Region:Asia

Author(s):Shubham

Product Code:KRAA4743

Pages:81

Published On:September 2025

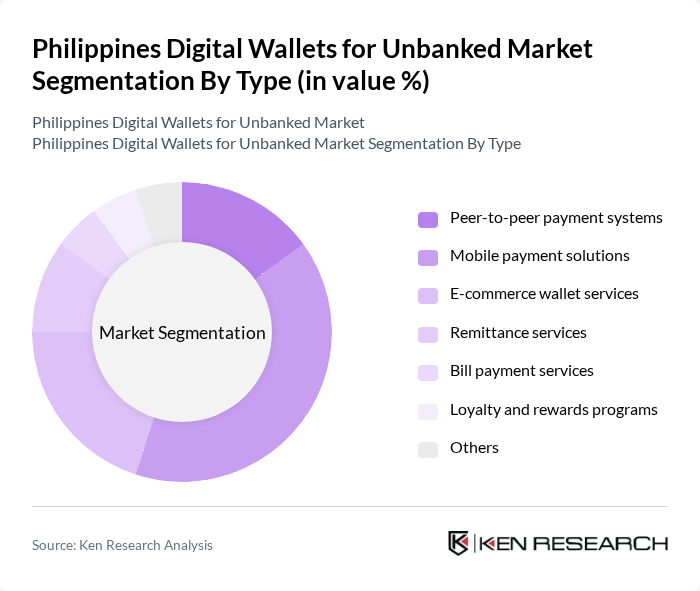

By Type:The segmentation by type includes various subsegments such as peer-to-peer payment systems, mobile payment solutions, e-commerce wallet services, remittance services, bill payment services, loyalty and rewards programs, and others. Among these, mobile payment solutions are currently dominating the market due to their convenience and widespread acceptance among consumers. The increasing reliance on smartphones for daily transactions has led to a surge in mobile payment adoption, making it the preferred choice for many users.

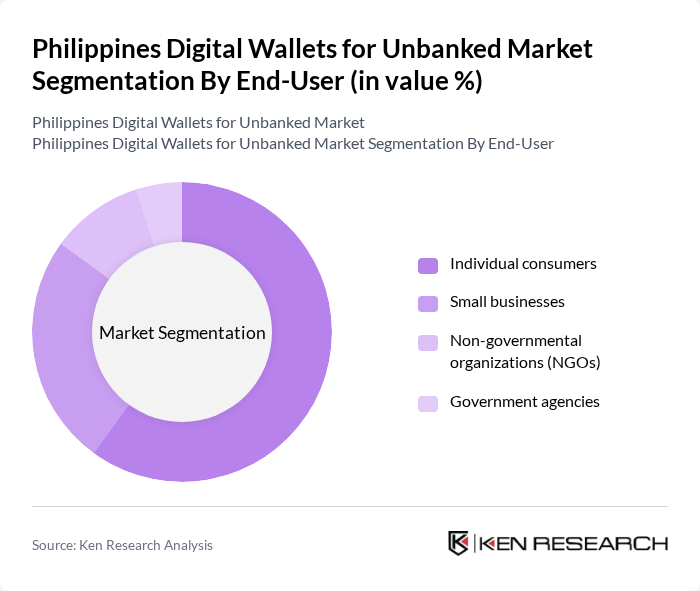

By End-User:The end-user segmentation includes individual consumers, small businesses, non-governmental organizations (NGOs), and government agencies. Individual consumers are the leading segment, driven by the increasing adoption of digital wallets for everyday transactions. The convenience of making payments, transferring money, and accessing financial services without the need for a traditional bank account has made digital wallets particularly appealing to this demographic.

The Philippines Digital Wallets for Unbanked Market is characterized by a dynamic mix of regional and international players. Leading participants such as GCash, PayMaya, GrabPay, Coins.ph, UnionBank, RCBC DiskarTech, Maya Bank, Globe Telecom, Smart Communications, AUB Pay, Cebuana Lhuillier, BPI Online, Land Bank of the Philippines, EastWest Bank, Philippine National Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of digital wallets in the Philippines appears promising, driven by ongoing technological advancements and increasing consumer acceptance. As smartphone penetration continues to rise, more unbanked individuals will gain access to digital financial services. Additionally, the government's commitment to enhancing financial inclusion through supportive regulations and infrastructure improvements will likely create a conducive environment for digital wallet adoption, fostering a cashless economy that benefits all segments of society.

| Segment | Sub-Segments |

|---|---|

| By Type | Peer-to-peer payment systems Mobile payment solutions E-commerce wallet services Remittance services Bill payment services Loyalty and rewards programs Others |

| By End-User | Individual consumers Small businesses Non-governmental organizations (NGOs) Government agencies |

| By Application | Retail transactions Online shopping Utility payments Fund transfers |

| By Distribution Channel | Direct-to-consumer Partnerships with retailers Online platforms |

| By User Demographics | Age groups Income levels Urban vs rural users |

| By Payment Frequency | Daily transactions Weekly transactions Monthly transactions |

| By Customer Loyalty | New users Retained users High-frequency users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Unbanked Individuals | 150 | Low-income workers, informal sector employees |

| Rural Unbanked Communities | 100 | Farmers, small business owners |

| Digital Wallet Users | 120 | Current users of digital wallets in urban areas |

| Financial Literacy Advocates | 80 | NGO representatives, community organizers |

| Government Officials in Financial Inclusion | 50 | Policy makers, program managers |

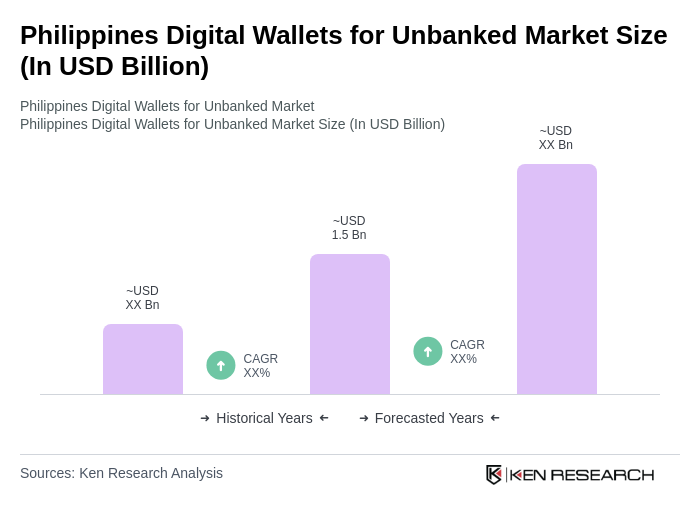

The Philippines Digital Wallets for the Unbanked Market is valued at approximately USD 1.5 billion, driven by smartphone penetration, e-commerce growth, and the need for financial inclusion among the unbanked population.