Region:Middle East

Author(s):Rebecca

Product Code:KRAC4717

Pages:83

Published On:October 2025

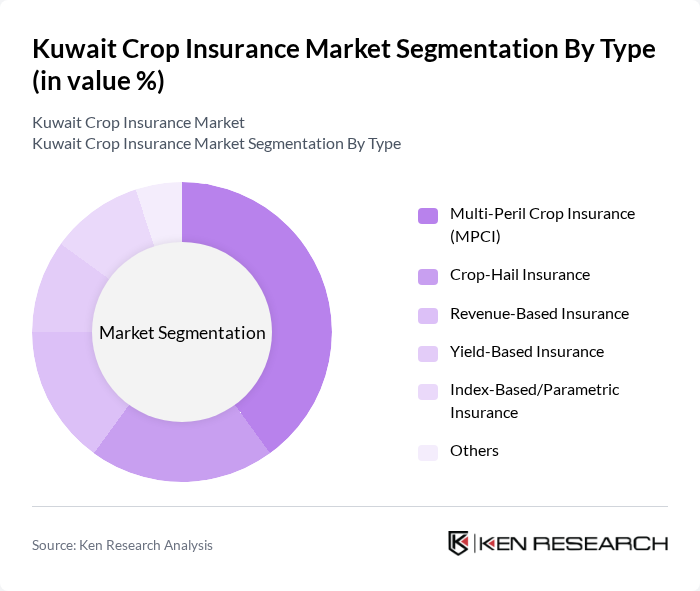

By Type:The market is segmented into various types of crop insurance products, including Multi-Peril Crop Insurance (MPCI), Crop-Hail Insurance, Revenue-Based Insurance, Yield-Based Insurance, Index-Based/Parametric Insurance, and Others. Each of these products caters to different risk management needs of farmers and agricultural enterprises, with MPCI being the most widely adopted due to its comprehensive coverage against multiple risks. Index-based and parametric insurance products are gaining traction, driven by their efficiency in claims processing and suitability for weather-related risks .

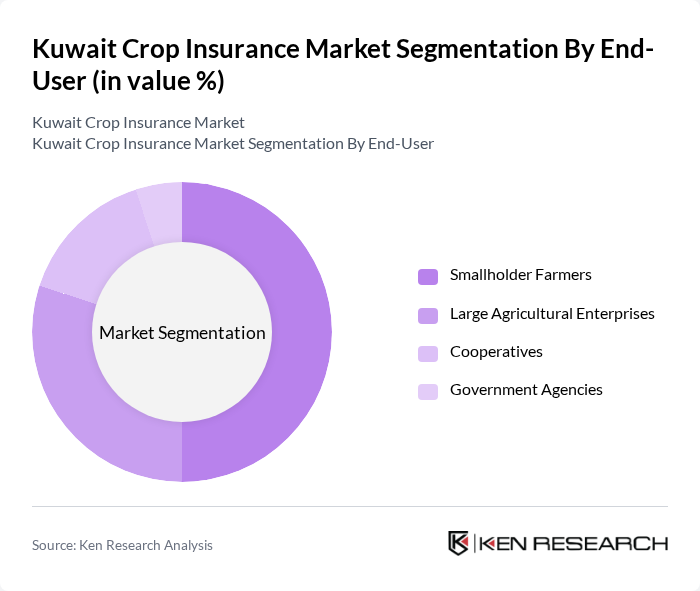

By End-User:The end-user segmentation includes Smallholder Farmers, Large Agricultural Enterprises, Cooperatives, and Government Agencies. Each segment has distinct needs and preferences regarding crop insurance products, influencing their purchasing decisions. Smallholder farmers represent the largest segment, reflecting the structure of Kuwait’s agricultural sector, while cooperatives and government agencies are increasingly adopting insurance as part of broader risk management and food security strategies .

The Kuwait Crop Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Insurance Company, Gulf Insurance Group, Al Ahleia Insurance Company, Warba Insurance Company, Kuwait Reinsurance Company, Takaful International Company, Al Sagr Insurance Company, Al Madina Insurance Company, Al Qurain Insurance Company, Al Fajer Insurance Company, First Takaful Insurance Company, Wethaq Takaful Insurance Company, Boubyan Takaful Insurance Company, Al-Dhafra Insurance Company, Al-Ahlia Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait crop insurance market appears promising, driven by increasing government support and a growing recognition of agricultural risks. As farmers become more aware of the benefits of insurance, the market is likely to see a rise in product offerings tailored to local needs. Additionally, advancements in technology, such as digital platforms for insurance processing, will streamline operations and enhance accessibility, fostering a more resilient agricultural sector in Kuwait.

| Segment | Sub-Segments |

|---|---|

| By Type | Multi-Peril Crop Insurance (MPCI) Crop-Hail Insurance Revenue-Based Insurance Yield-Based Insurance Index-Based/Parametric Insurance Others |

| By End-User | Smallholder Farmers Large Agricultural Enterprises Cooperatives Government Agencies |

| By Crop Type | Cereal Crops (e.g., wheat, barley) Vegetable Crops (e.g., tomatoes, cucumbers) Fruit Crops (e.g., dates, citrus) Oilseed Crops (e.g., sesame) Others |

| By Distribution Channel | Direct Sales Banks Brokers/Agents Online Platforms Others |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Policy Type | Individual Policies Group Policies Customized Policies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Insurance | 100 | Farmers, Agricultural Advisors |

| Vegetable Crop Insurance | 60 | Horticulturists, Crop Insurance Agents |

| Fruit Crop Insurance | 50 | Orchard Owners, Agricultural Economists |

| Livestock Insurance | 40 | Livestock Farmers, Veterinary Experts |

| Insurance Policy Providers | 70 | Insurance Underwriters, Risk Management Specialists |

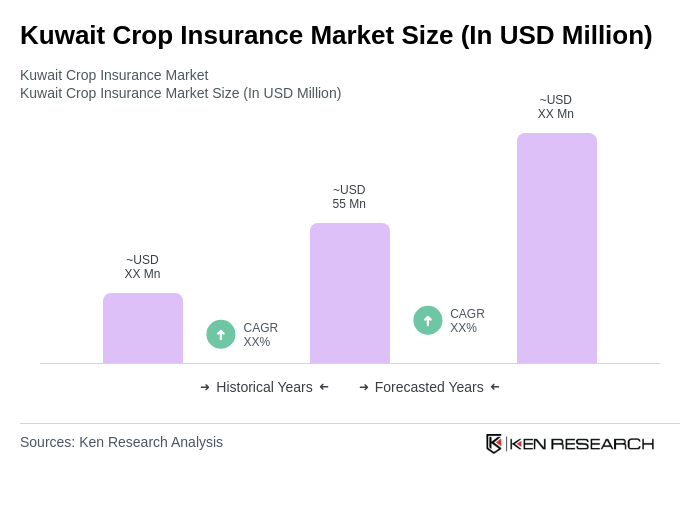

The Kuwait Crop Insurance Market is valued at approximately USD 55 million, reflecting a five-year historical analysis. This growth is attributed to increased awareness among farmers about risk management and the need for financial protection against crop failures.