Region:Asia

Author(s):Dev

Product Code:KRAC2690

Pages:89

Published On:October 2025

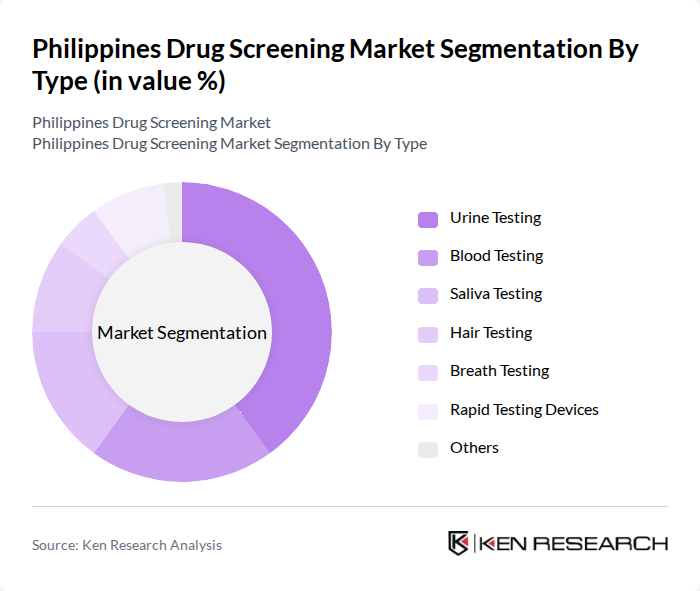

By Type:The market is segmented into Urine Testing, Blood Testing, Saliva Testing, Hair Testing, Breath Testing, Rapid Testing Devices, and Others. Each method offers distinct advantages: urine testing is cost-effective and widely accepted; blood testing provides high accuracy; saliva and hair testing are used for specific detection windows; breath testing is primarily for alcohol; rapid testing devices offer instant results for onsite screening.

Urine Testing remains the leading sub-segment due to its affordability, ease of administration, and broad substance detection capabilities. It is the preferred method for workplace, school, and government screening programs. The increasing adoption of pre-employment and random testing in corporate environments continues to drive its dominance.

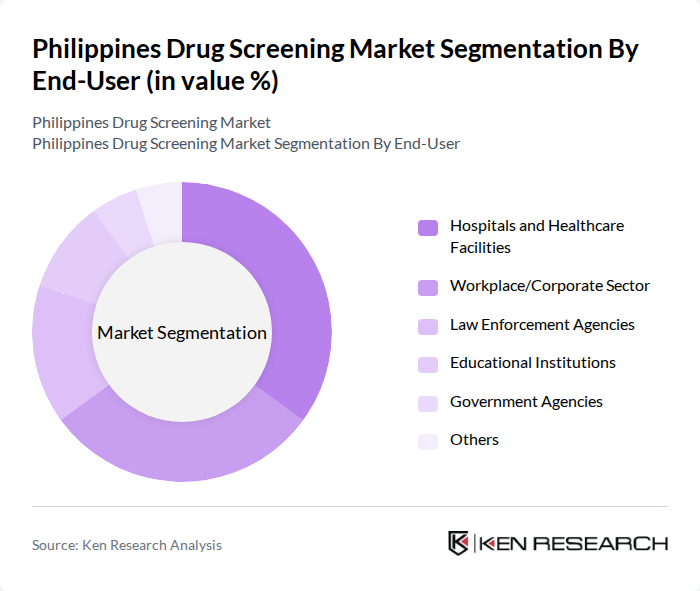

By End-User:The market is segmented by end-users: Hospitals, Clinical Laboratories, Corporates/Workplaces, Educational Institutions, Government Agencies (PNP, DOH, Customs), Sports Organizations, and Others. Hospitals and clinical labs require comprehensive screening for medical and legal purposes; workplaces and schools focus on prevention and compliance; government agencies and sports organizations emphasize safety and integrity.

Hospitals are the leading end-user segment, driven by the need for accurate diagnosis and management of drug-related health issues. Collaboration between hospitals and clinical laboratories enhances the reliability and efficiency of drug screening services, while increased public health initiatives and regulatory mandates further support market growth.

The Philippines Drug Screening Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hi-Precision Diagnostics, The Medical City Clinical Laboratories, Philippine Red Cross, Quest Diagnostics, Laboratory Corporation of America Holdings (LabCorp), Alere Inc. (now Abbott Rapid Diagnostics), Roche Diagnostics, Siemens Healthineers, Abbott Laboratories, Thermo Fisher Scientific, MedTox Scientific, Omega Laboratories, Psychemedics Corporation, Express Diagnostics International, SureHire, DrugScan, Confirm BioSciences, Shimadzu Corporation, OraSure Technologies, Drägerwerk AG & Co. KGaA contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines drug screening market is poised for significant evolution, driven by increasing awareness of substance abuse and the need for workplace safety. As technological innovations continue to emerge, the integration of AI and mobile testing solutions will enhance accessibility and efficiency. Furthermore, the government's commitment to drug-free initiatives will likely foster partnerships between public and private sectors, creating a more robust framework for drug testing services. This collaborative approach will be essential in addressing the challenges and maximizing the opportunities within the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Urine Testing Blood Testing Saliva Testing Hair Testing Breath Testing Rapid Testing Devices Others |

| By End-User | Hospitals Clinical Laboratories Corporates/Workplaces Educational Institutions Government Agencies (PNP, DOH, Customs) Sports Organizations Others |

| By Application | Pre-employment Screening Random Testing Post-accident Testing Rehabilitation Monitoring Law Enforcement Sports Doping Control Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Pharmacies Others |

| By Region | Luzon Visayas Mindanao Others |

| By Testing Method | Immunoassay Gas Chromatography-Mass Spectrometry (GC-MS) High-Performance Liquid Chromatography (HPLC) AI-powered Portable Analyzers Others |

| By Price Range | Low Range Mid Range High Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Doctors, Nurses, Pharmacists |

| Drug Testing Laboratories | 60 | Laboratory Managers, Technicians |

| Government Health Officials | 40 | Policy Makers, Regulatory Officers |

| Patients and Drug Users | 80 | Individuals undergoing drug testing, Support group members |

| NGOs and Advocacy Groups | 50 | Program Coordinators, Outreach Workers |

The Philippines Drug Screening Market is valued at approximately USD 120 million, reflecting a significant growth driven by increased awareness of drug abuse, stricter regulations, and rising demand for drug testing across various sectors such as workplaces and educational institutions.