Region:Asia

Author(s):Geetanshi

Product Code:KRAA3720

Pages:82

Published On:September 2025

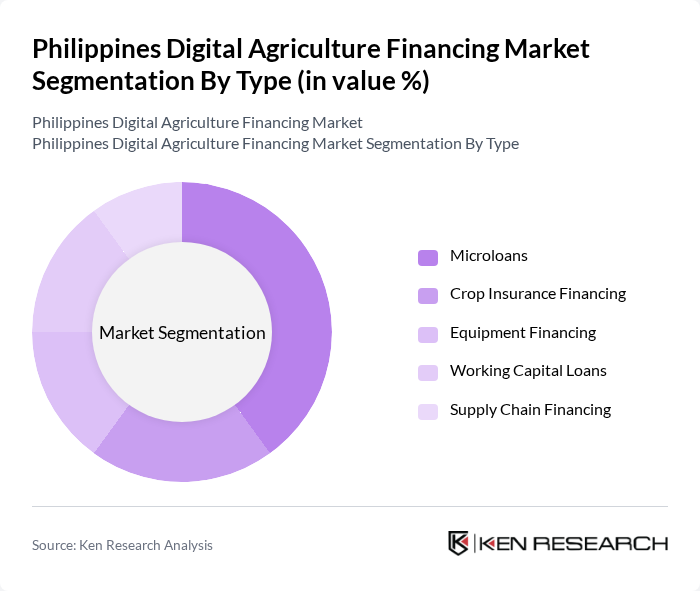

By Type:The market is segmented into various financing options tailored to the agricultural sector's diverse requirements. Subsegments includeMicroloans, Crop Insurance Financing, Equipment Financing, Working Capital Loans, and Supply Chain Financing. Microloans are the leading subsegment, driven by the proliferation of digital lending platforms and mobile-based credit solutions that provide smallholder farmers with rapid, flexible access to funds for inputs, technology, and operational needs. The growth of crop insurance financing is also notable, as digital platforms increasingly enable bundled insurance and credit products for risk mitigation.

By End-User:End-user segments includeSmallholder Farmers, Agricultural Cooperatives, Agribusiness Enterprises, and Agri-Fintech Startups. Smallholder farmers constitute the largest segment, reflecting their critical role in the Philippine agricultural landscape and their increasing reliance on digital platforms for credit and financial services. Agricultural cooperatives are also significant, leveraging collective bargaining and digital tools to facilitate financing and resource pooling for their members.

The Philippines Digital Agriculture Financing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Land Bank of the Philippines, Philippine Crop Insurance Corporation, RCBC (Rizal Commercial Banking Corporation), BPI (Bank of the Philippine Islands), UnionBank of the Philippines, EastWest Banking Corporation, Agribusiness Rural Bank, Inc., Fuse Lending, Inc. (GCash), Kiva Philippines, SeedIn Technology Inc., Cropital Enterprises Corporation, AgriDigital PH, GCash, Maya Bank, Inc., and ACDI/VOCA Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines digital agriculture financing market appears promising, driven by technological advancements and increasing government support. The integration of mobile-based financing solutions is expected to enhance accessibility for farmers, particularly in underserved regions. Additionally, partnerships with agri-tech startups will likely foster innovation, creating tailored financial products that meet the unique needs of farmers. These trends indicate a shift towards a more inclusive and efficient agricultural financing landscape, benefiting both farmers and investors.

| Segment | Sub-Segments |

|---|---|

| By Type | Microloans Crop Insurance Financing Equipment Financing Working Capital Loans Supply Chain Financing |

| By End-User | Smallholder Farmers Agricultural Cooperatives Agribusiness Enterprises Agri-Fintech Startups |

| By Investment Source | Private Investors Government Grants International Aid Crowdfunding Platforms |

| By Application | Crop Production Financing Livestock Financing Aquaculture Financing Agroforestry Financing |

| By Distribution Channel | Direct Lending Platforms Mobile Applications Financial Institutions NGOs and Cooperatives |

| By Policy Support | Subsidized Interest Rates Loan Guarantees Tax Incentives Capacity Building Programs |

| By Risk Assessment Methodology | Traditional Credit Scoring Alternative Data Analysis (e.g., Mobile Usage, Farm Data) Peer-to-Peer Lending Models Digital Identity Verification |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smallholder Farmers | 120 | Farm Owners, Agricultural Cooperatives |

| Agri-tech Startups | 60 | Founders, Product Managers |

| Financial Institutions | 40 | Loan Officers, Risk Assessment Managers |

| Government Agencies | 40 | Policy Makers, Program Directors |

| Industry Experts | 40 | Consultants, Academic Researchers |

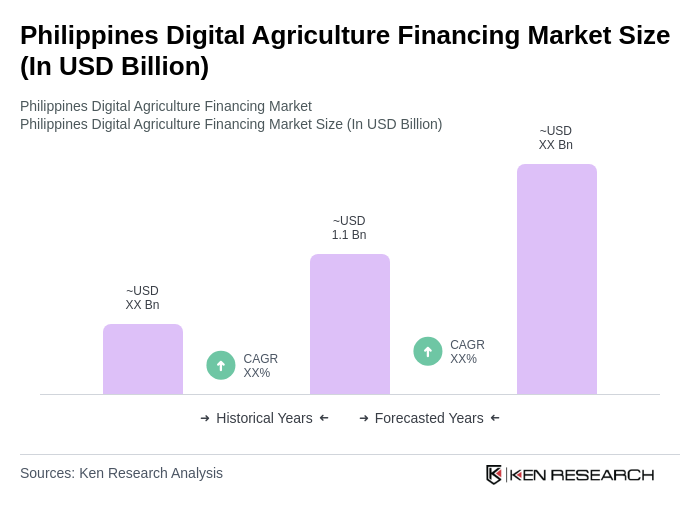

The Philippines Digital Agriculture Financing Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of digital technologies among rural farmers and government initiatives aimed at enhancing agricultural financing.