Philippines E-Learning and Digital Skilling Market Overview

- The Philippines E-Learning and Digital Skilling Market is valued at USD 1.8 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for online education and digital skills training, fueled by rapid digital transformation across education, corporate, and government sectors. The COVID-19 pandemic further accelerated the adoption of e-learning solutions, as educational institutions and businesses sought to maintain continuity in learning and training. Market expansion is also supported by improved internet access, mobile-first platforms, and the integration of AI and gamification technologies, which enhance engagement and personalize learning experiences for students and professionals nationwide .

- Metro Manila, Cebu, and Davao are the dominant cities in the Philippines E-Learning and Digital Skilling Market. Metro Manila, being the capital, has a higher concentration of educational institutions and corporate offices, leading to increased demand for e-learning solutions. Cebu and Davao are also emerging as key players due to their growing tech ecosystems, investments in digital infrastructure, and expanding startup communities focused on education technology .

- In 2023, the Philippine government enacted Republic Act No. 11927, also known as the “Digital Education Act of 2023,” issued by the Congress of the Philippines. This regulation mandates the integration of digital literacy and digital skills training into the national curriculum for both primary and secondary education. The Act requires educational institutions to adopt digital learning platforms, provide teacher training in digital competencies, and ensure equitable access to technology for all students. The initiative aims to enhance the overall quality of education, promote lifelong learning, and prepare students for participation in the digital economy .

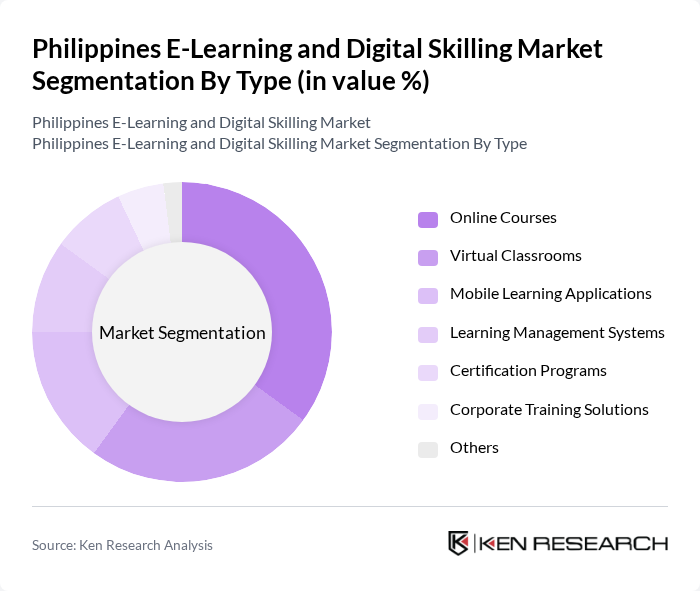

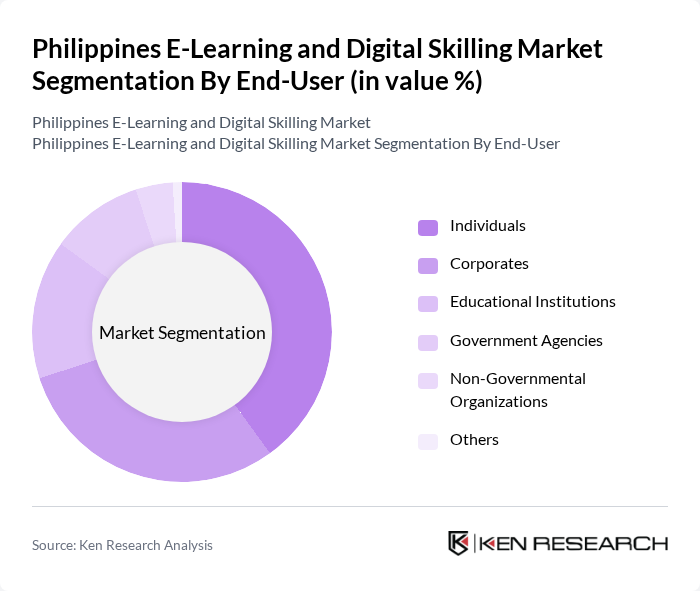

Philippines E-Learning and Digital Skilling Market Segmentation

By Type:The market is segmented into various types, including Online Courses, Virtual Classrooms, Mobile Learning Applications, Learning Management Systems, Certification Programs, Corporate Training Solutions, and Others. Among these, Online Courses have gained significant traction due to their flexibility and accessibility, allowing learners to engage at their own pace. Virtual Classrooms are also popular, especially in the corporate sector, as they facilitate real-time interaction and collaboration.

By End-User:The end-user segmentation includes Individuals, Corporates, Educational Institutions, Government Agencies, Non-Governmental Organizations, and Others. Individuals represent a significant portion of the market, driven by the need for personal development and skill enhancement. Corporates are increasingly investing in e-learning solutions to upskill their workforce, while educational institutions are adopting these technologies to complement traditional teaching methods.

Philippines E-Learning and Digital Skilling Market Competitive Landscape

The Philippines E-Learning and Digital Skilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABS-CBN Corporation, Edukasyon.ph, Coursera, Inc., Edmodo, Inc., Google for Education, Microsoft Corporation, Skillsoft Corporation, LinkedIn Learning, Pluralsight, Inc., Khan Academy, FutureLearn, Udemy, Inc., Quipper Limited, TESDA (Technical Education and Skills Development Authority), DIWA Learning Systems Inc., Bizmates Philippines, Inc., Eskwelabs, RareJob Philippines, Inc., Cypher Learning (NEO LMS), Topica Edtech Group contribute to innovation, geographic expansion, and service delivery in this space.

Philippines E-Learning and Digital Skilling Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:As of future, the Philippines boasts an internet penetration rate of approximately 73%, translating to around 84 million users. This growth is driven by the expansion of mobile networks and affordable data plans, which have increased access to online learning platforms. The World Bank reports that improved connectivity is crucial for educational advancements, enabling more individuals to engage in e-learning and digital skilling initiatives, thus fostering a more knowledgeable workforce.

- Government Initiatives for Digital Education:The Philippine government has allocated over PHP 1.5 billion (approximately USD 27 million) for digital education initiatives in future. This funding supports the development of online learning resources and infrastructure improvements. Programs like the "Digital Rise" initiative aim to enhance digital literacy among students and educators, ensuring that educational institutions are equipped to deliver quality e-learning experiences, thereby increasing participation in digital skilling.

- Rising Demand for Upskilling and Reskilling:With the Philippine unemployment rate projected to be around 4.5% in future, there is a significant push for upskilling and reskilling among the workforce. Approximately 60% of employers report a skills gap, prompting individuals to seek e-learning solutions to enhance their employability. This trend is further supported by the increasing need for digital skills in various sectors, including IT, healthcare, and business services, driving growth in the e-learning market.

Market Challenges

- Limited Access to Quality Internet:Despite the rising internet penetration, around 30% of rural areas in the Philippines still lack reliable internet access. This disparity creates significant barriers to e-learning, as students in these regions struggle to connect to online platforms. The National Telecommunications Commission reports that improving infrastructure in underserved areas is essential to ensure equitable access to digital education, which remains a challenge for the e-learning market.

- Resistance to Change in Traditional Learning Methods:Many educators and institutions in the Philippines are still heavily reliant on traditional teaching methods, with approximately 40% of teachers expressing reluctance to adopt e-learning tools. This resistance is often rooted in a lack of training and familiarity with digital platforms. The Department of Education emphasizes the need for comprehensive training programs to facilitate the transition to digital learning, highlighting a significant challenge for market growth.

Philippines E-Learning and Digital Skilling Market Future Outlook

The future of the Philippines e-learning and digital skilling market appears promising, driven by technological advancements and increasing government support. As more educational institutions adopt blended learning models, the demand for innovative digital solutions will rise. Additionally, the integration of artificial intelligence and data analytics into learning platforms is expected to enhance personalized learning experiences, making education more accessible and effective. This evolution will likely attract more investments and partnerships, further propelling market growth.

Market Opportunities

- Expansion of Corporate Training Programs:With over 1.1 million businesses in the Philippines, there is a growing opportunity for e-learning providers to develop tailored corporate training programs. Companies are increasingly investing in employee development, with an estimated PHP 20 billion (approximately USD 400 million) allocated for training in future, creating a lucrative market for digital skilling solutions.

- Growth of Gamification in Learning:The gamification of learning is gaining traction, with a projected market value of PHP 5 billion (around USD 100 million) by future. This trend is driven by the increasing demand for engaging and interactive learning experiences, particularly among younger learners. E-learning platforms that incorporate gamified elements can enhance user engagement and retention, presenting a significant opportunity for growth.