technology Others |

| By Sales Channel | Direct Sales Online Sales Agency Partnerships Reseller Partnerships Others |

| By Advertising Format | Native Advertising Sponsored Content Programmatic Advertising Retargeting Ads Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Geographic Targeting Others |

| By Campaign Objective | Brand Awareness Lead Generation Customer Retention Sales Conversion Others |

| By Industry Vertical | Consumer Goods Telecommunications Education Real Estate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 100 | Agency Owners, Account Managers |

| Brand Marketing Teams | 80 | Marketing Directors, Brand Managers |

| Martech Solution Providers | 60 | Product Managers, Sales Executives |

| Consumer Insights and Analytics | 70 | Data Analysts, Market Researchers |

| Regulatory Bodies and Industry Associations | 50 | Policy Makers, Compliance Officers |

The Germany Digital Advertising and Martech Market is valued at approximately USD 15 billion, reflecting significant growth driven by increased digital platform adoption, e-commerce expansion, and the importance of data analytics in marketing strategies.